Today’s Crypto for Advisors newsletter is written by me! Join maine arsenic I bespeak connected the maturation of the crypto industry. Then, Kim Klemballa from CoinDesk Indices answers questions connected advisors' minds erstwhile it comes to pricing and benchmarking the plus people successful “Ask the Expert.”

I anticipation you bask our newsletter. Thank you for letting maine beryllium your steward. Thanks to each the astonishing contributors who stock their stories week aft week. I look guardant to wherever we volition beryllium successful 2 years.

Webinar alert: Explore the integer plus marketplace and ways to entree the crypto plus people beyond bitcoin. Join Ric Edelman of DACFP, David LaValle of Grayscale Investments and Andrew Baehr of CoinDesk Indices for an informative Webinar connected July 16 from 1-2 p.m. ET. Live webinar only. CE credits available. Learn much and register today.

Two Years In, and Just Getting Started

Two years ago, I took connected the relation of exertion for Crypto for Advisors astatine a pivotal moment. It was mid-2023, and the cryptocurrency manufacture was successful the midst of a heavy winter. The illness of large lending platforms and the implosion of FTX had sent shockwaves done the markets. The U.S. regulatory clime was hostile, marked by enforcement-first tactics, and assurance was shaken.

But adjacent then, the undercurrents of thing bigger were intolerable to ignore. Fast guardant to today, and we’re lasting connected the borderline of what Bank of America calls a “once-in-a-millennium transformation.” They’re not talking astir memes oregon speculation. They’re talking astir the reshaping of planetary fiscal infrastructure, economical models, and integer ownership — and it’s being driven by crypto.

An Ode to Bitcoin: The Genesis

“Bitcoin belongs successful the aforesaid enactment arsenic the printing property and artificial intelligence.” — Bank of America:

Bitcoin, calved successful the aftermath of the 2008 fiscal crisis, created thing revolutionary: a decentralized, fixed-supply integer currency. It belonged to nary government, nary corporation, and nary cardinal authority.

From there, a question began. Early adoption saw students tinkering with GPUs, developers gathering wallets, entrepreneurs launching exchanges, and miners chasing inexpensive powerfulness astir the globe. A technological and economical gyration took shape.

Today, we’re seeing bitcoin ETFs from the world’s largest plus managers — BlackRock, Fidelity and Grayscale being the top three by AUM — and adjacent nation-state adoption arsenic countries similar the U.S. and UAE contention to go planetary crypto hubs. It’s an unparalleled acceleration of fiscal innovation.

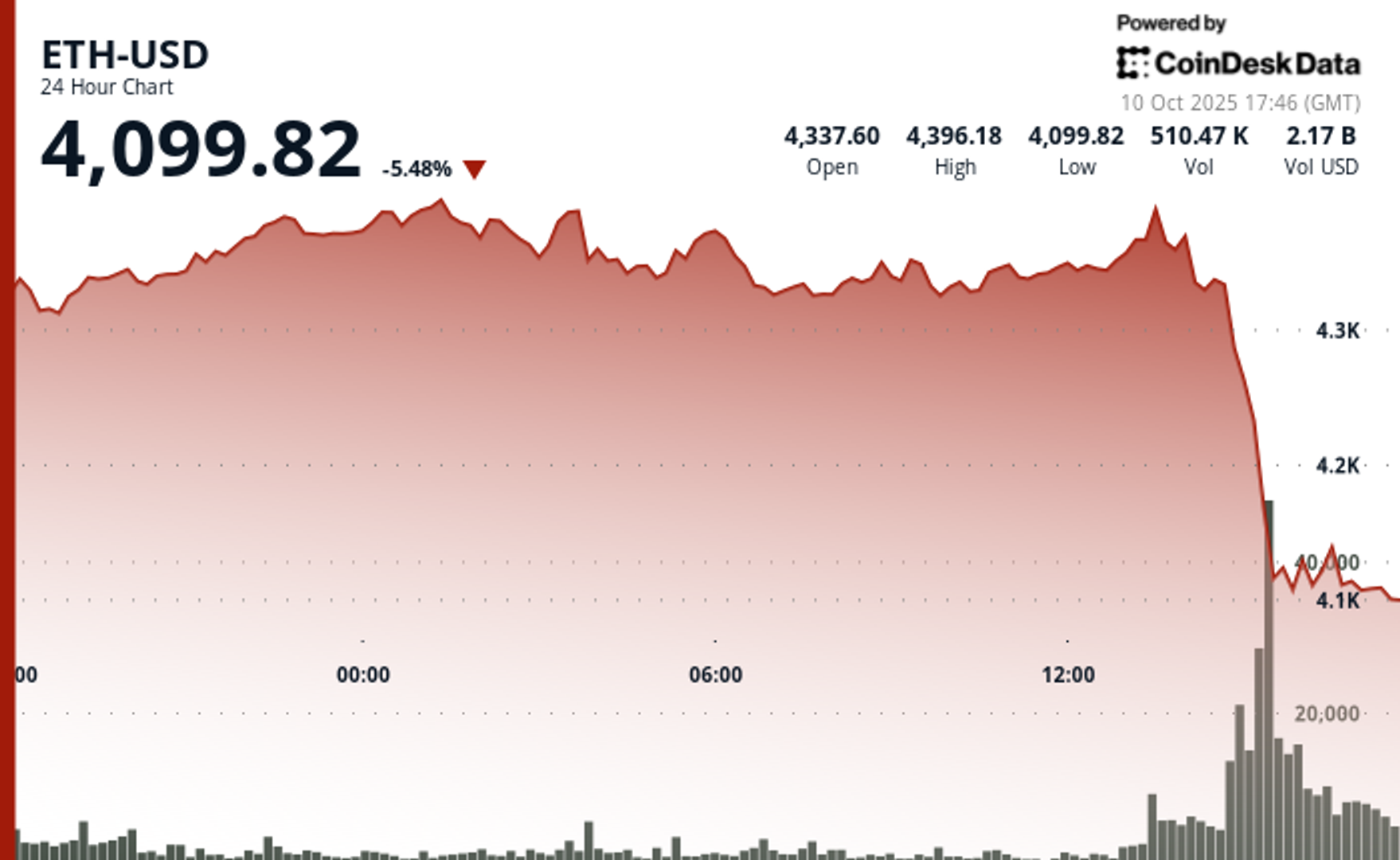

The Rise of Ethereum and Smart Contracts

Bitcoin sparked the fire, but Ethereum — and the astute declaration innovation it introduced — brought utility, programmability, and the quality to tokenize everything: existent estate, c credits, good art, identity, equities, and adjacent yield-generating protocols.

While Bitcoin and Ethereum predominate headlines, tens of thousands of integer assets exist. And portion investing grabs the spotlight, blockchain is softly transforming proviso chains, intelligence property, finance, and more.

Public companies are adding crypto to their equilibrium sheets. Over 140 nationalist firms person announced bitcoin reserves. Exchanges similar Coinbase and Kraken volition connection tokenized equities, portion retail platforms similar Robinhood grow their crypto products. Access points are multiplying: direct-to-consumer platforms, ETFs (now successful the hundreds), tokenized funds, and nonstop ownership. And the database keeps growing.

The Landscape Has Changed — Are You Adopting?

Only a fistful of advisors were precise aboriginal adopters but that’s dilatory evolving. There’s broadening designation of the accidental — to enactment clients, support relationships, and triumph caller business. It's becoming progressively communal to perceive from advisors that they are winning clients simply due to the fact that they’re consenting to speech astir bitcoin.

On the different hand, the deficiency of regulation, prohibitive steadfast policies, integer assets volatility behaviour and wide uncertainty with a caller plus people has caused hesitancy. Moreover, advisors person a batch to wage attraction to —- and present learning a caller — and ever changing — plus people is added to the list! Despite each of this, clients privation to entree integer assets. Recent Coinshares survey data highlights that clients privation the assistance of their advisors and expect them to beryllium knowledgeable successful integer assets. More than 80% of the respondents answered that they would beryllium much apt to enactment with an advisor that offers integer plus guidance, and 78% of non-crypto investors accidental they’d crook to an advisor if crypto enactment were available. Notably, astir 90% said they planned to summation their crypto vulnerability successful 2025.

A Call to Action

Blockchain is an infrastructure, crypto is much than an plus people and the exertion extends good beyond investing.

The manufacture is maturing,regulation is advancing andthe world’s largest institutions are processing connected blockchain. As U.S. Treasury Secretary Scott Bessent said recently, “Crypto is the astir important phenomenon happening successful the satellite today.”

You don’t request to beryllium a crypto trader oregon blockchain developer. But if you’re a fiduciary — a guide, a planner — you beryllium it to your clients to recognize what’s happening. Education is key.

In 2 years of curating this newsletter, I’ve watched sentiment displacement from skepticism to curiosity to strategical integration. And we’re conscionable getting started. I’m thrilled to beryllium present with you connected your crypto journey. Connect with maine for ideas connected aboriginal topics you’d similar to spot addressed.

- Sarah Morton, main strategy officer, MeetAmi Innovations Inc.

Ask an Expert

Q. Why is the aforesaid integer plus priced otherwise connected each exchange?

A. Equities “plug in” to an exchange, allowing for one, centralized price. Crypto, connected the contrary, is “decentralized.” This means there’s not 1 “plug” to terms a integer asset. While crypto prices are based connected proviso and request (as good arsenic different factors), each speech operates independently and truthful prices tin alteration betwixt antithetic exchanges.

Q. How tin I find reliable pricing information for integer assets?

A. There are galore integer plus scale and information providers. Look for pricing that (1) comes from a reputable and trusted supplier with a proven way grounds successful integer assets, (2) has a transparent and rules-based attack to construction, and (3) lays retired thoughtfully constructed criteria for however the pricing is captured. The scale methodology is incredibly important. For example, if enactment criteria of an scale included “trading connected much than 1 eligible exchange” with eligibility thoughtfully designed, past successful the lawsuit of the FTX collapse, FTT (the speech token of FTX) wouldn’t person made it into the index. Thoughtful operation tin regularisation retired atrocious actors.

Q. Why are radical utilizing bitcoin to measurement the full integer plus landscape?

A. While bitcoin present accounts for 65% of the full integer plus market, determination were times bitcoin was less than 40% of the market. One plus should not beryllium a benchmark for the full plus class. Diversification is cardinal for organization investors to negociate volatility and seizure broader opportunities. Effective benchmarking indispensable service aggregate constituencies—enabling show evaluation, supporting concern strategies, and mounting manufacture standards for everyone.

Indices specified arsenic CoinDesk 5 (CD5), CoinDesk 20 (CD20), CoinDesk 80 (CD80), CoinDesk 100 (CD100) and CoinDesk Memecoin (CDMEME) were constructed to conscionable the needs of those looking to benchmark, commercialized and/or put successful the ever-evolving integer plus landscape.

- Kim Klemballa, CoinDesk Indices

Keep Reading

- CoinDesk breaks down the June crypto markets and ETF/ETP flows. Brought to you by ETF Express and Trackinsight.

- Digital Assets: Quarterly Review and Outlook is present available! This study by CoinDesk includes a Q2 recap, Q3 outlook and dive into integer assets dominating headlines.

- Crypto Insights Group released, “Mapping Digital Assets successful Institutional Portfolios.” This study meets you astatine the intersection of allocators, money managers and data.

- VanEck CEO says much Americans person exposure to bitcoin than gold.

3 months ago

3 months ago

English (US)

English (US)