Yesterday, July 30th, was the 10-year day of Ethereum’s launch. In today’s Crypto for Advisors newsletter, Alec Beckman from Psalion writes astir Ether’s increasing relation arsenic a treasury reserve plus and highlights increasing trends.

Then, Eric Tomaszewski from Verde Capital Management answers questions astir Ether arsenic an concern successful Ask an Expert.

Thank you to our sponsor of this week's newsletter, Grayscale. For fiscal advisors: register for the upcoming Minneapolis lawsuit connected September 18th.

Ethereum: The Rising Treasury Asset Reshaping Corporate Finance

Ether, the cryptocurrency of the Ethereum blockchain, is rapidly being adopted by nationalist companies arsenic a strategical treasury asset, an improvement that is helping to reshape firm concern and displacement ETH’s marketplace dynamics.

Bitcoin has agelong dominated the digital treasury conversation. Its capped proviso and decentralized quality marque it a hedge against ostentation and a store of value. Ether is catching up, acknowledgment to its output potential, economics, real-world utility, and maturing organization infrastructure.

Why Ethereum Appeals to Treasuries

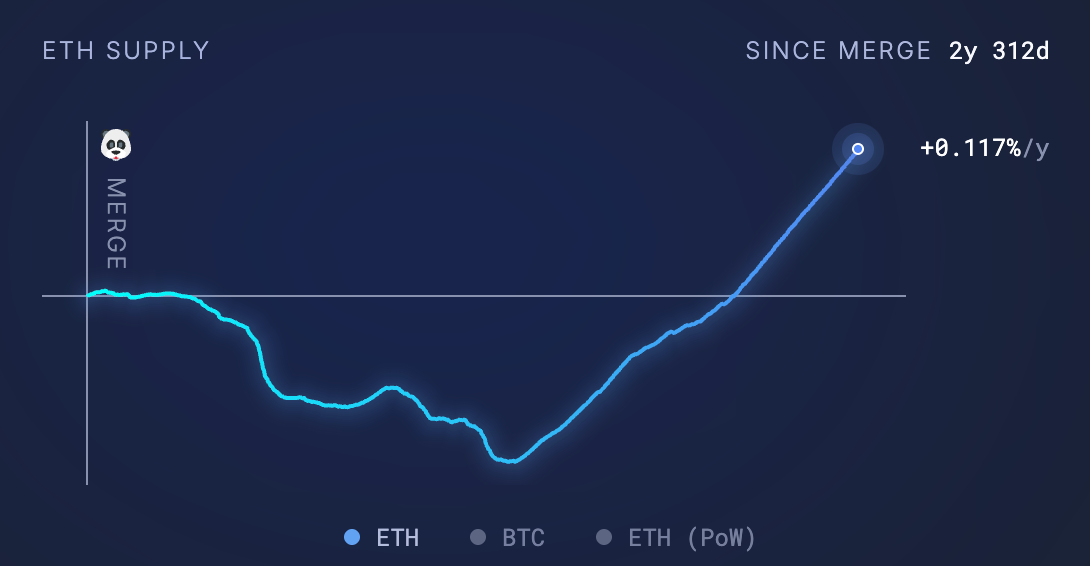

Ethereum’s 2022 transition to proof-of-stake enabled holders to gain yearly staking yields betwixt 2% and 4%, creating a passive income furniture that Bitcoin doesn’t offer. The plus has besides been deflationary astatine times, with much ETH burned than issued, supporting a store-of-value thesis.

At the aforesaid time, Ethereum powers an ecosystem of decentralized applications, tokenized assets, and astute contracts. For corporations, it tin relation not lone arsenic a reserve plus but besides arsenic superior for deploying services and infrastructure.

The ETH Treasury Wave

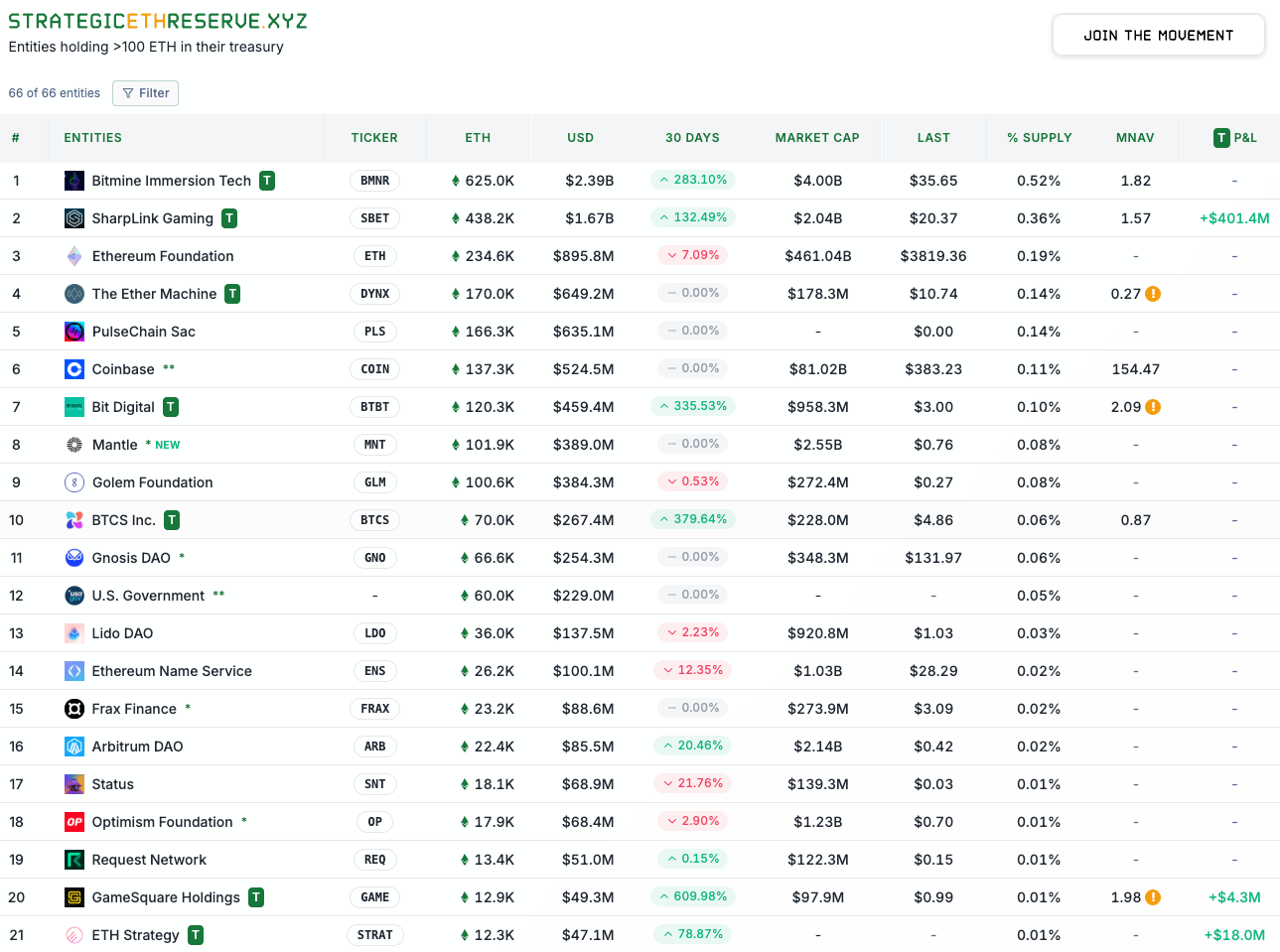

Several public companies are present gathering treasury strategies astir ETH, pursuing aboriginal movers similar MicroStrategy successful Bitcoin:

- Bit Digital holds implicit 120,300 ETH and stakes its full allocation. CEO Sam Tabar calls it a “flywheel model,” wherever staking output funds operations. They plan to adhd more to the tune of > $1b.

- BTCS precocious accrued its holdings to implicit 70,000 ETH and was among the archetypal nationalist firms to involvement ETH arsenic a treasury strategy.

- Bitmine Immersion is aiming to get 5% of full ETH supply. Backed by important backing and led by Tom Lee, it present holds implicit 625,000 ETH.

- Sharplink Gaming holds much than $1.67 cardinal successful ETH, adding astir 80,000 coins successful a azygous week and pursuing staking arsenic a halfway strategy. Joe Lubin is simply a committee subordinate and moving their ETH acquisition strategy.

- Gamesquare has allocated an archetypal $30 cardinal successful ETH with approval to standard to $250 million. It besides plans to integrate DeFi and NFT-based output arsenic differentiators. GameSquare sees the Ethereum Network arsenic Manhattan, with a Financial District (DeFi), an creation territory (NFTs), and more. Investing successful it contiguous is captious for aboriginal worth and use.

- The Ether Machine, a SPAC-backed conveyance spun retired from Publicly Traded Dynamix, is targeting $1.5 cardinal successful ETH arsenic it prepares to spell public.

The companies listed supra each program to adhd importantly more. Other companies person conscionable announced their holdings specified arsenic ETHzilla.

These companies aren’t conscionable buying… they’re signaling semipermanent condemnation and, successful galore cases, gathering products and gross streams straight connected Ethereum. One illustration is GameSquare, whose strategy intimately aligns with their assemblage successful the gaming, media, and amusement industries and sees the transportation with on-chain products built connected Ethereum. It is important to them to foster fiscal alignment with their audience.

BTCS is implementing a akin strategy to align with its audience, arsenic block building and staking make a vertical stack connected the Ethereum Network, resulting successful efficiencies successful transactions and staking.

The Demand–Supply Imbalance

ETH’s terms has climbed steadily successful caller months, and nationalist institution purchases are 1 of the superior catalysts for this increase. In a caller 30-day span, implicit 32 times much ETH was purchased than issued. That includes buying from treasury allocators, staking vehicles, and recently approved ETFs. A continuation of this inclination volition make a proviso shock.

Unlike Bitcoin, wherever miners often indispensable merchantability their bitcoin to screen operational costs, Ethereum’s displacement to proof-of-stake reduces sell-side unit and aligns holders with securing the network.

Conclusion

Ethereum is nary longer conscionable a level for developers; it’s present a fiscal plus that nationalist companies are adopting astatine scale. With built-in yield, deflationary dynamics, and rising organization demand, ETH is emerging arsenic a cornerstone of firm treasury strategy. As much firms determination from “interested” to “allocated,” this caller question of ETH buyers whitethorn assistance specify the adjacent signifier of the crypto cycle.

Special convey you to Sam Tabar, CEO of Bit-Digital, Charles Allen, CEO of BTCS, Justin Kenna, CEO of GameSquare and Rhydon Lee, managing spouse of Goff Capital (affiliated with GameSquare) connected sharing their insights with maine connected ETH Treasury Companies, differentiation, and the Ethereum web successful general.

- Alec Beckman, vice president of growth, Psalion

Ask an Expert

Q: Why is ETH being discussed arsenic a strategical reserve asset?

A: Ethereum has softly go fiscal infrastructure, not conscionable a speculative asset.

Unlike bitcoin (which is mostly a “store of value” ), ETH powers a existent system that ties to astute contracts, tokenized assets, stablecoin transactions, and decentralized fiscal services. As much economical enactment settles connected Ethereum, ETH is being considered a reserve plus by institutions, fintech firms, DAOs, and adjacent sovereign actors.

The crushed is that ETH is the substance that makes the strategy work. It's akin to holding lipid successful an vigor system oregon treasuries successful a dollar system.

Q: Should firm treasuries dainty ETH similar a currency equivalent, long-duration tech-oriented equity, oregon a signifier of intangible infrastructure?

A: In practice, I spot this arsenic a caller sleeve successful the portfolio that I’d telephone a “digital infrastructure reserve." It carries tech beta and regulatory risk, but besides offers operational inferior (smart-contract escrow, settlement, tokenization rails). That’s neither currency nor equity.

Q: How bash you construe “ETH arsenic a strategical reserve” into applicable implications?

A: For institutions and treasuries:

- ETH serves arsenic the currency and collateral for moving on-chain businesses.

- It generates output (staking) similar T-bills.

- It’s held connected equilibrium sheets, declared successful treasury policies, and audited.

For individuals & families:

- ETH is treated arsenic a semipermanent strategical asset.

- Allocated thoughtfully (at slightest 1 — 5%) and separated from short-term needs.

- Used to gain staking income, hedge against fiat devaluation, and summation vulnerability to Ethereum’s increasing relation successful concern and tokenized infrastructure.

Q: What would beryllium that ETH deserves to beryllium treated similar a superior reserve plus implicit the adjacent 10 years?

A: If much of the world’s fiscal enactment similar tokenized existent estate, stablecoins, and ample planetary payments are settling straight connected Ethereum, it shows increasing spot successful the network. As Ethereum becomes halfway infrastructure for planetary worth transfer, ETH moves from speculation to a morganatic strategical reserve.

Strategicethreserve.xyz is simply a large root for gauging progression. Beyond that, it's adjuvant to ticker the innovation and creativity of names similar Robinhood and The Ether Machine, to sanction a few.

- Eric Tomaszewski, fiscal advisor, Verde Capital Management

Keep Reading

- The White House released its archetypal Digital Asset Policy Report connected Wednesday, July 30th.

- Billionaire Ray Dalia recommends a 15% bitcoin exposure successful portfolios to hedge against fiat debasement.

- Samsung has partnered with Coinbase to integrate crypto payments for Samsung users.

4 months ago

4 months ago

English (US)

English (US)