There has been a alteration successful the reasoning of the ample crypto investors known arsenic whales. Data shows USD coin (USDC) has go the stablecoin of prime connected the Ethereum blockchain, not the larger tether (USDT).

In crypto, whales are the biggest cryptocurrency holders – organization investors, exchanges, deep-pocketed individuals – who are susceptible of moving ample amounts of tokens and swaying marketplace prices. Analysts intimately ticker their enactment to spot trends and expect ample terms movements.

Data from CoinMetrics, a blockchain investigation firm, shows wallet addresses connected the Ethereum blockchain that clasp much than $1 cardinal USDC surpassed the fig of wallets that clasp USDT, inactive the largest stablecoin by marketplace cap.

“In the existent marketplace condition, a batch of radical presumption USDC arsenic the safer, preferred stablecoin," Edward Moya, trading level Oanda’s elder marketplace analyst, told CoinDesk.

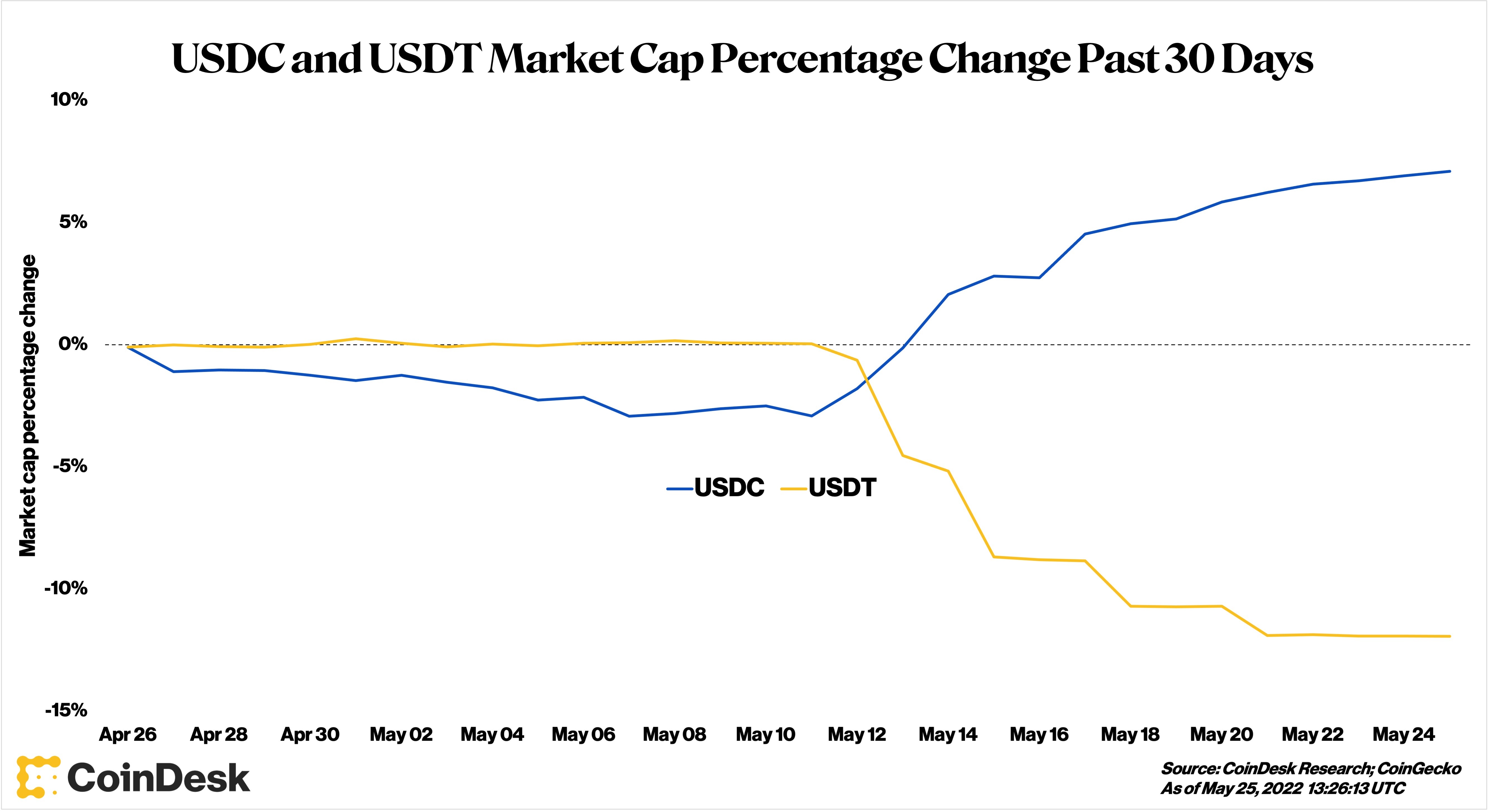

USDC, the second-largest stablecoin, has been gaining marketplace stock since the once-$18 cardinal UST stablecoin collapsed and USDT’s peg to the dollar wobbled.

CoinMetrics looked astatine blockchain information since May 9, erstwhile UST lost its peg to the U.S. dollar. The steadfast identified 147 Ethereum wallet addresses that accrued their USDC equilibrium by astatine slightest $1 cardinal portion decreasing their USDT equilibrium by astatine slightest $1 million. Among them, determination were 23 that added astatine slightest $10 cardinal USDC and disposed of $10 cardinal USDT. Many of these addresses are exchanges, custodial services oregon decentralized concern protocols, the study added.

The study besides said USDC’s vantage implicit Tether's USDT successful alleged escaped interval proviso – the fig of tokens that investors clasp – connected the Ethereum blockchain deed an all-time precocious connected Tuesday among each holder groups.

"This apt reflects the information that lone ample holders are mostly privileged to redeem USDT and mint caller USDC to seizure an arbitrage," Kyle Waters, expert astatine CoinMetrics, wrote successful the report. "But it mightiness besides beryllium the lawsuit that immoderate ample accounts are de-risking their holdings, turning to the perceived assurances of USDC’s monthly attestations and full-reserve backing."

Tether, the institution down USDT, reduced its commercialized insubstantial holdings by 17% from $24.2 cardinal to $20.1 cardinal successful the archetypal quarter, according to its latest, quarterly, attestation report of the assets backing the stablecoin. However, it besides said $286 cardinal of its assets were being held successful non-U.S. Treasury bonds with a maturity of little than 180 days.

USDT has suffered $10 cardinal successful redemptions wide since the UST failure, which shook investors' spot successful the stableness of stablecoins successful general. Redemptions pushed down the wide circulating proviso of USDT to $73 cardinal from $83 cardinal successful 10 days. In the aforesaid period, USDC’s proviso roseate to $53 cardinal from $48 billion.

USDC has gained successful marketplace capitalization astatine the disbursal of USDT's marketplace share. (CoinDesk)

Amid the flurry of events arsenic UST's worthy dropped to astir zero wrong days, USDT concisely lost its peg to the dollar. Even though its terms rapidly recovered to $1, the wobble renewed uncertainty astir what assets backmost the worth of USDT.

Most decentralized concern (DeFi) transactions instrumentality spot connected the Ethereum blockchain, and USDC has been the stablecoin of prime successful DeFi.

For example, DAI, the largest decentralized and overcollateralized stablecoin, is holding USDC alternatively of USDT successful its treasury. DAI, the currency of the blockchain protocol MakerDAO, has a marketplace capitalization of much than $6 cardinal and keeps its 1:1 speech ratio to the U.S. dollar by amassing overmuch much crypto assets than the marketplace worth of each the DAI tokens successful circulation.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Crypto Long & Short, our play newsletter featuring insights, quality and investigation for the nonrecreational investor.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)