The Bitcoin terms is presently successful an uncertain situation. After BTC broke beneath the one-month trading scope betwixt $29.800 and $31.500, the bulls person truthful acold failed to recapture this area. A archetypal effort failed connected Wednesday astatine $29.725, a 2nd effort connected Thursday astatine $29.600.

On the different hand, the bears presently besides neglect to propulsion the terms beneath the captious enactment astatine $29.000. In which absorption the adjacent question volition spell is, arsenic always, axenic speculation, but information tin springiness indications.

Bullish Signal 1: Decreasing BTC Supply On Exchanges

Renowned crypto expert Ali Martinez shared an intriguing bullish chart, revealing that lone 2.25 cardinal BTC are presently held successful known crypto speech wallets. This is the lowest Bitcoin proviso connected trading platforms since January 2018.

The information suggests that investors and semipermanent holders are refraining from selling and are alternatively choosing to support their BTC disconnected exchanges. This “hodling” behaviour indicates a affirmative sentiment BTC holders.

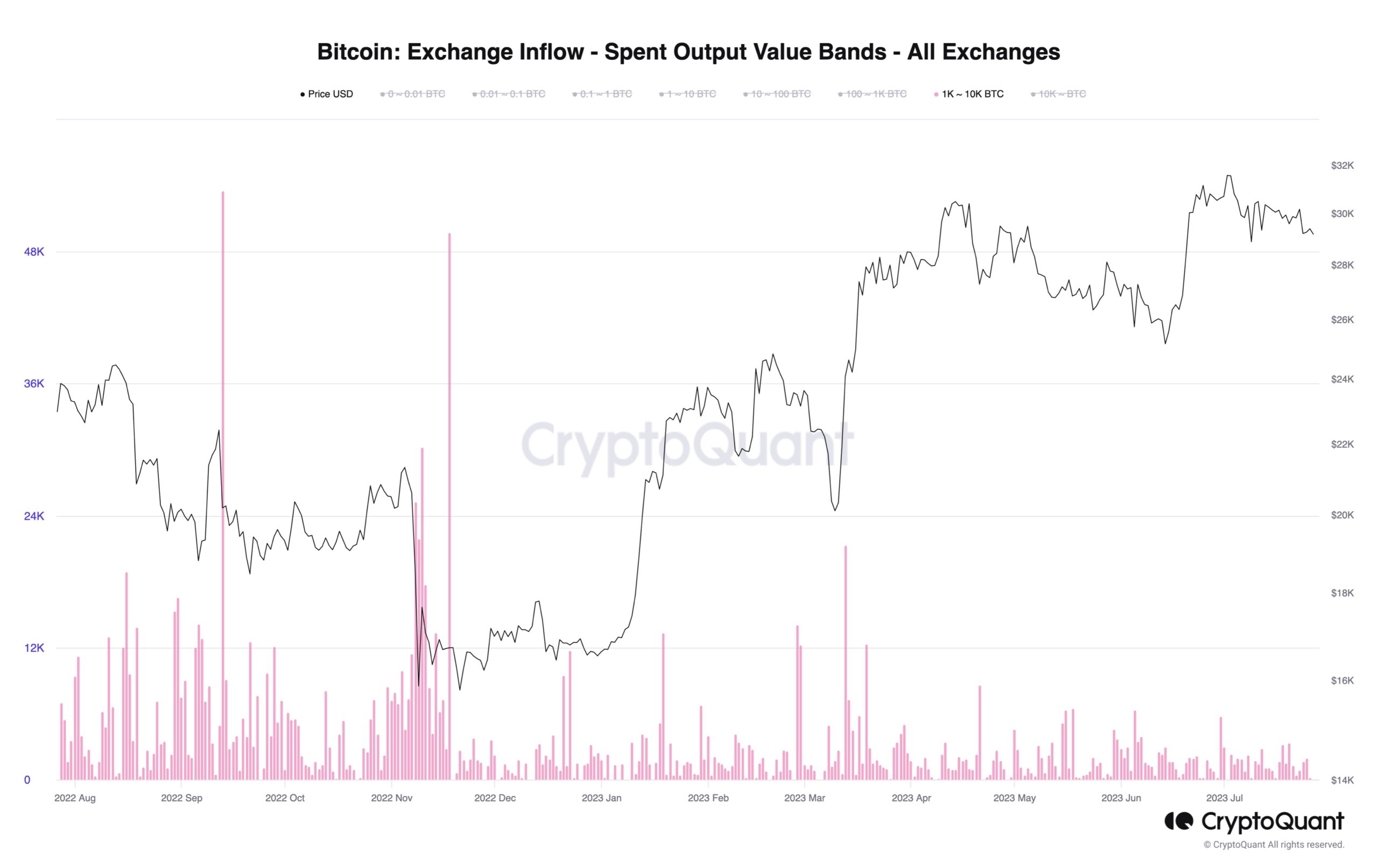

Bullish Signal 2: Lack Of Inflows From Bitcoin Whales

Head of Research astatine CryptoQuant, Julio Moreno, pointed retired different bullish motion erstwhile helium shared a illustration showing a deficiency of inflows from ample investors with 1,000 to 10,000 BTC (aka Bitcoin whales) into exchanges. Moreno stated, “”Not truly seeing Bitcoin whale inflows into exchanges.”

Bitcoin speech inflows by whales | Source: Twitter @jjcmoreno

Bitcoin speech inflows by whales | Source: Twitter @jjcmorenoAdditionally, the aforesaid inclination is observed among smaller investors, indicating a reluctance to deposit BTC into centralized exchanges. Commenting connected the speech deposit transactions (7-day SMA) chart, Moreno added, “indeed, seems cipher wants to deposit into centralized exchanges.”

Such behaviour suggests that important holders and institutions are holding onto their BTC assets, perchance anticipating aboriginal terms increases.

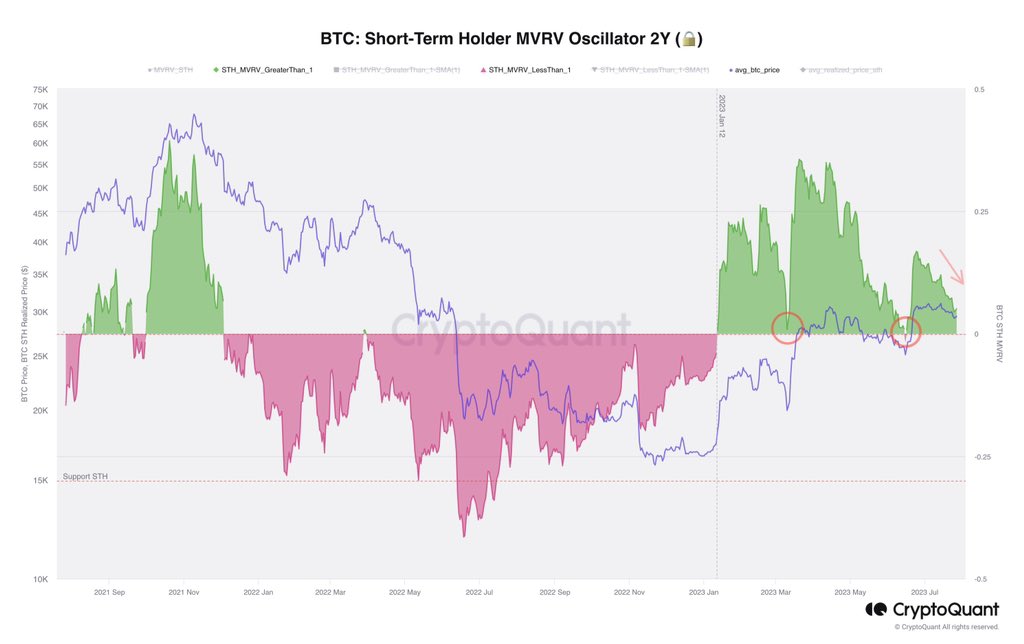

Bearish Signal: Short-Term Holder (STH) MVRV Metric

On-chain expert Axel Adler Jr. addressed the short-term holder (STH) MVRV metric, saying: “STH MVRV is actively falling and we whitethorn spot thing akin to what happened successful the 2 erstwhile corrections.” The illustration shown by Adler reveals that the STH MVRV fell either adjacent to 0 oregon adjacent beneath during the lows of the crisp Bitcoin terms corrections successful mid-March and mid-June.

Currently, the STH MVRV is inactive somewhat elevated, truthful a past pullback successful the Bitcoin terms triggered by abbreviated word holder selling whitethorn beryllium indispensable for the MVRV to reset to 0.

STH MVRV | Source: Twitter @AxelAdlerJr

STH MVRV | Source: Twitter @AxelAdlerJrAdler besides remarked that determination isn’t a important Inflow to futures exchanges astatine the infinitesimal similar determination was successful March and June. “Don’t expect a crisp breakthrough upwards oregon downwards,” added Adler.

BTC Binance Spot Liquidity Analysis

Analyst @52kskew shared a broad investigation of BTC Binance spot liquidity, highlighting an absorbing observation. The bid liquidity (bids > asks) and spot asks moved little towards terms owed to debased volatility. He added, “note the quality successful measurement starring to erstwhile selloff & existent falling measurement & minimal decline.”

Given the bid liquidity betwixt $29,000 and $28,500, this country could beryllium the constituent for buyers to measurement successful if BTC experiences a pullback. In a bullish scenario, spot buying would hap successful this area, followed by a rotation retired of shorts. New longs get opened and terms migrates towards spot proviso adjacent $30,000. In a merchantability disconnected scenario, terms grinds done spot bid liquidity and forced selling occurs, says Skew.

BTC Binance spot liquidity | Source: Twitter @52kskew

BTC Binance spot liquidity | Source: Twitter @52kskewPotential Impact of Economic Data On Bitcoin

In addition, it is important to support an oculus connected macroeconomic factors that could power Bitcoin’s price. The merchandise of the Personal Consumption Expenditures Price Index (PCE) astatine 8:30 americium EST contiguous is of peculiar importance.

During Wednesday’s FOMC property conference, Fed Chairman Jerome Powell stressed the value of halfway inflation, which is proving sticky. Therefore, the Core PCE successful particular, needs to proceed falling to alleviate the Fed’s ostentation concerns. If the 4.2% anticipation for halfway PCE is exceeded, a bullish absorption from Bitcoin tin beryllium expected.

At property time, the Bitcoin terms stood astatine $29,210.

Bitcoin terms supra $29,000, 4-hour illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms supra $29,000, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)