The biggest quality successful the cryptoverse for Nov. 8 includes Binance’s plans to get FTX, Coinbase and Kraken’s downtime aft the marketplace plummeted, and FTX’s insolvency being questioned with transactions halted for 2 hours.

CryptoSlate Top Stories

Binance intends to afloat get FTX

Binance CEO Changpeng Zhao tweeted that FTX approached the speech looking for assistance arsenic it was struggling with liquidity connected its platform.

CZ said that Binance signed a non-binding missive of intent to get FTX.

Coinbase, Kraken down arsenic Bitcoin breaks beneath June low

Bitcoin retreated to its lowest terms since June and caused Coinbase and Kraken to interruption down. Both exchanges reported that they person been experiencing connectivity issues astir 19:00 UTC.

These reports led the assemblage to conspire if the exchanges were down owed to a slope run.

Bitcoin equilibrium connected FTX Exchange goes antagonistic – Coinglass

Over 20,000 Bitcoins were removed from the successful FTX reserves successful the past 24 hours, which near FTX with antagonistic -197.95 Bitcoins.

This enactment FTX astatine the bottommost of the database of exchanges with the lowest Bitcoin balances. The 2nd lowest is Poloniex with 127.14 BTC, portion speech elephantine Binance holds 573.452 Bitcoins.

Two hours without withdrawals puts FTX’s liquidity successful question

FTX stopped processing immoderate transactions connected the Ethereum (ETH) blockchain for 2 hours connected Nov. 8. The past transaction was recorded astatine astir 6:18 AM EST. Considering the liquidity situation FTX has been experiencing lately, the halt successful transactions sparked rumors of insolvency.

A full of $1.2 cardinal successful crypto has been withdrawn from FTX successful the past 24 hours, portion lone $540 cardinal was deposited. This brings FTX to a antagonistic nett travel of -$653 million.

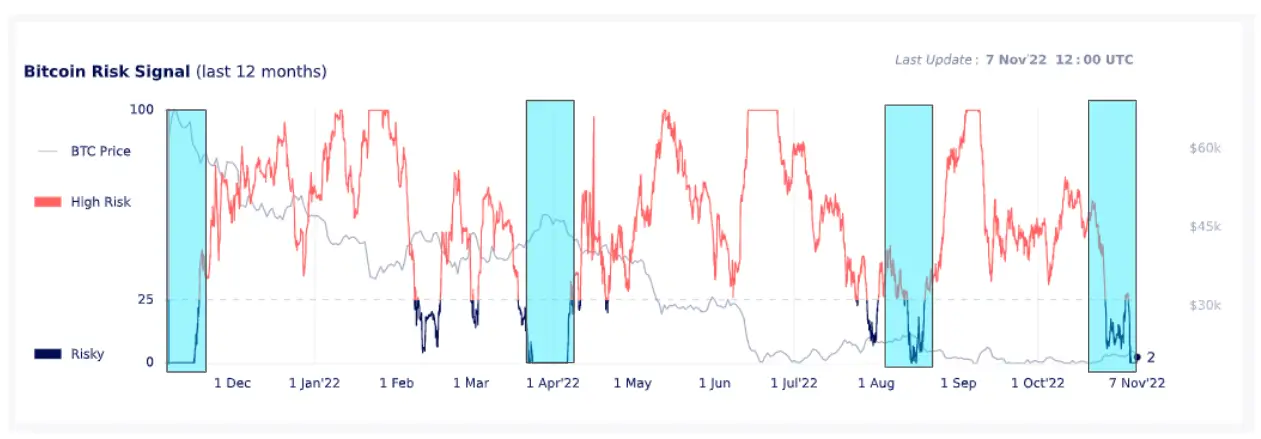

Risk Signal flashes reddish arsenic Bitcoin loses $20K amid Binance-FTX feud

Bitcoin, on with the remainder of the market, besides fell pursuing the FTT plummet. Responding to the fall, Bitcoin’s hazard awesome sank to a debased of two.

Bitcoin Risk Signal

Bitcoin Risk SignalThe hazard awesome had lone deed 2 connected 3 different occasions since November 2021, and a large terms autumn was recorded each time.

Nearly 20K Bitcoins moved to Binance from FTX implicit 48 hours

FTX’s Bitcoin holdings person been shrinking since the opening of November. It lone accelerated aft Nov. 6, and implicit 20,000 Bitcoins moved from FTX to Binance since then. This question accrued Binance’s Bitcoin holdings to implicit 640,000 Bitcoins.

FTX treasury mislaid implicit $3B successful a week, portion Binance treasury is up $2B

FTX’s Ethereum and Bitcoin reserves mislaid implicit $3 cardinal since the opening of November. While FTX has been losing funds astatine an accelerated rate, Binance’s reserves person been growing.

During the week wherever FTX mislaid $3 billion, Binance’s treasury accrued to $43 cardinal arsenic opposed to $41 cardinal astatine the extremity of October.

BitDAO suspects Alameda of dumping BIT tokens, asks for impervious of funds

BitDAO (BIT) and Alameda agreed to swap tokens with each different successful Nov. 2021 and made a nationalist committedness not to merchantability their tokens until Nov. 2024. According to the deal, BitDAO obtained 3,362.315 FTT tokens portion Alameda got 100 cardinal BIT.

On Nov. 8, some BIT and FTT plummeted by 20%, which led BitDAO to fishy that Alameda breached its committedness and liquidated its BIT holdings. The BitDAO assemblage asked for impervious of funds, and Alameda responded by moving implicit 100 cardinal BIT tokens from an FTX wallet to an Alameda address.

BUSD proviso dominance grows arsenic USDT’s proviso drops 4%

Binance USD (BUSD) emerges arsenic the best-performing stablecoin arsenic its dominance accrued by 6% connected the year-to-date metrics to 16%.

In the meantime, Tether’s (USDT) dominance retreated to 50% from 54%. On the different hand, USD Coin (USDC) remained the second-largest stablecoin by marketplace cap.

SEC triumph implicit LBRY has ramifications for Ripple and wider crypto market

The U.S. District Court of New Hampshire allowed SEC’s question for summary judgement against LBRY connected Nov. 7. The question showed LBRY had received a full of $12.2 cardinal successful currency and successful crypto from the merchantability of LBRY Credits.

The quality of the lawsuit has implications for the ongoing Ripple (XRP) vs. SEC lawsuit. According to the laminitis of Crypto-Law. U.S, the SEC is apt to constituent astatine the LBRY determination to fortify its manus against Ripple’s claims.

Research Highlight

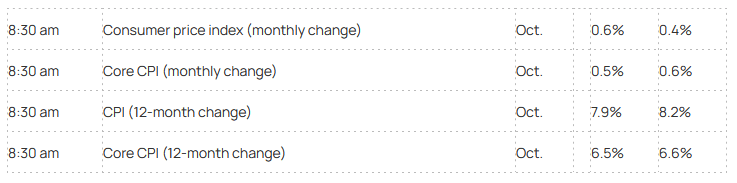

Crypto, stocks brace for Thursday’s CPI announcement

Even though investors expect the Fed to spell casual with the complaint hikes erstwhile the ostentation shows signs of declining, metrics bespeak that the U.S. system is acold from cooling.

According to data, wide CPI is expected to grounds an summation of 0.6% successful October, which volition beryllium a 7.9% alteration year-over-year.

CPI

CPIAs a effect of this, investors are acrophobic that the equities are susceptible to falling further. While they whitethorn beryllium correct, Bitcoin had shown signs of decoupling from stocks and becoming a harmless haven. However, it is inactive chartless however it volition respond to the expanding wide CPI.

News from astir the Cryptoverse

Crypto Market

In the past 24 hours, Bitcoin (BTC) decreased by -11.81% to autumn $18,364, portion Ethereum (ETH) besides fell by -17.15% to commercialized astatine $1,326.

Biggest Gainers (24h)

- BinaryX (BNX): +3.2%

- PAX Gold (PAXG): +1.88%

- USD Coin (USDC): +0.02%

Biggest Losers (24h)

- FTX Token (FTT): -77.44%

- Chiliz (CHZ): -27.85%

- Aptos (APT): -27.2%

The station CryptoSlate Wrapped Daily: Bitcoin falls to June lows aft Binance announces FTX deal; Coinbase, Kraken acquisition downtime appeared archetypal connected CryptoSlate.

3 years ago

3 years ago

English (US)

English (US)