Last week, integer plus concern products saw $2.2 cardinal successful inflows, reflecting a broader marketplace uptrend driven by Donald Trump’s caller triumph astatine the just-concluded US statesmanlike election.

In the archetypal fractional of the week, inflows peaked astatine $3 billion, lifting full assets nether absorption (AUM) to an all-time precocious of $138 billion. However, Bitcoin’s grounds terms show during the play prompted an outflow of astir $866 million, resulting successful a nett inflow of $2.2 billion.

According to CoinShares, this inflow pushed the totals since the September involvement complaint chopped to $11.7 billion, bringing the year-to-date full to $33.5 billion.

James Butterfill, Head of Research astatine CoinShares, explained that:

“This caller surge successful enactment appears to beryllium driven by a operation of looser monetary argumentation and the Republican party’s cleanable expanse successful the caller US elections.”

US-Bitcoin ETFs proceed to dominate

Bitcoin’s dominance remained strong, with $1.48 cardinal successful inflows. The important flows tin beryllium linked to the awesome show of the US-based spot exchange-traded money (ETF) products, which proceed to pull important attraction from retail and organization traders.

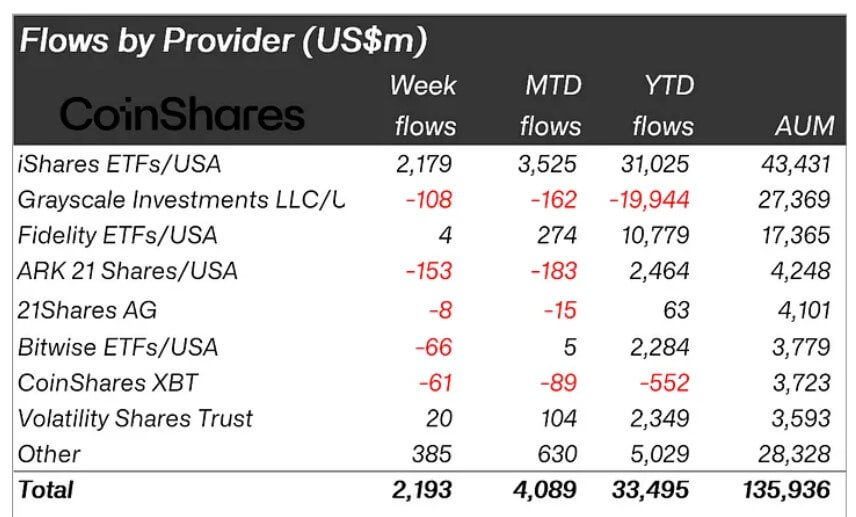

Flows by Asset Management Firms (Source: CoinShares)

Flows by Asset Management Firms (Source: CoinShares)According to CoinShares data, BlackRock’s IBIT and Fidelity’s FBTC saw inflows of $2.1 cardinal and $4 million, respectively. On the different hand, outflows of $153 cardinal from the Ark 21 Shares money outstripped those of Grayscale, which stood astatine $108 cardinal for the week.

Meanwhile, Bitcoin’s record-breaking terms show supra the $90,000 people has attracted bearish traders, who invested $49 cardinal successful abbreviated Bitcoin products.

Moreover, the bullish marketplace sentiment appeared to power involvement successful Ethereum, which besides attracted important inflows of $646 cardinal (equivalent to 5% of its AUM). Butterfill linked this inflow to predetermination results and a projected Beam Chain web upgrade.

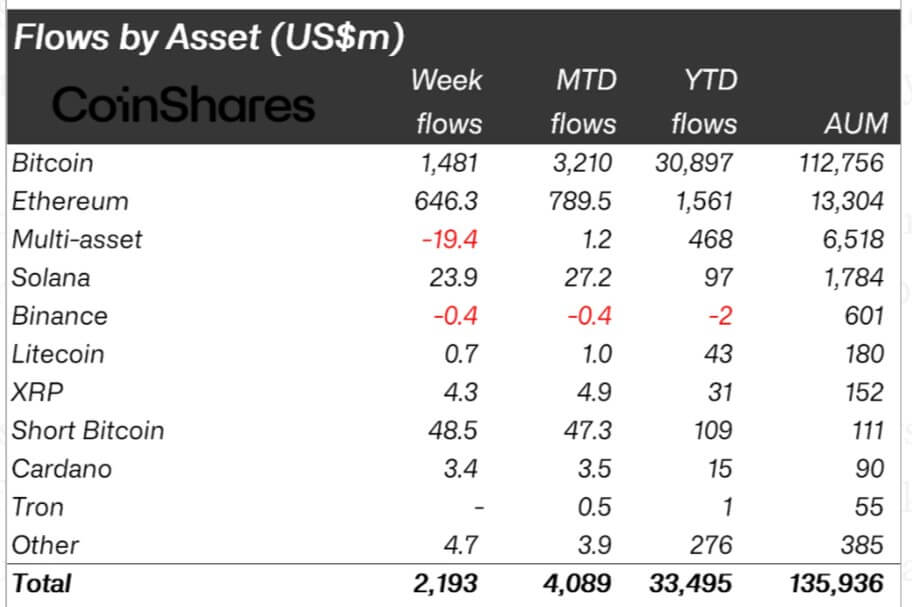

Crypto Asset Flows. (Source: CoinShares)

Crypto Asset Flows. (Source: CoinShares)Other assets, including Solana, XRP, and Cardano, saw much humble inflows of $24 million, $4.3 million, and $3.4 million, respectively.

The station Crypto funds spot $2.2 cardinal inflow, pushing 2024 full to $33.5 billion appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)