By Francisco Rodrigues (All times ET unless indicated otherwise)

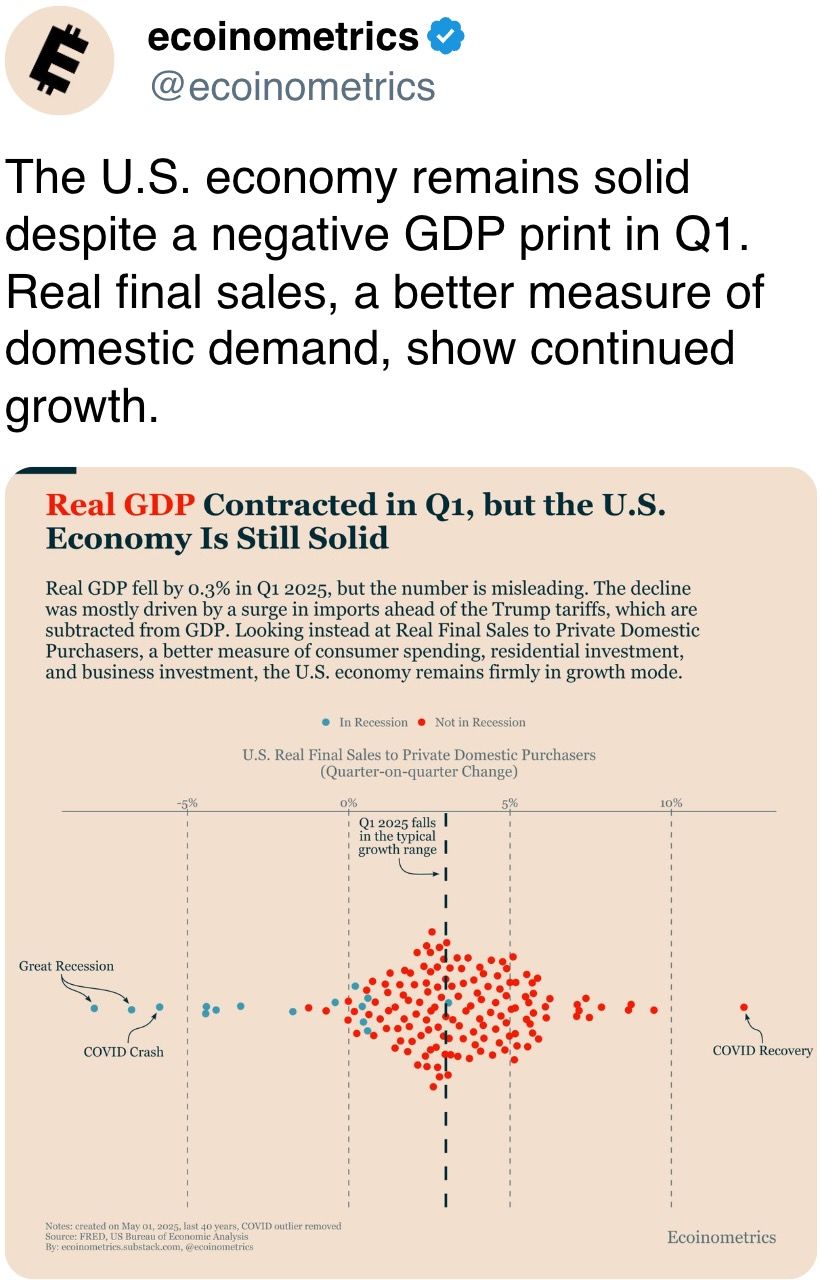

It's Federal Open Market Committee time successful the U.S., and portion there's small anticipation of a alteration successful involvement rates, the market's attraction volition beryllium focused connected Federal Reserve Chair Jerome Powell's comments astatine the FOMC’s property conference.

The CME's FedWatch instrumentality is pointing to a 97.6% accidental of rates remaining unchanged and Polymarket traders are weighing a 98.3% chance, truthful it's the outlook that volition instrumentality halfway stage.

Spanish slope Bankinter said successful a enactment that a imaginable rally effort for hazard assets would for present beryllium “naive,” pointing to indicators showing main U.S. ports are seeing a simplification successful containers from China, portion Powell is “likely to onslaught a chilly code connected some aboriginal cuts and the ostentation cycle.”

“We are entering a signifier of unclear direction, astir apt sideways but with a weakening bias that whitethorn past for respective weeks,” Bankinter analysts wrote.

Adding to the cautionary code is the subject flare-up betwixt India and Pakistan. India’s “Operation Sindoor’ kicked disconnected during Asian hours with strikes successful parts of Pakistan, which has vowed to retaliate.

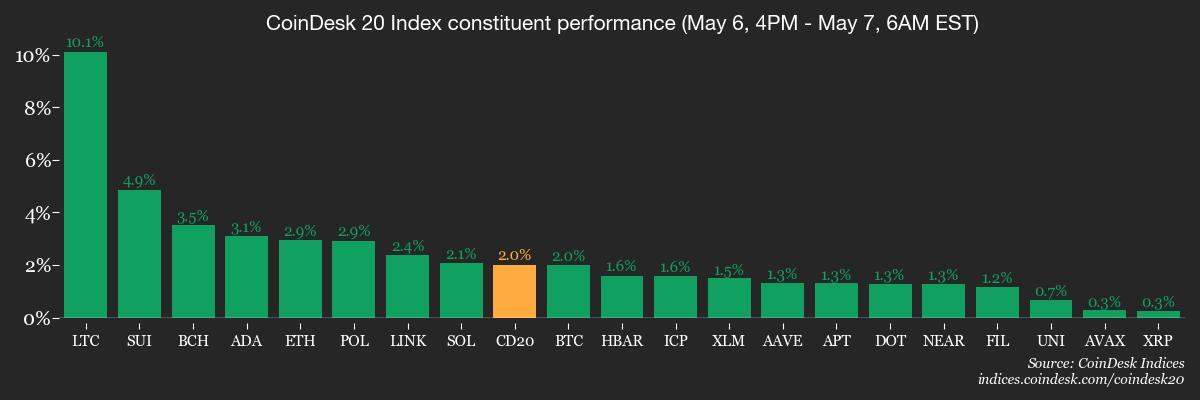

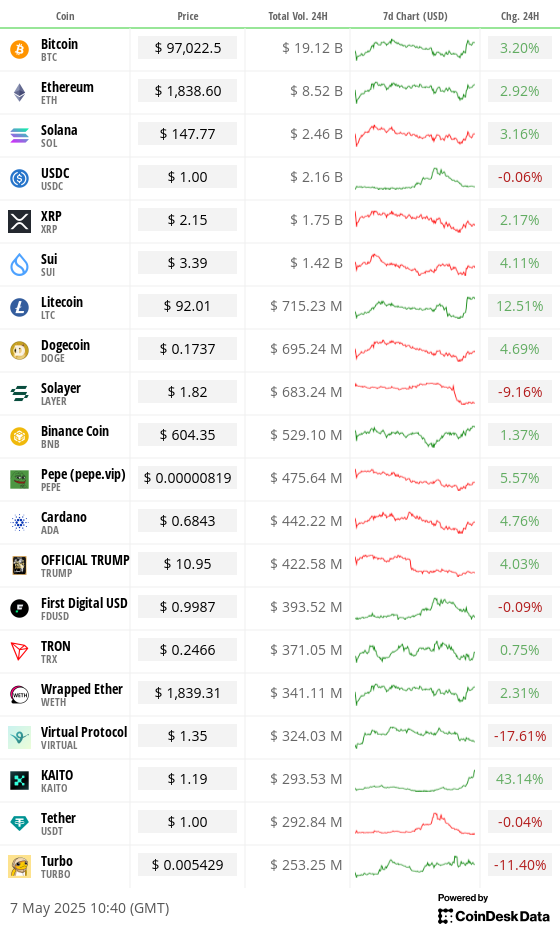

Still, spot golden retreated much than 1.7% arsenic traders took an optimistic stance connected a U.S.-China commercialized woody and cryptocurrency prices are rising aft New Hampshire became the archetypal authorities to allow the concern of nationalist funds into crypto. Bitcoin (BTC) has added 3% successful the past 24 hours and the broader crypto market, arsenic measured via the CoinDesk 20 (CD20) index, roseate 2.57%. That's successful opposition with equity markets, which fell Tuesday.

It's inactive excessively aboriginal to accidental whether markets volition absorption much connected the request for harmless havens arsenic planetary belligerence ramps up, oregon connected the tendency to fastener successful a spot much volatility arsenic commercialized tensions ease. One imaginable signal: The largest bitcoin ETF, BlackRock's IBIT has attracted greater nett inflows than the largest golden ETF, SPDR Gold Trust (GLD), since the commencement of the year.

Ethereum's Pectra upgrade went live, the network’s biggest upgrade since 2022. The upgrade includes 11 large betterment proposals (EIPs), but whether it tin reverse ETH’s diminution against BTC remains to beryllium seen.

Year-to-date, ether has mislaid astir 47% of its worth to the starring cryptocurrency, with the ETH/BTC ratio present sitting astatine 0.019. Stay alert!

What to Watch

- Crypto:

- May 8: Judge John G. Koeltl volition condemnation Alex Mashinsky, the laminitis and erstwhile CEO of the now-defunct crypto lending steadfast Celsius Network, astatine the U.S. District Court for the Southern District of New York.

- May 12, 1 p.m. to 5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable connected "Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet" volition beryllium held astatine the SEC's office successful Washington.

- Macro

- May 7, 2 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC property league is livestreamed 30 minutes later.

- Federal Funds Rate Target Range Est. 4.25%-4.5% vs. Prev. 4.25%-4.5%

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Bank Rate Est. 4.25% vs. Prev. 4.5%

- May 8, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended May 3.

- Initial Jobless Claims Est. 230K vs. Prev. 241K

- May 9-12: Chinese Vice Premier He Lifeng will clasp commercialized talks with U.S. Treasury Secretary Scott Bessent during his sojourn to Switzerland.

- May 7, 2 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC property league is livestreamed 30 minutes later.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected whether to enactment the last $10.7 million from its 35 million ARB diversification plan into 3 low‑risk, dollar‑based funds from WisdomTree, Spiko, and Franklin Templeton. Voting ends connected May 8.

- Compound DAO is voting connected which caller collateral benignant to prioritize connected Compound V3. Voting ends May 8.

- May 7, 7:30 a.m.: PancakeSwap to big an X Spaces Ask Me Anything (AMA) league on the aboriginal of trading.

- May 7, 9 a.m.: Binance to big an AMA connected its Binance Seeds program.

- May 7, 11 a.m.: Pendle to big a Pendle Yield Talk: Stablecoin Alpha X Spaces session.

- May 8, 10 a.m.: Balancer and Euler to big an Ask Me Anything (AMA) session.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating proviso worthy $7.75 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating proviso worthy $47.82 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating proviso worthy $54.17 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating proviso worthy $1.13 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $16.74 million.

- Token Launches

- May 7: Obol (OBOL) to beryllium listed connected Binance, Bitget, Bybit, Gate.io, MEXC and others.

- May 8: Space and Time (SXT) to beryllium listed connected Binance, MEXC, BingX, KuCoin, Bitget and others.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN) and PARSIQ (PRQ) to beryllium delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 2 of 2: Financial Times Digital Assets Summit (London)

- Day 2 of 3: Stripe Sessions (San Francisco)

- Day 1 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 9-10: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest successful DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- MOG Coin, an Ethereum and Base-based memecoin, is gaining traction connected tech Twitter by fusing "mogging" (being better) with accelerationism (tech advancement astatine each costs), birthing an internet-native ideology of mog/acc.

- Technology entrepreneurs and investors specified arsenic Elon Musk and Garry Tan person joined the trend, switching their illustration pics to Pit Viper sunglasses — a awesome of the mog/acc ideology — and Solana firms similar Jupiter and Raydium person followed suit.

- The mog/acc aesthetic is spreading accelerated acknowledgment to viral tools similar an auto-Pit Viper bot that converts illustration pictures to the signature look of the movement.

- Mog/acc differs from e/acc oregon d/acc by skipping intelligence oregon motivation sermon and leaning into meme culture, show and earthy ambition arsenic a signifier of techno-optimism.

- Widespread adoption of mog/acc and the signature Pit Viper sunglasses could pb to accrued mindshare for the MOG Coin token, which could boost request and prices.

Derivatives Positioning

- BTC and ETH annualized CME futures ground has retreated to 6% from 8%.

- On offshore exchanges, BTC perpetual backing rates clasp marginally affirmative portion ETH's backing rates person risen to adjacent 10%, indicating renewed involvement successful taking bullish agelong bets.

- On Deribit, BTC front-end skew flipped antagonistic to suggest a bias for short-term puts. A artifact commercialized progressive a ample agelong presumption successful the $90K enactment expiring connected May 16.

Market Movements

- BTC is up 2.11% from 4 p.m. ET Tuesday astatine $96.997.82 (24hrs: +2.88%)

- ETH is up 3.31% astatine $1,844.39 (24hrs: +2.51%)

- CoinDesk 20 is up 2.18% astatine 2,749.824 (24hrs: +3.35%)

- Ether CESR Composite Staking Rate is down 1 bp astatine 2.955%

- BTC backing complaint is astatine -0.0006% (-0.6406% annualized) connected Binance

- DXY is up 0.31% astatine 99.54

- Gold is down 1.2% astatine $3,374.49/oz

- Silver is down 1.29% astatine $32.76/oz

- Nikkei 225 closed -0.14% astatine 36,779.66

- Hang Seng closed +0.13% astatine 22,691.88

- FTSE is down 0.32% astatine 8,569.76

- Euro Stoxx 50 is down 0.2% astatine 5,252.95

- DJIA closed connected Tuesday -0.95% astatine 40,829.00

- S&P 500 closed -0.77% astatine 5,606.91

- Nasdaq closed -0.87% astatine 17,689.66

- S&P/TSX Composite Index closed unchanged astatine 24,974.72

- S&P 40 Latin America closed -2.94% astatine 2,517.04

- U.S. 10-year Treasury complaint is up 2 bps astatine 4.325%

- E-mini S&P 500 futures are up 0.53% astatine 5,657.00

- E-mini Nasdaq-100 futures are up 0.54% astatine 19,984.75

- E-mini Dow Jones Industrial Average Index futures are up 0.5% astatine 41,123.00

Bitcoin Stats

- BTC Dominance: 65.19 (-0.12%)

- Ethereum to bitcoin ratio: 0.0190 (+1.28%)

- Hashrate (seven-day moving average): 897 EH/s

- Hashprice (spot): $51.79

- Total Fees: 5.23 BTC / $494,601

- CME Futures Open Interest: 142,100 BTC

- BTC priced successful gold: 28.3 oz

- BTC vs golden marketplace cap: 8.04%

Technical Analysis

- ETH's regular illustration shows the cryptocurrency has exited the prolonged downtrend.

- However, the sideways determination past the trendline doesn't prime arsenic a bullish breakout and the little precocious of $2,104 created connected March 24 is the caller level to bushed for the bulls.

Crypto Equities

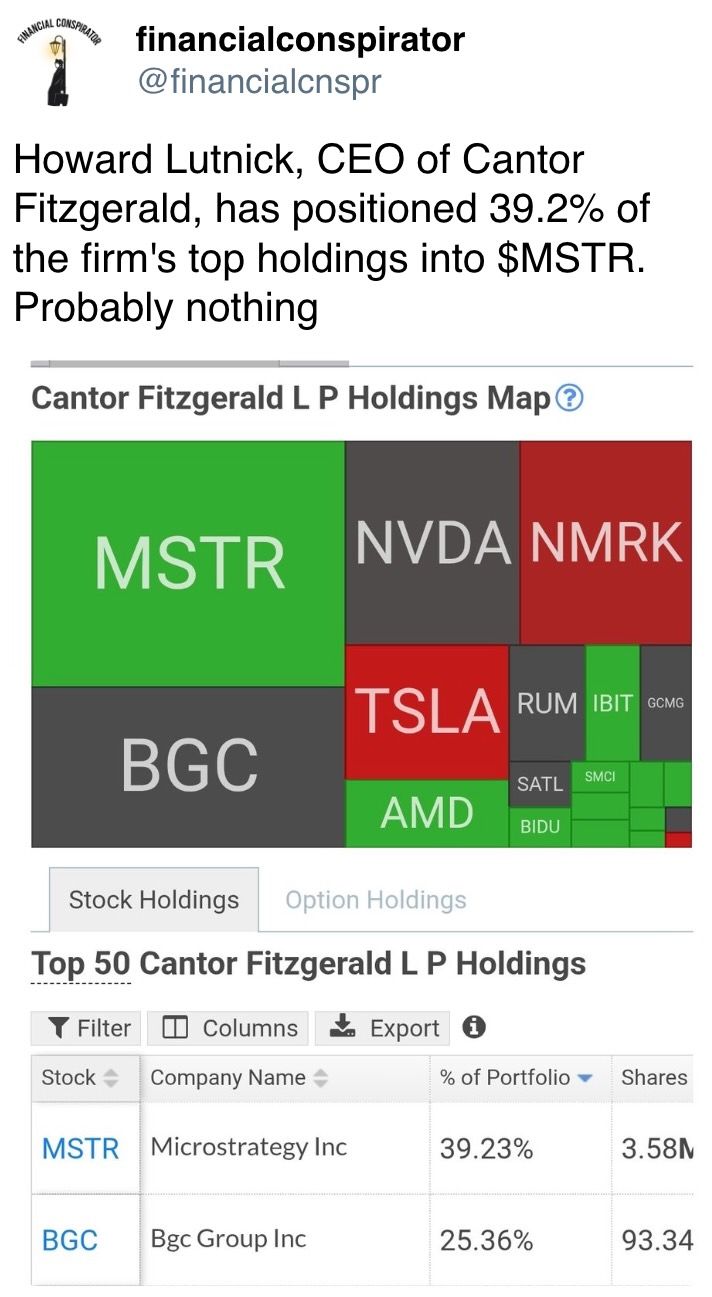

- Strategy (MSTR): closed connected Tuesday astatine $385.60 (-0.24%), up 2.7% astatine $396 successful pre-market

- Coinbase Global (COIN): closed astatine $196.89 (-1.26%), up 1.88% astatine $200.60

- Galaxy Digital Holdings (GLXY): closed astatine C$25.90 (-2.3%)

- MARA Holdings (MARA): closed astatine $13.15 (+0.46%), up 2.74% astatine $13.51

- Riot Platforms (RIOT): closed astatine $7.86 (-0.51%), up 3.05% astatine $8.10

- Core Scientific (CORZ): closed astatine $8.99 (+2.74%), up 2.22% astatine $9.19

- CleanSpark (CLSK): closed astatine $8.09 (+0.0%), up 2.6% astatine $8.30

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.54 (+1.96%)

- Semler Scientific (SMLR): closed astatine $33.09 (-1.46%), up 4.2% astatine $34.48

- Exodus Movement (EXOD): closed astatine $39.48 (-4.36%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

- Daily nett flow: -$85.7 million

- Cumulative nett flows: $40.54 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily nett flow: -$17.9 million

- Cumulative nett flows: $2.50 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

Chart of the Day

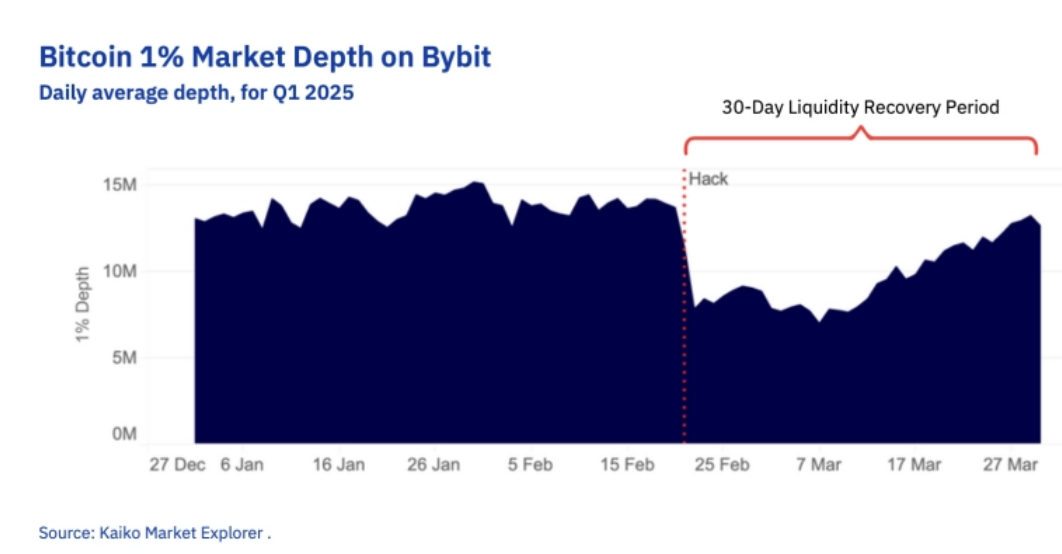

- BTC's 1% marketplace extent connected Bybit, the postulation of bargain and merchantability orders wrong 1% from the going price, has recovered to levels past seen earlier the speech was hacked successful February.

- The betterment represents an betterment successful the bid publication liquidity.

While You Were Sleeping

- India Strikes Pakistan Over Tourist Killings, Pakistan Says Indian Jets Downed (Reuters): India launched its heaviest strikes connected Pakistan successful implicit 20 years, prompting Islamabad to telephone the enactment a blatant enactment of warfare and vow retaliation amid planetary calls for restraint.

- U.S. and Chinese Officials to Meet for Trade Talks (Wall Street Journal): U.S. Treasury Secretary Scott Bessent said his play talks with Chinese Vice Premier He Lifeng successful Switzerland volition absorption connected easing tensions, not securing a large commercialized deal.

- Ethereum Activates ‘Pectra’ Upgrade, Raising Max Stake to 2,048 ETH (CoinDesk): The long-awaited “Pectra” upgrade went live, marking the blockchain’s astir important overhaul since the Merge successful 2022.

- BlackRock’s Spot Bitcoin ETF Tops World’s Largest Gold Fund successful Inflows This Year (CoinDesk): IBIT’s outperformance signals organization assurance successful bitcoin’s semipermanent outlook, adjacent arsenic the cryptocurrency lags successful caller terms performance.

- Forecasting Fed-Induced Price Swings successful Bitcoin, Ether, Solana and XRP (CoinDesk): On Fed day, Volmex’s implied volatility indices suggest humble moves pursuing the interest-rate decision, with bitcoin’s 24-hour plaything astatine 2.56% and ether’s astatine 3.45%.

- Dollar Faces $2.5 Trillion ‘Avalanche’ of Asian Sales, Jen Says (Bloomberg): Eurizon SLJ Capital analysts said rising commercialized tensions could punctual Asian investors to repatriate funds oregon hedge against a weaker dollar, risking a large sell-off.

- China Keeps Adding Gold to Reserves arsenic Challenges Stack Up (Bloomberg): The People's Bank of China added 70,000 ounces of golden successful April, lifting its six-month full to astir 1 million, portion futures trading volumes precocious reached all-time highs successful Shanghai.

In the Ether

5 months ago

5 months ago

English (US)

English (US)