The ether (ETH) spot marketplace lull has traders focusing connected derivatives, with immoderate uncovering options cheaper successful this debased implied volatility environment.

Barring a little spike to $3,200 aboriginal this week, ether, the second-largest cryptocurrency by marketplace value, has mostly traded successful the scope of $2,400 to $3,200 since precocious January.

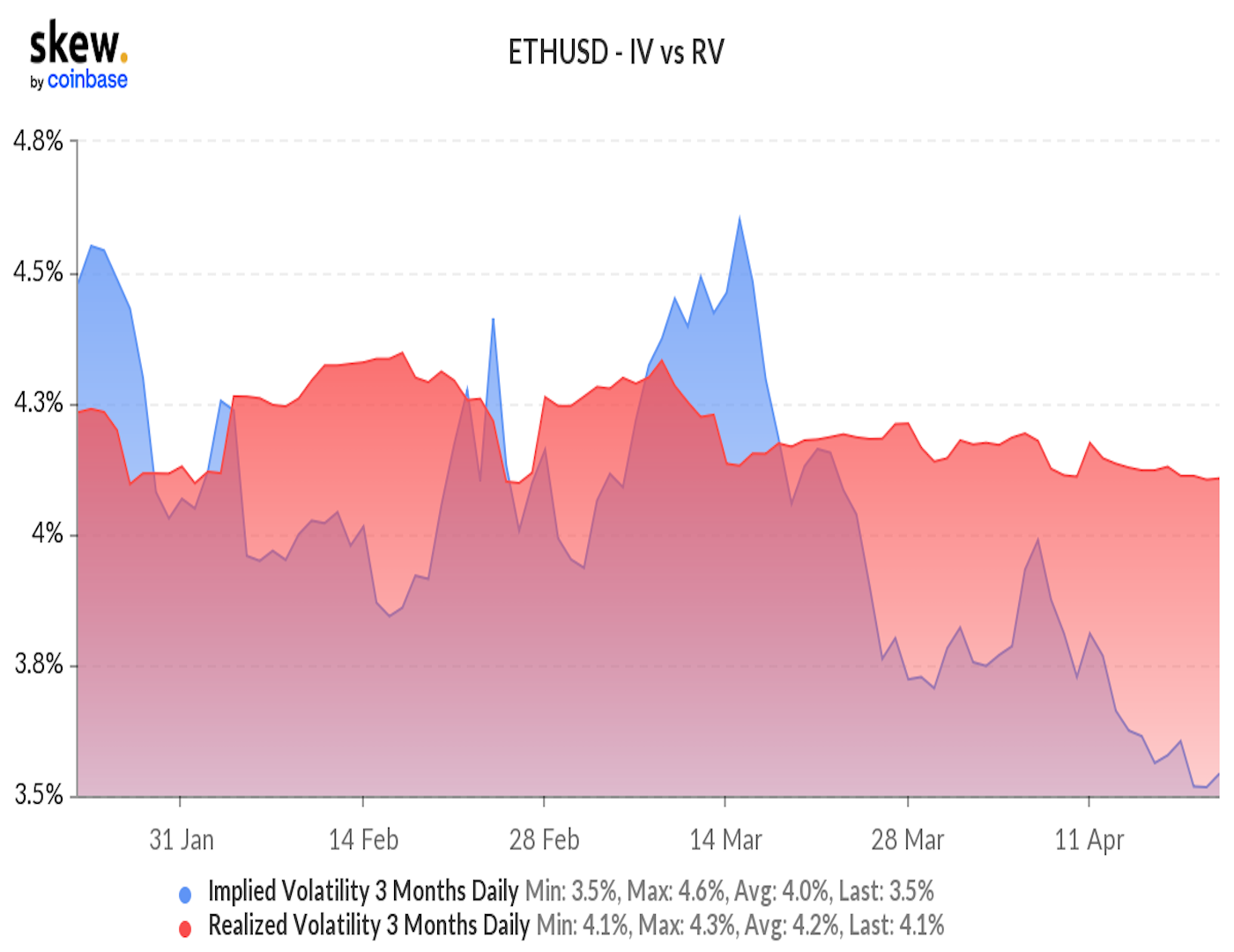

The operation of directionless terms enactment and explosive growth of the decentralized concern enactment vaults has pushed ether's three-month regular implied volatility (IV) oregon expectations for terms turbulence to 3.5%, the lowest since November 2020, according to information provided by Skew.

The implied volatility is undervalued compared to its beingness mean of 4.9%, but it is besides importantly inexpensive compared to the three-month regular humanities volatility, presently astatine 4.1%. The dispersed betwixt the humanities volatility and implied volatility is the widest it has been since July 2021.

In different words, options, some telephone and put, are cheap. Implied volatility is 1 of the captious factors determining the prices of options, which are derivative contracts that springiness the purchaser the close but not the work to bargain oregon merchantability an underlying plus astatine a predetermined terms connected oregon earlier a circumstantial date. A telephone enactment gives the close to buy, portion a enactment offers the close to sell.

"In my opinion, it makes consciousness to bargain options [call and put] fixed volatility is low," Samneet Chepal, quantitative expert astatine the integer plus concern steadfast Ledger Prime told CoinDesk successful a Telegram chat. "The IV is rather inexpensive mostly owed to the choppy marketplace action, which results successful traders being much complacent successful selling vol positive the interaction of systematic selling from the DeFi enactment vaults."

(Skew)

Buying options – telephone and enactment – tracking inexpensive implied volatility fundamentally means taking a agelong presumption connected volatility. It's a direction-neutral stake that would marque wealth arsenic agelong arsenic determination are terms swings. The implied volatility is mean-reverting and positively impacts the option's price.

While spot and futures markets let traders to instrumentality directional bets, options unfastened an further magnitude of volatility trading. However, it's not without risks. For example, the implied volatility tin enactment inexpensive for a prolonged play earlier bouncing to the mean, and options suffer wealth arsenic the clip for expiration nears. It's called theta decay successful options parlance. So, traders buying volatility via agelong call/put positions tin suffer wealth if the expected bump up successful implied volatility doesn't materialize earlier expiration.

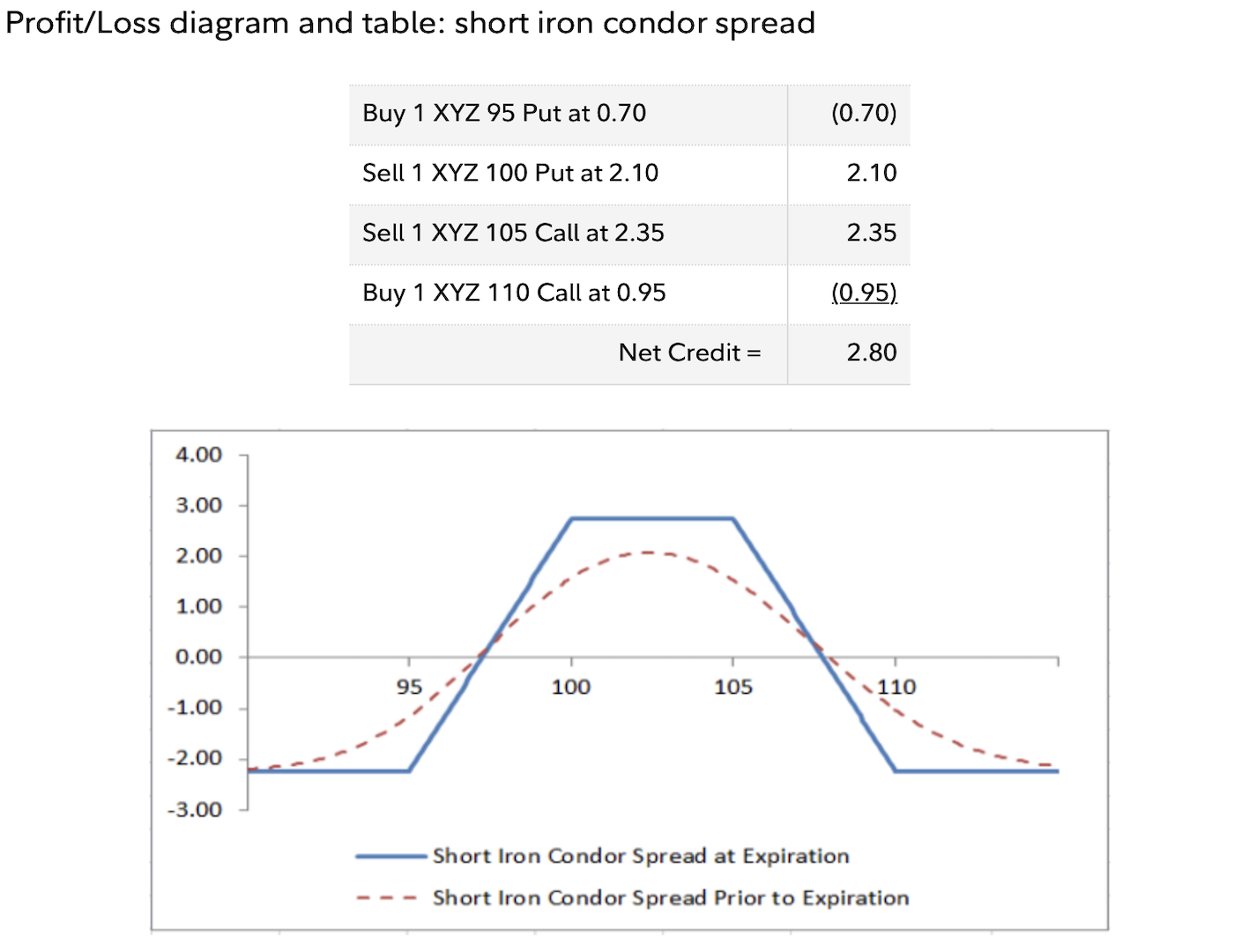

"While options look cheap, there's a hazard that we proceed seeing choppy terms enactment for immoderate clip hence resulting successful the [options] premium being decayed," Chepal said, adding that selling a strategy called robust condor could mitigate hazard associated with continued low-volatility sideways terms action.

Selling an robust condor is simply a four-part strategy established for nett credit. Both the imaginable nett and maximum hazard are limited, arsenic seen below.

(Fidelity.com)

Griffin Ardern, a volatility trader astatine crypto plus absorption steadfast Blofin, said, "the full of April is simply a comparatively bully clip to stake connected volatility [with calls and puts], but close now, it's preferable to usage a operation of telephone options to spell agelong connected volatility. That's due to the fact that puts look comparatively overpriced."

Indeed, put-call skews, which measurement the outgo of puts comparative to calls, amusement puts are drafting a higher terms than calls crossed each clip frames, including the six-month expiry. Traders person been buying outs disconnected late. "We've besides seen ample request for debased delta [lower strike] puts, peculiarly successful ETH, crossed the expiries retired till December with strikes arsenic debased arsenic 1,000. This could besides beryllium a play connected further delays with the ETH Merge," Singapore-based QCP Capital said successful a Telegram broadcast.

Ardern cited a operation of telephone ratio dispersed – bargain a telephone adjacent the spot terms and merchantability 2 astatine a higher level - and a abbreviated futures presumption arsenic a preferred strategy. "If IV rises and the marketplace falls, you volition get a higher nett for a comparatively little cost," Ardern said. "Compared with buying strangles, the outgo of gathering this strategy tin beryllium comparatively little portion achieving akin benefits."

Straddles and strangles are wide utilized to nett from an impending volatility spike. These strategies impact buying the aforesaid expiry telephone and enactment options successful adjacent numbers.

Options trading is acold much analyzable than trading successful the spot marketplace oregon buying/selling futures. Before mounting up a position, seasoned traders survey the alleged enactment greeks similar delta, gamma, theta, and vega. This tin beryllium a daunting task to the uninitiated and dabbling with options without the indispensable know-how tin pb to important losses.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)