The U.S. Securities and Exchange Commission (SEC) has cleared a way for a flood of caller crypto exchange-traded products to deed the market, a determination analysts accidental could reshape however wealth flows into integer assets.

On Wednesday, the bureau approved generic listing standards for "commodity-based spot shares" crossed regulated exchanges Nasdaq, Cboe BZX and NYSE Arca.

Read more: SEC Makes Spot Crypto ETF Listing Process Easier, Approves Grayscale's Large-Cap Crypto Fund

The caller rules region the request for each crypto ETP to acquisition its ain idiosyncratic regularisation filing nether Section 19(b) of the Exchange Act. Instead, an offering whose underlying assets fulfill definite nonsubjective eligibility tests — for example, if the crypto trades connected a marketplace that is simply a subordinate of the Intermarket Surveillance Group (ISG), oregon if the underlying asset's futures declaration is listed connected a CFTC-regulated designated declaration marketplace for astatine slightest six months — tin beryllium listed utilizing these generic standards.

What's next?

The regulatory displacement marks a watershed for the crypto industry, removing overmuch of the procedural resistance that has historically slowed getting caller crypto products to the market, analysts said.

"[The] crypto ETF floodgates are astir to open," said Nate Geraci, a well-followed ETF expert and president of NovaDius Wealth Management.

"Expect an implicit deluge of caller filings and launches," helium said. "You whitethorn not similar it, but crypto is going mainstream via the ETF wrapper."

Matt Hougan, main concern serviceman of integer plus absorption steadfast and ETF issuer Bitwise, said the SEC's determination is simply a "coming of age" infinitesimal for crypto.

"[It's] a awesome that we’ve reached the large leagues," helium wrote. "But it’s besides conscionable the beginning."

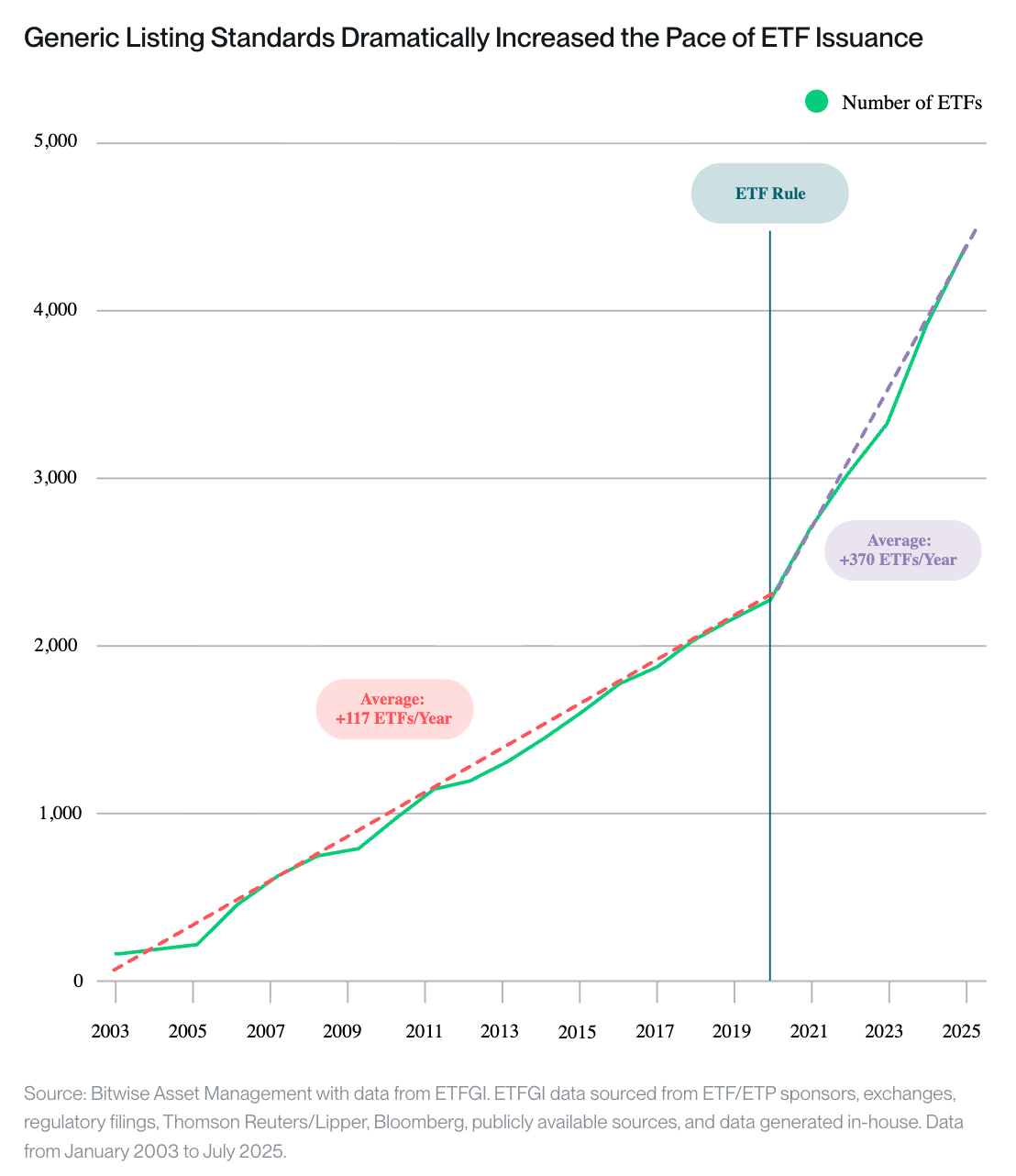

History backs up predictions that the fig of caller crypto ETF launches volition accelerate nether the caller regime.

When the SEC approved generic listing standards for enslaved and stock-based products successful 2019, the fig of ETFs launches much than tripled successful a year, rising to 370 from 117 the twelvemonth before, Hougan pointed out.

What does it mean for crypto prices?

Hougan cautioned against assuming caller crypto ETPs volition automatically thrust ample inflows. "The specified beingness of a crypto ETP does not warrant important inflows," helium wrote. "You request cardinal involvement successful the underlying asset."

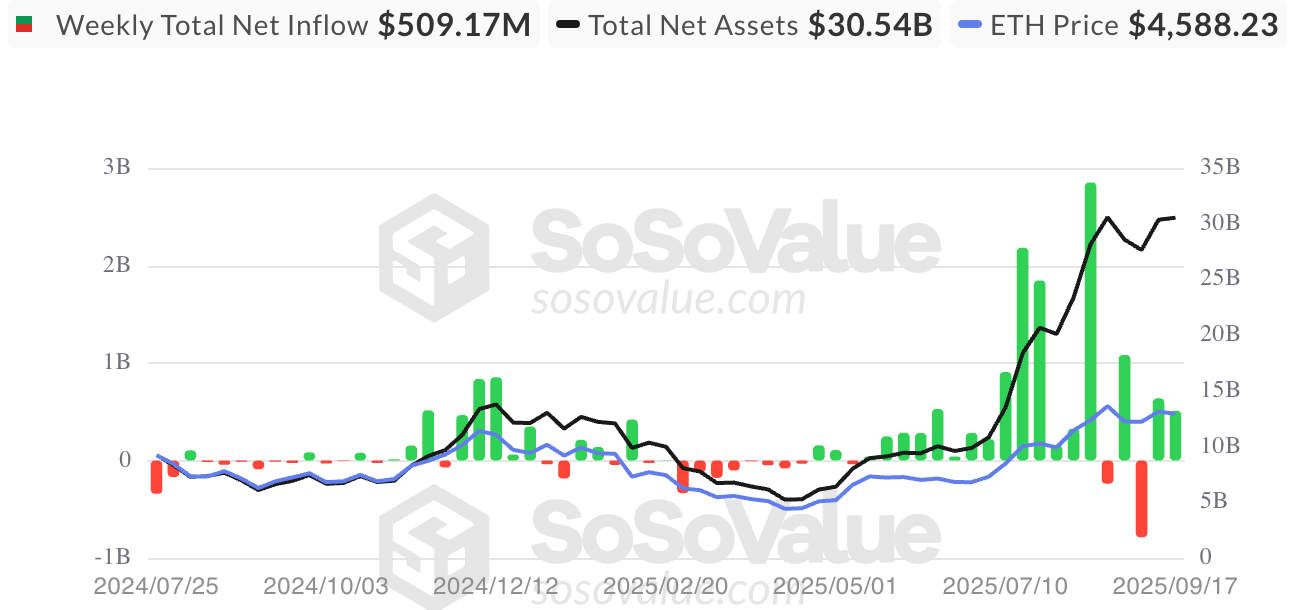

Take, for example, the dilatory commencement of spot ether (ETH) ETFs. They lone began gathering meaningful inflows astir a twelvemonth aft launch, erstwhile stablecoin enactment and — by hold — Ethereum's concern communicative picked up, Hougan wrote.

By contrast, products tied to smaller-cap assets with little tangible usage cases whitethorn conflict to pull superior absent renewed fundamentals, helium added.

Still, helium argued that ETPs dramatically little the obstruction for accepted investors, making it acold easier for organization and retail allocators to pivot into crypto erstwhile sentiment turns. They besides assistance demystify cryptocurrencies for mainstream audiences erstwhile names similar Avalanche (AVAX) and Chainlink (LINK) look successful brokerage accounts, Hougan said.

"What we are seeing present are underlying assets further down the worth curve being rolled into these wrappers and strategies," Paul Howard, elder manager of Wincent told CoinDesk successful a note. "For institutions that cannot ain spot [crypto] directly, these vehicles supply a wrapper and determination liquidity into the ecosystem."

The tokens astir apt benefitting from this are large-cap altcoins. "Dogecoin (DOGE), XRP (XRP), Solana (SOL), Sui (SUI), Aptos (APT) and others are present ushering successful the adjacent question of [products] arsenic investors look for opportunities and applications extracurricular of bitcoin (BTC) and ETH," Howard said.

2 months ago

2 months ago

English (US)

English (US)