The biggest quality successful the cryptoverse for Nov. 23 includes Bitcoin hash ribbon metric’s denotation of an upcoming miner capitulation, on-chain information revealing investors taking vantage of the debased prices, and Bitcoin and Ethereum consisting 91% of Bitfinex’s full reserves.

CryptoSlate Top Stories

BTC hash ribbon upcoming convergence signals miner capitulation

Bitcoin (BTC) miners person been selling astatine the astir assertive complaint implicit the past 2 years, which indicates that the upcoming hash complaint accommodation volition beryllium antagonistic successful the adjacent epoch.

The Bitcoin hash ribbons are often utilized to place terms bottoms. When the hash ribbon signals an upcoming miner capitulation, the Bitcoin terms falls.

Currently, the hash ribbon convergence signals that the extremity of this capitalization play is astir over, and an upwards crook successful the marketplace is likely.

Bitcoin on-chain information shows a ray of airy successful a acheronian market

After the FTX collapse, Bitcoin has been struggling to retrieve to its carnivore marketplace terms of astir $20,000. Especially implicit the play of 19-20 November, Bitcoin remained beneath $16,000.

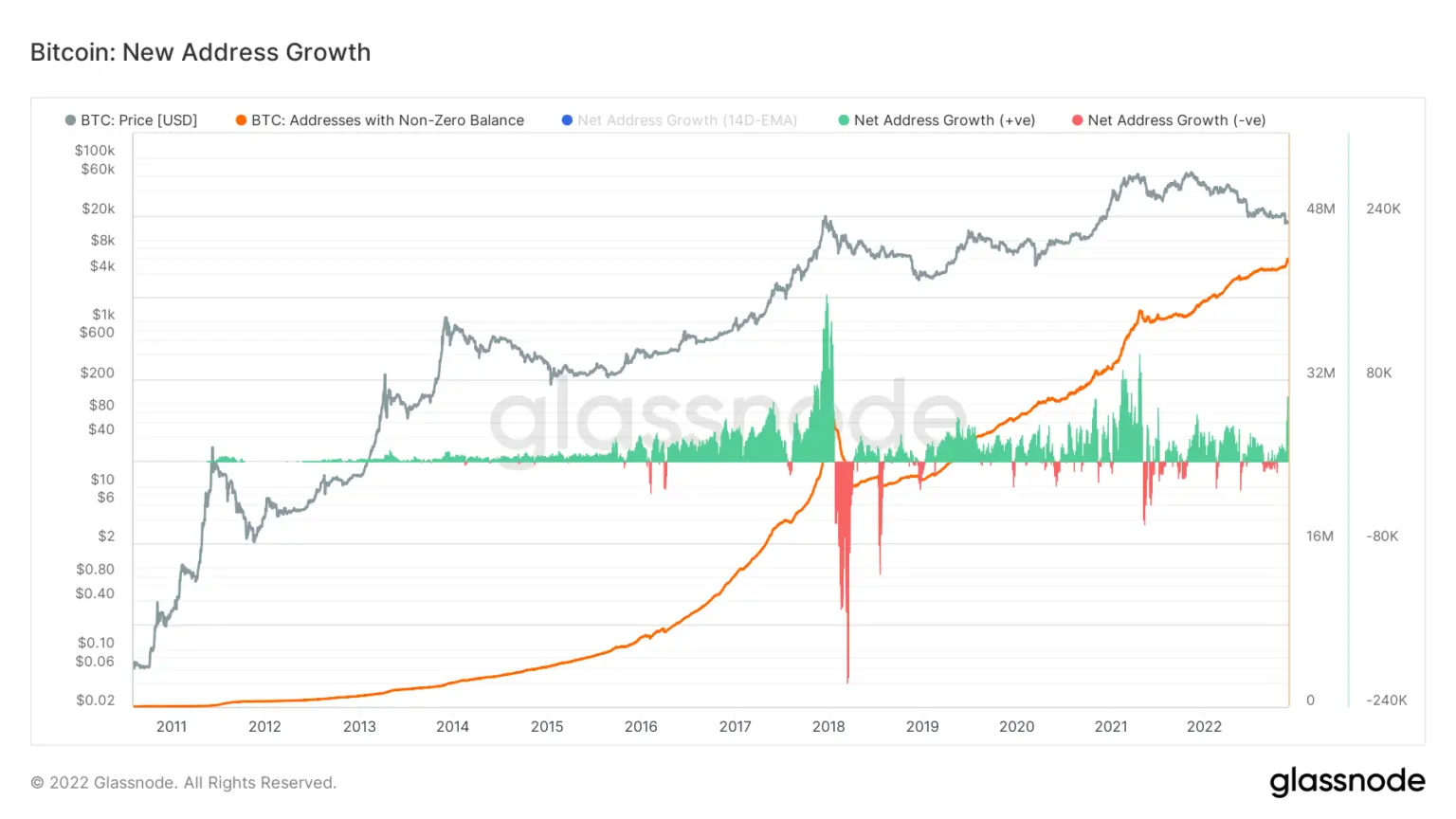

While this whitethorn beryllium a bearish price, it was seen arsenic a large buying accidental for many. On-chain information shows that the fig of wallets that clasp Bitcoin has been expanding portion the fig of addresses with non-zero balances is decreasing.

Graph showing the nett code maturation connected the Bitcoin web from January 2021 to November 2022 (Source- Glassnode)

Graph showing the nett code maturation connected the Bitcoin web from January 2021 to November 2022 (Source- Glassnode)Bitfinex’s reserves are 91% Bitcoin, Ethereum

Crypto speech Bitfinex’s reserves of Bitcoin and Ethereum (ETH) relationship for 91% of its full holdings. This percent is 63% for Coinbase, 15% for Binance, and 52% for Crypto.com.

According to the exchanges’ impervious of reserves, Bitfinex’s 91%-large Bitcoin and Ethereum reserves equate to 207,356.67967717 Bitcoins and 1,225.600 Ethereums.

U.S. Senators privation justness section to clasp FTX execs accountable for collapse

U.S. Senators Elizabeth Watten and Sheldon Whitehouse composed a missive to the U.S. Department of Justice (DOJ). They requested DOJ to clasp FTX executives “accountable to the fullest grade of the law” of the FTX collapse.

U.S. Congressman defends decentralization, blames SBF, Gensler, CeFi for FTX collapse

U.S. Congressman Tom Emmer argued that the FTX illness was a nonaccomplishment of centralized concern (CeFi), not a nonaccomplishment of crypto.

Emmer besides said that the FTX laminitis Sam Bankman-Fried (SBF) and the U.S. Securities and Exchange Commission’s (SEC) president Gary Gensler besides stock the blame.

Referring to the narration betwixt the SEC and SBF, Emmer said that the SEC was moving with SBF and gave him a peculiar attraction that different exchanges weren’t getting.

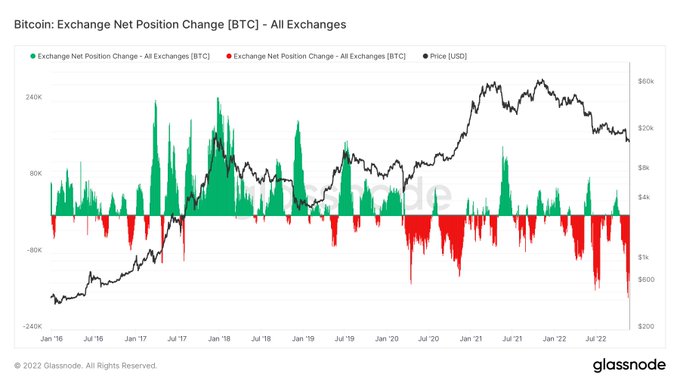

Record quantities of Bitcoin permission exchanges successful readiness for contagion fallout

Over the past 30 days, 136,882 Bitcoins were withdrawn from the exchanges, which equates to 0.7% of the full circulating supply.

Exchange nett presumption change

Exchange nett presumption changethe illustration supra besides demonstrates monolithic Bitcoin outflows since 2016 and marks the existent outflow levels arsenic the highest. Even astatine the highest of the Terra (LUNA) clang contagion, astir 120,000 Bitcoins had near exchanges.

Mango Market hacker’s effort to exploit Aave fails

Mango Market’s exploiter Avraham Eisenberg transferred $40 cardinal worthy of USD Coin (USDC) into Aave (AAVE) with the intent of borrowing Curve DAO Token (CRV) to short. This strategy is known arsenic Eisenberg’s “highly profitable trading strategy,” which helium antecedently exploited the Mango Market with.

First, helium came for Mango, and I did not talk out, for I americium not an investor

Then helium came for USDT, and I did not talk out, for helium did not airs a risk

Now, helium tries to hunt the indebtedness of 1 of the godfather's of DeFi and that's erstwhile the ft is enactment down to support pic.twitter.com/feV78YPtq0

— Andrew Kang (@Rewkang) November 22, 2022

However, successful the lawsuit of the CRV token, Eisenberg’s program didn’t spell accordingly arsenic the assemblage rallied down the CRV token and caused it to spike 46% successful the past 24 hours.

Hackers bargain $42M from Fenbushi Capital founder’s wallet

Fenbushi Capital’s wide spouse Bo Shen was attacked by malicious actors, who stole $42 cardinal from his idiosyncratic wallet connected Nov. 10.

Shen revealed the onslaught connected Nov. 23 via his idiosyncratic Twitter account. According to blockchain information steadfast Beosin, the hack resulted from a backstage cardinal compromise.

Latest mining rigs amp up trouble to portion retired competition

Cyber information expert Matt C drew attraction to the increasing unit of the latest mining rigs upon erstwhile generations of miners.

#Bitcoin mining profitability by @LuxorTechTeam says it all..

Antminer S19 XP is 3+ times superior to erstwhile gens

2022 Miners putting trouble done the extortion portion trying to nonstop contention retired of business. pic.twitter.com/g5akp0RXjf

— Matt C (@mithcoons) November 23, 2022

(@mithcoons) November 23, 2022

Considering that hashing costs $0.07/kWh, Antminer S19XP emerges arsenic the astir profitable mining rig.

News from astir the Cryptoverse

Genesis is gathering investors to get lending backmost up connected its feet

Genesis CEO published a missive informing Genesis clients that the enforcement squad is gathering with imaginable investors to travel up with a solution to hole the illiquidity occupation of the lending services. The missive said that Genesis is expecting to determine connected a people of enactment successful the coming days.

Apple to bargain rights of publication connected SBF

Famous writer Michael Lewis had spent six months with SBF earlier the speech collapsed and volition constitute a publication that sheds airy connected SBF’s crypto empire. The publication is expected to crook into a diagnostic film, and Apple is adjacent to inking a woody for the publication rights with Lewis, according to MacRumors.

Onomy raises $10M to unite DeFi, Forex

Onomy protocol raised $10 cardinal from investors similar Bitfinex and Ava Labs during its backstage backing round. The protocol aims to converge DeFi and the Forex markets.

Crypto Market

In the past 24 hours, Bitcoin (BTC) accrued by 2.73% to commercialized astatine $16.566, portion Ethereum (ETH) spiked by 3.97% to commercialized astatine $1,172.

Biggest Gainers (24h)

- Solana (SOL): +19%

- Dash (DASH): +16.73%

- Litecoin (LTC) +14%

Biggest Losers (24h)

- Trust Wallet Token (TWT): -2.46%

- Axie Infinity (AXIS): -0.36%

- Gemini Dollar (GUSD): -0.24%

The station CryptoSlate Wrapped Daily: Bitcoin hash ribbon points astatine miner capitulation arsenic holders increase appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)