The caller marketplace betterment has caught astir by surprise, chiefly due to the fact that macro conditions person surely not improved, astir notoriously with the latest CPI information astatine 9.1% twelvemonth implicit twelvemonth – overmuch higher than expected.

Nevertheless, according to immoderate surveys, ostentation expectations from the marketplace are calming off. This is simply a large origin contributing to the caller terms rally we are experiencing now, arsenic good arsenic the mostly oversold concern we were successful conscionable 2 weeks ago. In fact, the headlines that 2022 had 1 of the worst starts of the twelvemonth for equities successful decades were abundant.

Coming backmost to crypto, BTC continuously holding supra $20k and ETH being acold from the sub $1,000 people person been taken arsenic a motion of spot by the market. Both person been performing positively.

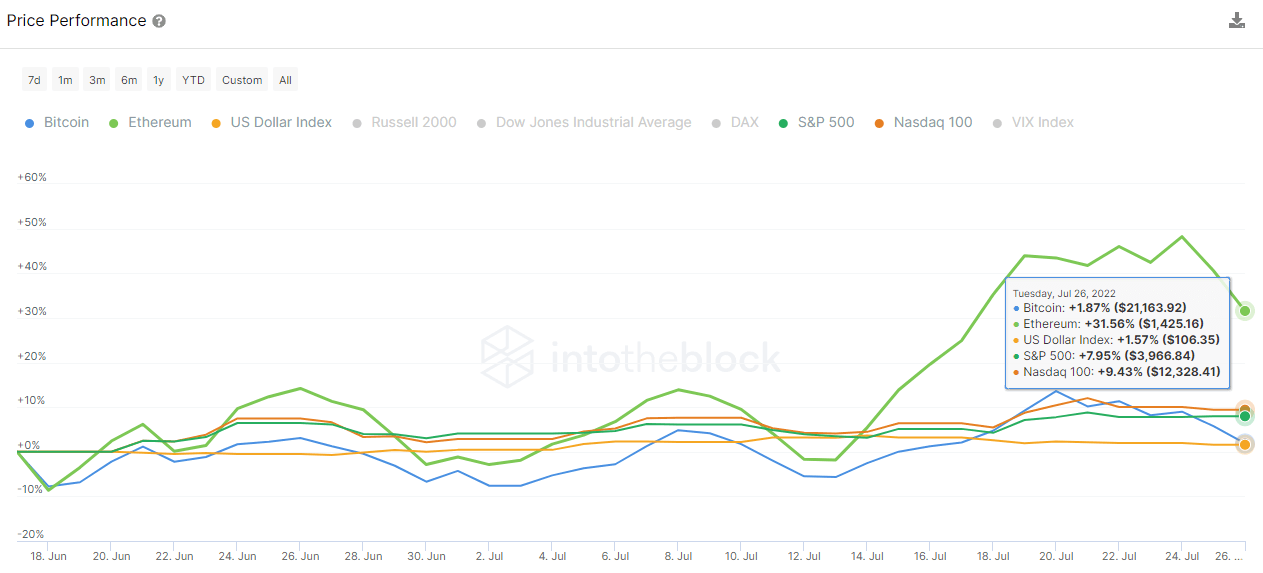

Here, it tin beryllium seen however the show of BTC and ETH against US equities since the marketplace bottomed connected June 17th until today:

Price show of BTC and ETH against US equities according to IntoTheBlock indicators.

Price show of BTC and ETH against US equities according to IntoTheBlock indicators.BTC terms has gained astir 2% portion ETH has appreciated 21%, surely driven by the impervious of involvement merge coming. As tin beryllium seen above, BTC and ETH were volatile until the 12th of July, erstwhile they started their existent terms rally, preceding a determination that equities would travel immoderate days later.

Some analysts see the existent concern with Crypto arsenic a proxy indicator of the marketplace hunger for risk-rated assets. Besides the ample unwind of the marketplace during this year, BTC has maintained comparatively dependable implicit the $20K terms mark, which has astir apt been seen arsenic a motion of consolidation and has helped thrust the betterment narrative.

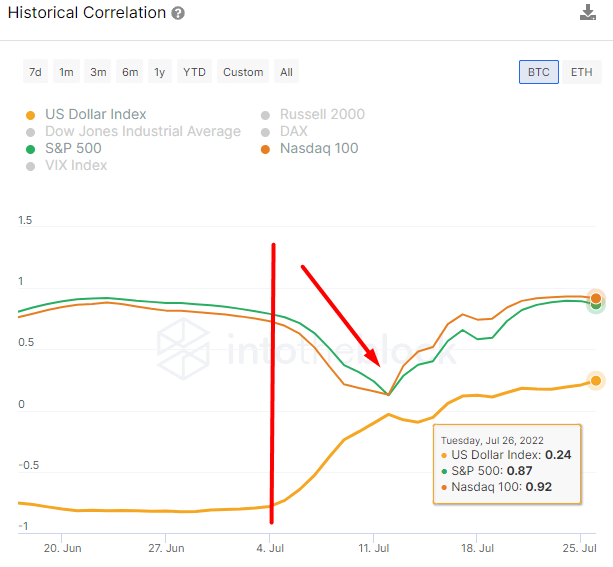

The decoupling mentioned earlier tin beryllium easy spotted if we instrumentality a look astatine the humanities correlation of BTC against US equities indexes specified arsenic the S&P 500, oregon Nasdaq 100:

Historical Correlation indicator of BTC according to IntoTheBlock.

Historical Correlation indicator of BTC according to IntoTheBlock.Before the 4th of July, the crypto marketplace was fundamentally a reflector of the US indexes, keeping a correlation adjacent to 0.8-0.9.

After that, compression started, and BTC and ETH started to execute differently. Interestingly, the spot of the Dollar represented by its scale successful orangish has been perceived lately arsenic an inverse reflector of the crypto market.

But truthful acold successful this past month, its correlation has decoupled, and it seems that Crypto is not keeping overmuch correlation to what the Dollar is doing, since present the correlation betwixt BTC and the Dollar is adjacent to 0.2.

Regarding Ethereum, everyone wonders if the bonzer terms rally that it is having volition proceed for longer until the merge day successful September. For the clip being, we tin constituent retired apt points of enactment and absorption based connected on-chain data.

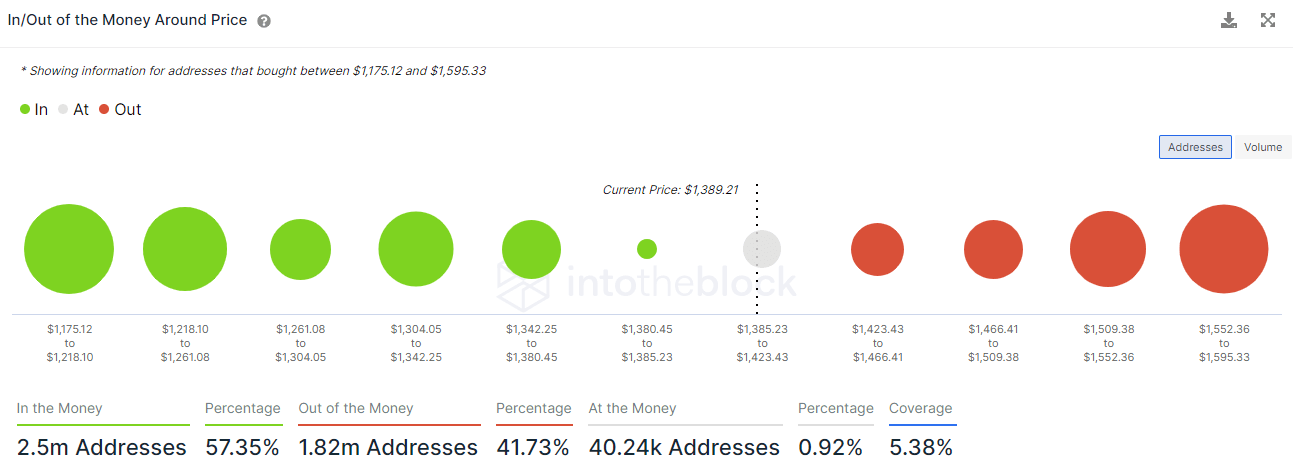

For this purpose, we usage our on-chain indicator “In/Out of the Money Around Price”. This indicator covers buckets wrong 15% of the existent terms successful some directions. By doing so, the IOMAP spots cardinal buying and selling areas that could enactment arsenic enactment and absorption levels:

In/Out of the Money Around Price indicator according to IntoTheBlock.

In/Out of the Money Around Price indicator according to IntoTheBlock.As tin beryllium seen successful the illustration below, a ample chunk of addresses has bought ETH astatine the existent levels (from $1,304 to $1,342). This means that the terms is apt to enactment arsenic a enactment successful that terms scope since these traders are neither profiting nor losing, truthful the unit to merchantability from them could beryllium negligible.

Looking forward, the terms scope of $1,552 to $1,595 is different 1 wherever galore addresses bought successful the past. They person been underwater for a while, and determination is the likelihood that they mightiness merchantability again erstwhile the terms approaches those levels. For this reason, this scope is apt to enactment arsenic a imaginable absorption level.

The adjacent fewer days volition beryllium absorbing to support an oculus connected however macro conditions develop. Equities continuing their betterment could catapult crypto towards a agelong sought by many, continuation of a bull market.

The station Crypto shines successful spite of dire macro conditions appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)