Jump Trading’s caller transportation of millions successful Ethereum to centralized exchanges has unsettled the crypto market.

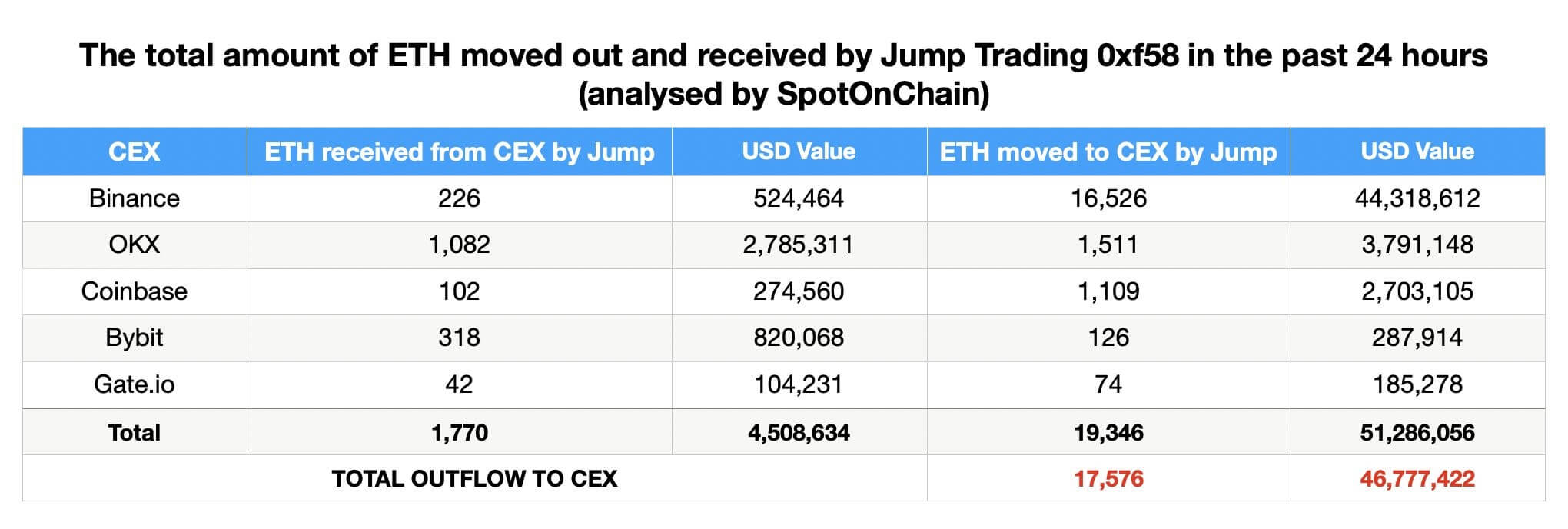

Over the weekend, the steadfast moved 17,576 ETH, valued astatine $46.78 million, to exchanges specified arsenic Binance, OKX, Coinbase, ByBit, and Gate.io, according to blockchain analytical level Spot On Chain.

Jump Trading ETH Transfers (Source: Spot On Chain)

Jump Trading ETH Transfers (Source: Spot On Chain)This determination follows a signifier noted by crypto expert Ember CN. Since July 25, Jump Trading has converted 83,091 wstETH, worthy $341 million, into 97,600 stETH and unstaked 86,059 stETH, valued astatine $274 million, from Lido Finance. The steadfast subsequently deposited a nett 72,213 ETH, worthy $231 million, into assorted exchanges.

Typically, specified transfers awesome bearish sentiment, suggesting holders whitethorn privation to merchantability disconnected their crypto. Despite these moves, the steadfast inactive retains important assets, including astir 37,604 wstETH and 3,214 RETH, valued astatine astir $110 million, according to Arkham Intelligence data.

Meanwhile, different wallet associated with the steadfast holds astir $585 cardinal successful crypto, including USDC and USDT. However, on-chain data shows that the wallet’s equilibrium declined by much than 50% past period earlier recovering to its existent balance.

Market impact

Jump Trading’s actions person contributed to a broader marketplace decline, with large integer assets similar Bitcoin and Ethereum experiencing double-digit drops. Blockchain expert Lookonchain pointed out that the marketplace has fallen by implicit 33% since the steadfast began selling connected July 24.

Gracy Chen, CEO of Bitget, told CryptoSlate that salient players similar Jump Trading offloading ETH and the bearish forecasts pursuing ETF approvals influenced the marketplace downturn.

Adam Cochran, the Managing Partner astatine Cinneamhain Ventures, criticized Jump Trading’s operations, stating:

“Jump liquidating their crypto publication into bladed markets connected a summertime Sunday day perfectly sums up wherefore their crypto cognition is specified a mess.”

Meanwhile, different crypto assemblage members speculated that the money question whitethorn beryllium a prelude to its impending ineligible confrontation with the US Commodity Futures Trading Commission (CFTC). The fiscal regulator is investigating the firm’s trading and concern activities wrong the crypto space. Amid these challenges, institution president Kanav Kariya has resigned.

Over the years, Jump Trading has faced galore challenges, including a $325 cardinal hack of Wormhole, losses from the FTX illness successful 2022, and accusations of manipulating Terra’s algorithmic UST stablecoin peg.

The station Crypto marketplace reels from Jump Trading’s monolithic Ethereum transfers appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)