Sino Global Capital, 1 of Asia’s biggest and astir well-known crypto investors, led by Matthew Graham, tweeted a connection this week that its “direct vulnerability to FTX speech was confined to mid-seven figures held successful custody.”

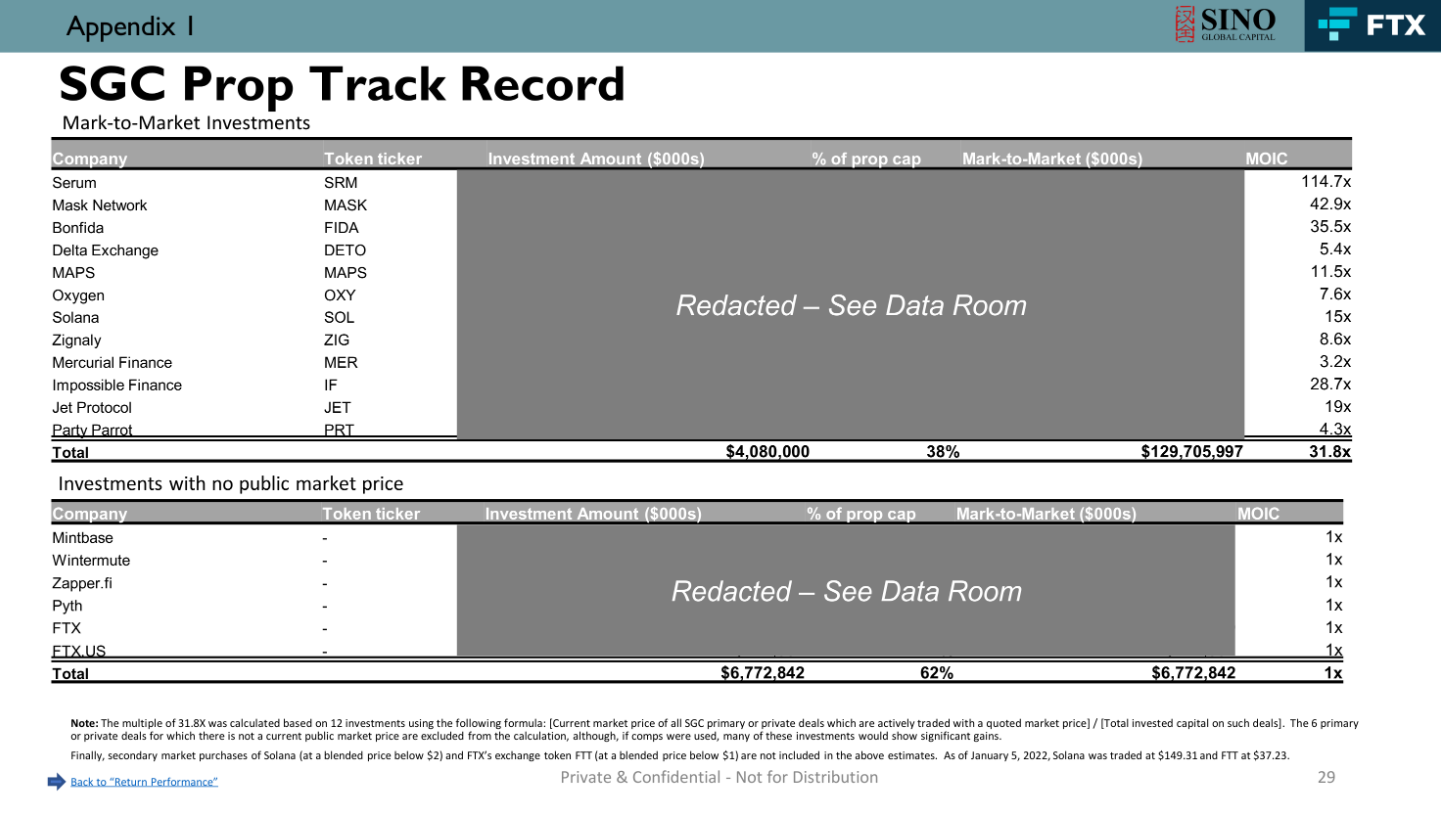

The wording of the connection leaves unfastened the question of however large the firm’s indirect vulnerability mightiness beryllium – including a portfolio of integer tokens that stood astatine $129 cardinal arsenic precocious earlier this year, according to investor documents; galore of those tokens, including the Solana blockchain’s SOL, were among those intimately associated with Sam Bankman-Fried, the once-billionaire crypto whiz-kid-turned-pariah who ran FTX.

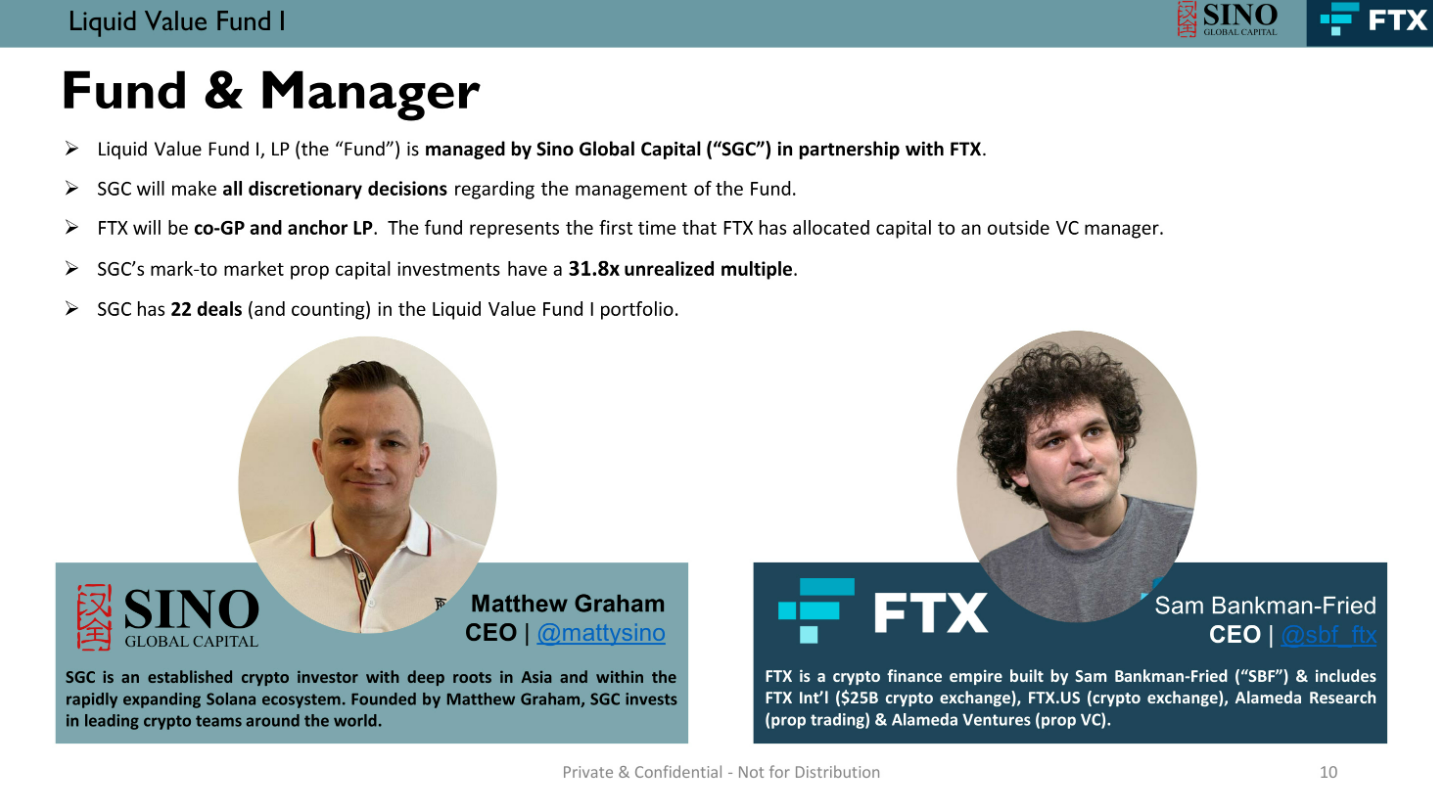

What's driving the other scrutiny present is the surfacing of a slide deck – posted connected a nationalist website but confirmed arsenic authentic by a idiosyncratic acquainted with the substance – that Sino had shopped to investors earlier this twelvemonth erstwhile it was raising a crypto concern fund, with a people of arsenic overmuch as $200 million.

FTX was described successful the descent platform arsenic a "partner" successful the fundraising, with the imaginable to unlock "significant strategical value." As of January, the money had already raised $90 million, with FTX arsenic an anchor investor.

Sino, successful seeking to marketplace its ain investing way record, included a elaborate database of its ain investments – immoderate $129 cardinal of "mark-to-market investments." They included Solana's autochthonal SOL tokens on with Serum (SRM), Maps (MAPS), Oxygen (OXY) and Jet Protocol (JET).

Each of those tokens has suffered terms declines of 80% oregon much arsenic Bankman-Fried's crypto empire unraveled, including the recent FTX bankruptcy.

It's not wide if Sino inactive owns the tokens successful that made up the proprietary trading publication arsenic of January, oregon however overmuch the caller money presently manages, oregon what the money owns. CoinDesk could not get caller documents connected the money detailing show oregon the existent portfolio.

In the lawsuit that the investments haven't liquidated, 1 interest mightiness beryllium that what small worth is near successful the token holdings mightiness beryllium eroded further if Sino moved to dump them; the tokens are truthful thinly traded that determination apt aren't capable consenting buyers astatine the current, already depressed price.

“There isn't capable liquidity to merchantability each the tokens,” said Sara Gherghelas, blockchain expert astatine DappRadar. “The selling could beryllium imaginable if the squad uses immoderate of their ain tokens to supply the liquidity necessary. If this happens, it volition origin a drastic alteration successful the price.”

(Sino Global Capital)

The Liquid Value I money was rolled out successful precocious 2021 astatine the tallness of the bull marketplace mania, targeting a rise of $200 million. It was the archetypal clip Sino, which antecedently had invested chiefly lone arsenic a principal, had turned to extracurricular superior successful a ceremonial money vehicle.

The money wasn’t publically disposable to retail investors, alternatively shopped astir to precocious nett worthy individuals.

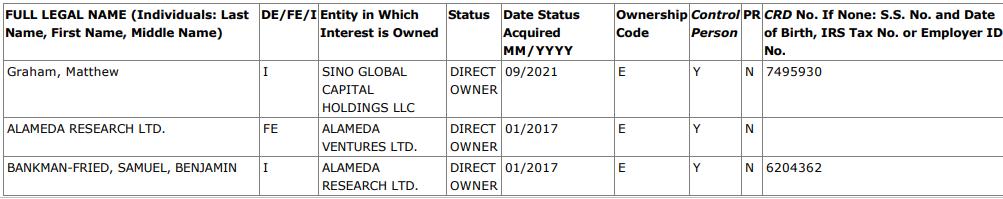

Bankman-Fried himself was an indirect capitalist successful the Liquid Value I fund's wide spouse via his trading steadfast Alameda Research and an entity called Alameda Ventures, according to a U.S. Securities and Exchange Commission (SEC) filing successful February.

(Securities and Exchange Commission)

Among its main investments, Sino Global besides elaborate a $6.8 cardinal portfolio of assets for which determination was nary disposable marketplace price. Those included equity stakes successful FTX and its American arm, FTX.US.

The descent platform doesn’t accidental precisely what investments would beryllium made successful the caller fund, but it does accidental that the “Liquid Value Fund I could grounds a akin breakdown” to Sino’s proprietary investments.

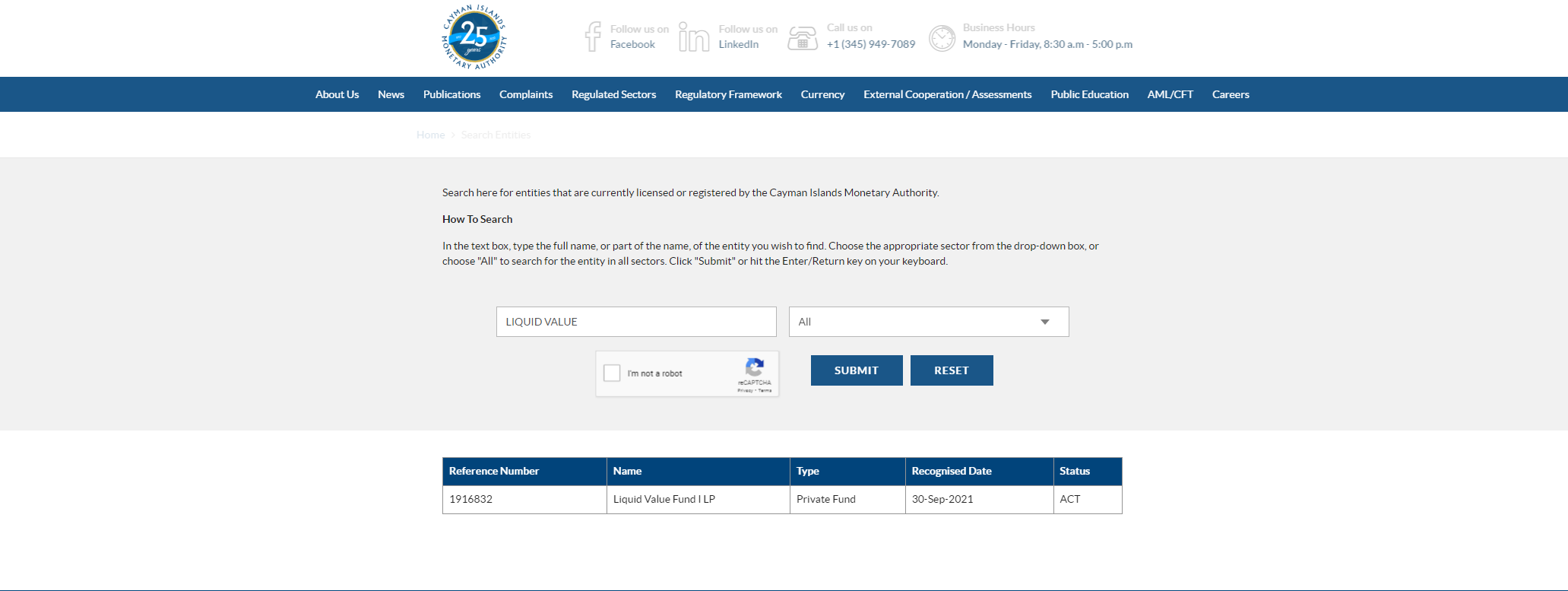

Liquid Value Fund I is presently active, according to a filing with a Cayman Islands money directory, with a registration day of September 2021.

(Cayman Islands Monetary Authority)

Patrick Loney, the firm’s wide counsel and caput of capitalist relations, responded to an email from CoinDesk seeking remark connected the Liquid Value I fund, by saying helium would get backmost soon. He cc’d Mona Hamdy, main strategy officer.

Hamdy said successful an email aft work of this communicative that the extracurricular concern money does not clasp positions akin to the main holdings elaborate successful the descent deck. She said that a ample absorption of the fund's investing efforts has been connected infrastructure and gaming.

If the token concern selections successful Liquid Value Fund I were akin to the choices that Sino had made for its concern portfolio, that mightiness beryllium a atrocious motion for the money – since, arsenic is the lawsuit with the proprietary portfolio, galore of the prices for those tokens person suffered steep declines this year.

Data from CoinGecko shows that MAPS, OXY and JET are precise thinly traded successful digital-asset markets, with little than $250,000 of regular trading volume.

Ajay Dhingra, caput of probe and analytics astatine Unizen, said that, “If idiosyncratic executes a marketplace merchantability bid of 1 cardinal MAPS, it tin easy hitch retired the buy-side books with slippage of 25-30%.”

(Sino Global Capital)

Sino said successful its connection this week that "We trusted FTX to beryllium a bully histrion committed to pushing the manufacture forward," and that "We profoundly regret that misplaced trust."

"Sino Global Capital is functioning arsenic mean and continues to put arsenic a fund," according to the statement. "Fund investments person been balanced crossed ecosystems, and we bash not employment leverage oregon short-term trading strategies."

But astatine a basal level, the fund's ain strategy and operations were truthful tightly linked with FTX's that, adjacent isolated from immoderate losses, a speedy dissociation is apt to beryllium difficult.

It's imaginable that Sino sold disconnected immoderate of the holdings to instrumentality nett oregon trim exposure. But adjacent if they were sold earlier the melodramatic downfall of the past 2 weeks, the returns would beryllium questionable fixed the terms declines earlier this twelvemonth crossed crypto markets.

A idiosyncratic acquainted with the substance told CoinDesk that a cardinal pillar of the fund’s selling was to play up the connections with FTX and Bankman-Fried.

Bankman-Fried’s sanction and FTX’s logo featured prominently connected the January descent deck.

Also touted were FTX’s “rapidly increasing marque designation successful the U.S done high-profile sponsorships of Miami Heat Arena, MLB and prima athletes including Tom Brady, Steph Curry and Lewis Hamilton.”

Sino’s Graham was initially scheduled to look connected a sheet this week connected the “outlook for integer assets” astatine an concern league successful Singapore alongside Matthew Heller, an FTX executive.

UPDATE (Nov. 19, 20:52 UTC): Adds remark from Mona Hamdy, Sino's main strategy officer.

3 years ago

3 years ago

English (US)

English (US)