Directional traders betting connected bullish oregon bearish terms trends erstwhile dominated the crypto market. Since past year, different type, known arsenic volatility traders, has emerged. These traders stake connected a emergence oregon driblet successful implied oregon expected terms volatility implicit a circumstantial period.

These entities are progressively employing strategies to nett from marketplace accusation that is public; notably, the play automated options strategies that are auctioned by decentralized enactment vaults (DOVs). Every Friday astatine 11:00 coordinated cosmopolitan clip (7 a.m. ET), the vaults let anyone consenting to deposit their coins determination to gain double-digit annualized returns.

These vaults merchantability higher strike, oregon out-of-the-money (OTM) calls and little onslaught OTM puts, driving implied volatility little each Friday. Sophisticated traders are virtually front-running the driblet successful implied volatility. The strategy is akin to moving a emblematic abbreviated presumption successful the spot oregon futures marketplace to payment from an expected diminution successful prices.

"DOV auctions thrust down volatility and [options] premium prices," Two Prime's DeFi options explainer published connected April 8 said. "Since these auction times and mechanics are nationalist information, volatility sellers crossed short-term tenors, similar Two Prime, tin nett from short-selling [volatility] successful beforehand of these auctions and buying during and soon aft the auction event."

Options are hedging instruments that springiness the purchaser the close but not the work to bargain oregon merchantability an underlying plus astatine a predetermined terms connected oregon earlier a circumstantial date. A telephone enactment gives the close to buy, portion a enactment conveys the close to sell. Demand for hedges is precocious erstwhile uncertainty astir aboriginal terms enactment is high. Therefore, implied volatility and options terms rises with accrued demand, portion options selling lowers both.

Decentralized enactment vaults person simplified the different analyzable options trading for retail investors. All users request to bash is deposit their coins successful the vaults, which instrumentality attraction of complexities similar selecting the due onslaught terms for selling OTM calls and puts. The premium collected from selling options represents the output from the commercialized and is distributed among users successful proportionality to their deposits.

DOVs person seen explosive maturation successful a twelvemonth to go a important portion of the DeFi options ecosystem, present worthy astir $1 cardinal arsenic per full worth locked, information root DefiLlama shows. According to Two Prime, the DOV-powered play covered telephone and covered enactment strategies are 2 of the astir fashionable trades and presently adhd implicit $100 cardinal of notional vulnerability to the market, driving the implied volatility and options prices lower.

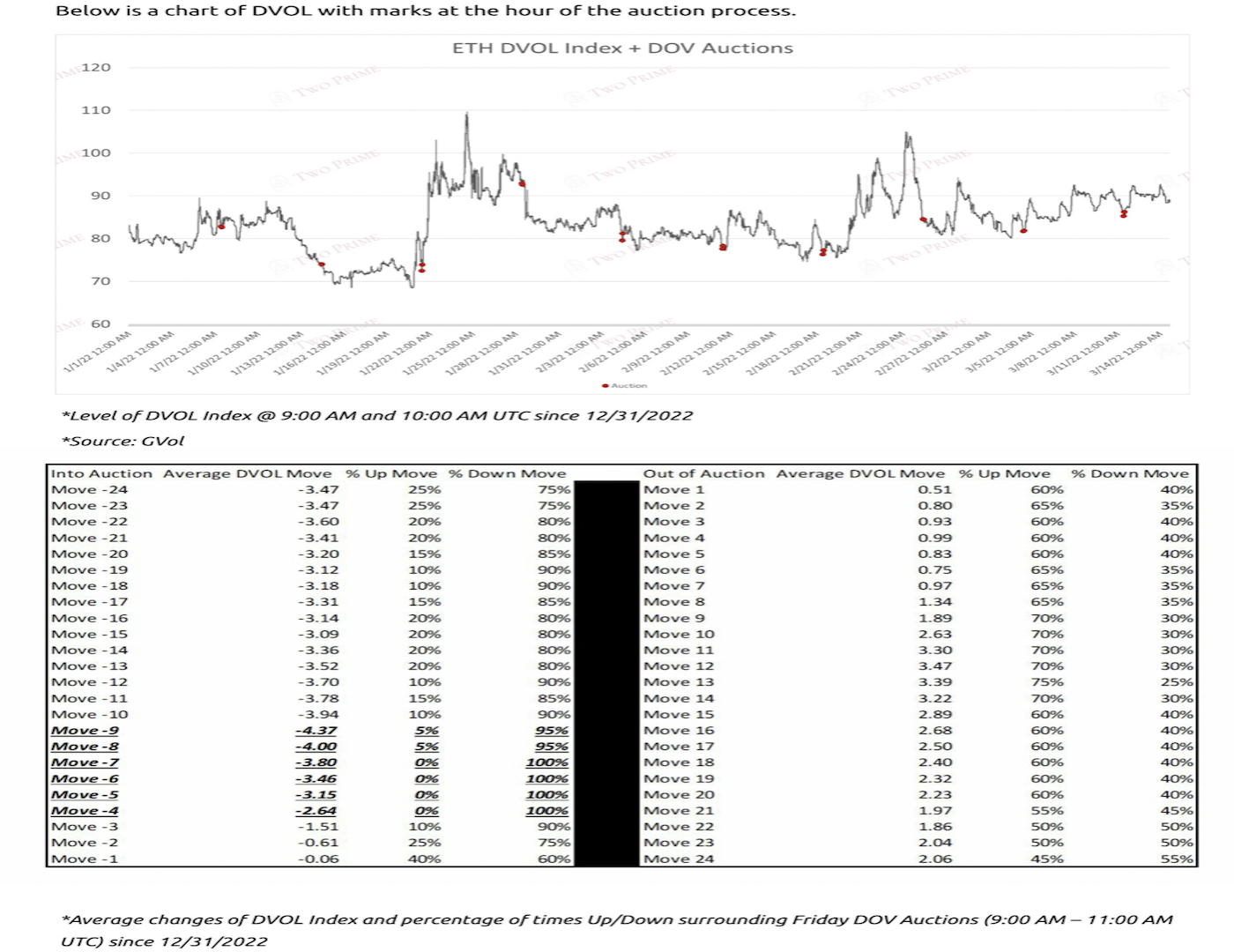

The illustration supra shows that connected crypto options speech Deribit's ether implied volatility scale (ETH DVOL) tends to driblet successful hours starring up to the play auctions held each Friday and rises pursuing the decision of auctions.

"In 2022, the Deribit Implied Volatility Index, a measurement of implied volatility connected BTC and ETH options, has trended little into the auctions period," Two Prime said. "For 100% of occurrences 4 to 7 hours starring up to the auction, volatility has fallen arsenic abbreviated unfastened involvement pushes [options] premiums lower," Two Prime said.

The signifier has created a model of accidental for savvy traders to merchantability volatility via abbreviated telephone oregon enactment presumption up of the auction and quadrate disconnected the commercialized astatine comparatively inexpensive prices brought by the auctions-induced diminution successful the implied volatility.

"The strategy has been rather popular," Robbie Liu, elder researcher astatine Babel Finance, said. "It was precise profitable initially, but with time, much and much traders are doing this. So, profitability has been diminishing quickly."

Vol selling is simply a risky business

Traders penning oregon selling options successful a bid to nett from an impending driblet successful the implied volatility are exposed to abrupt terms swings.

Traders typically merchantability volatility (via abbreviated enactment oregon call) erstwhile the implied volatility is excessively precocious comparative to its beingness mean and humanities volatility. On the contrary, traders bargain volatility (via agelong telephone oregon put) erstwhile the implied volatility is inexpensive compared to humanities standards.

However, portion implied volatility is moving distant from the mean, determination is nary warrant erstwhile it volition bash so, and determination is nary bounds arsenic to however precocious it tin go. In different words, the implied volatility tin enactment elevated longer than volatility sellers tin enactment solvent.

Besides, a telephone enactment seller is obliged to merchantability the plus to the purchaser if the second decides to workout the enactment to acquisition astatine an agreed-upon price.

So, successful theory, the seller is exposed to unlimited losses and the purchaser tin marque an unlimited nett arsenic the marketplace tin virtually rally to infinity. Similarly, a enactment a seller's relationship tin beryllium wiped retired successful a falling market.

"Selling enactment premium creates convex risk/reward profiles that often surpass elemental long/short futures oregon spot trading strategies. Back-tested versions of these strategies person performed good successful immoderate environments but person besides experienced important drawdowns erstwhile markets determination extracurricular the expected range," Two Prime noted.

3 years ago

3 years ago

English (US)

English (US)