Investors stepped backmost this week arsenic a premix of shifting bets and speedy profit-taking pushed wealth retired of spot crypto ETFs. Markets moved fast, and immoderate of the biggest swings were driven by short-term reactions alternatively than a alteration successful semipermanent views.

Spot Crypto ETF Flows

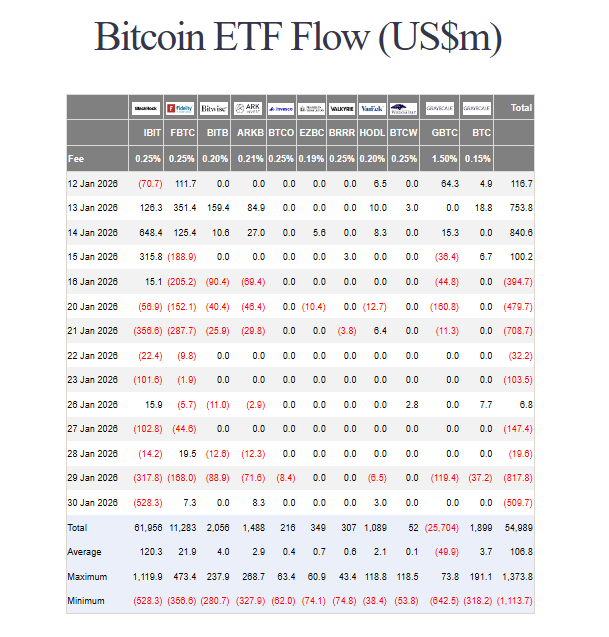

Based connected reports from Farside, US-based spot Bitcoin ETFs saw astir $1.50 cardinal permission implicit 5 trading days, portion spot Ether ETFs had astir $327 cardinal successful outflows.

That adds up to astir $1.80 cardinal pulled from these funds successful conscionable a fewer days. On Jan. 14, reports enactment a precise ample inflow for Bitcoin ETFs — $840 cardinal — which shows however rapidly wealth tin spell successful and out.

Some traders treated that time arsenic a buying moment. Others utilized it to instrumentality profit. That push-and-pull shows up successful the numbers.

Source: Farside Investors

Source: Farside InvestorsA Rally In Metals, Then A Sudden Drop

Gold and metallic grabbed attraction erstwhile they climbed to caller highs. Prices surged, and galore investors moved wealth into precious metals.

But the rally was short-lived. On a azygous trading day, golden fell sharply from its highest and metallic tumbled adjacent more.

Reports accidental those abrupt reversals near immoderate investors rethinking their moves and helped make a question of selling crossed different hazard assets, including crypto.

Bitcoin Price Action

Bitcoin has been swinging. Over the past week, BTC fell astir 6.50% portion Ether dropped astir 8.90%, and they were trading astir $82,500 and $2,685, respectively, according to CoinMarketCap.

The marketplace had a abbreviated spike aft speech of the US CLARITY Act, but prices past cooled. Moves similar this are often tied to positioning, borderline calls, and traders reacting to headlines.

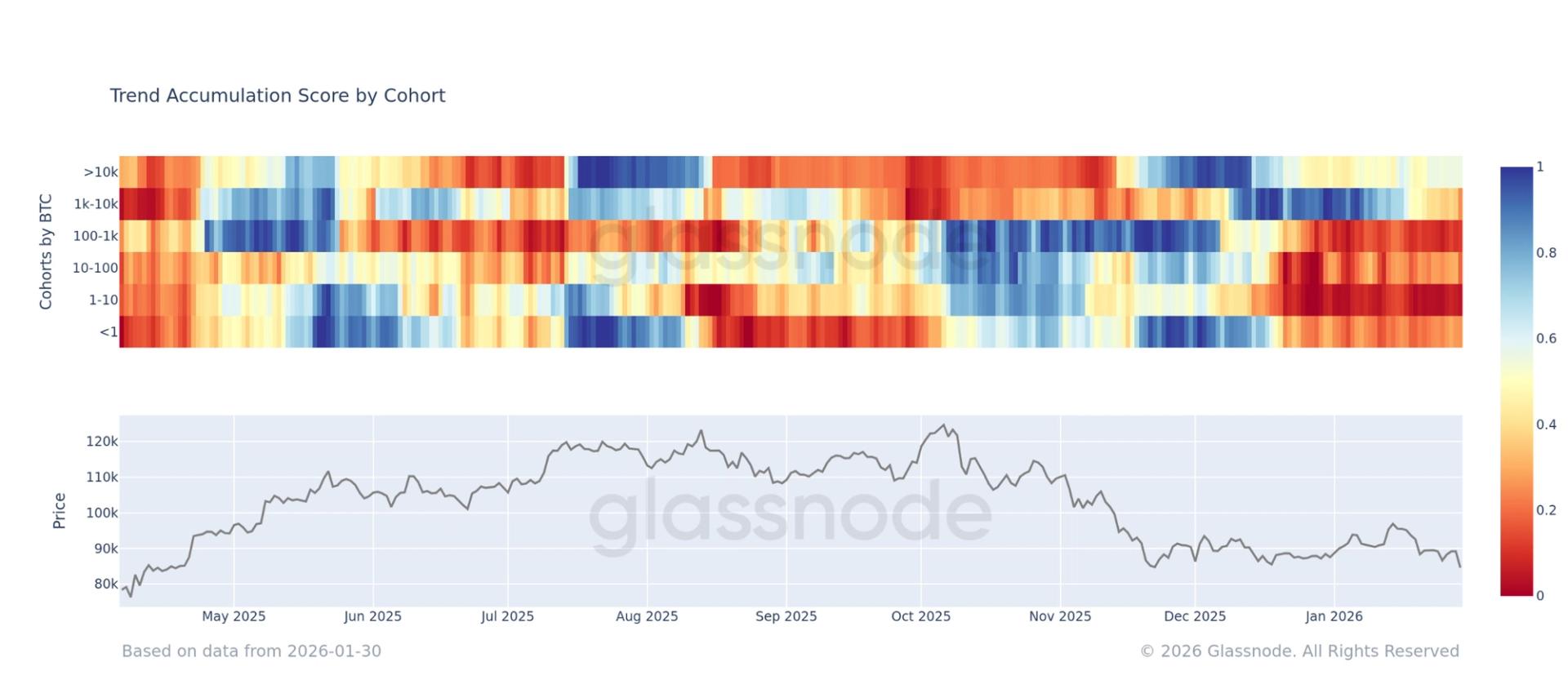

At times, ample flows into ETFs person pushed prices up. Other times, outflows coincide with volatile days erstwhile traders adjacent positions quickly.

What Analysts Are Saying

Reports enactment that immoderate marketplace watchers presumption the pullback arsenic temporary. ETF expert Eric Balchunas said the existent negativity astir Bitcoin’s terms is short-sighted and pointed to beardown show successful anterior years arsenic context.

Another voice, Bitwise’s Matt Hougan, suggested that continued ETF request could nonstop Bitcoin into a overmuch higher trajectory implicit time.

These views bespeak antithetic timeframes — immoderate absorption connected contiguous flows, others connected however dependable request mightiness signifier prices months from now.

Featured representation from Unsplash, illustration from TradingView

1 hour ago

1 hour ago

English (US)

English (US)