The biggest quality successful the cryptoverse for Nov. 17 includes the precocious selling inclination of Bitcoin holders older than 10 years, SBF’s $1.6 cardinal idiosyncratic indebtedness from Alameda Research, and Bitcoin and Ethereum’s emergence arsenic the 2nd and 3rd astir shorted crypto asset.

CryptoSlate Top Stories

Who sold the astir BTC successful the aftermath of the FTX collapse? 10yr holders merchantability astatine highest ever rate

The illness of FTX enactment immense unit connected investors, portion the terms of Bitcoin (BTC) fell arsenic debased arsenic $15,000.

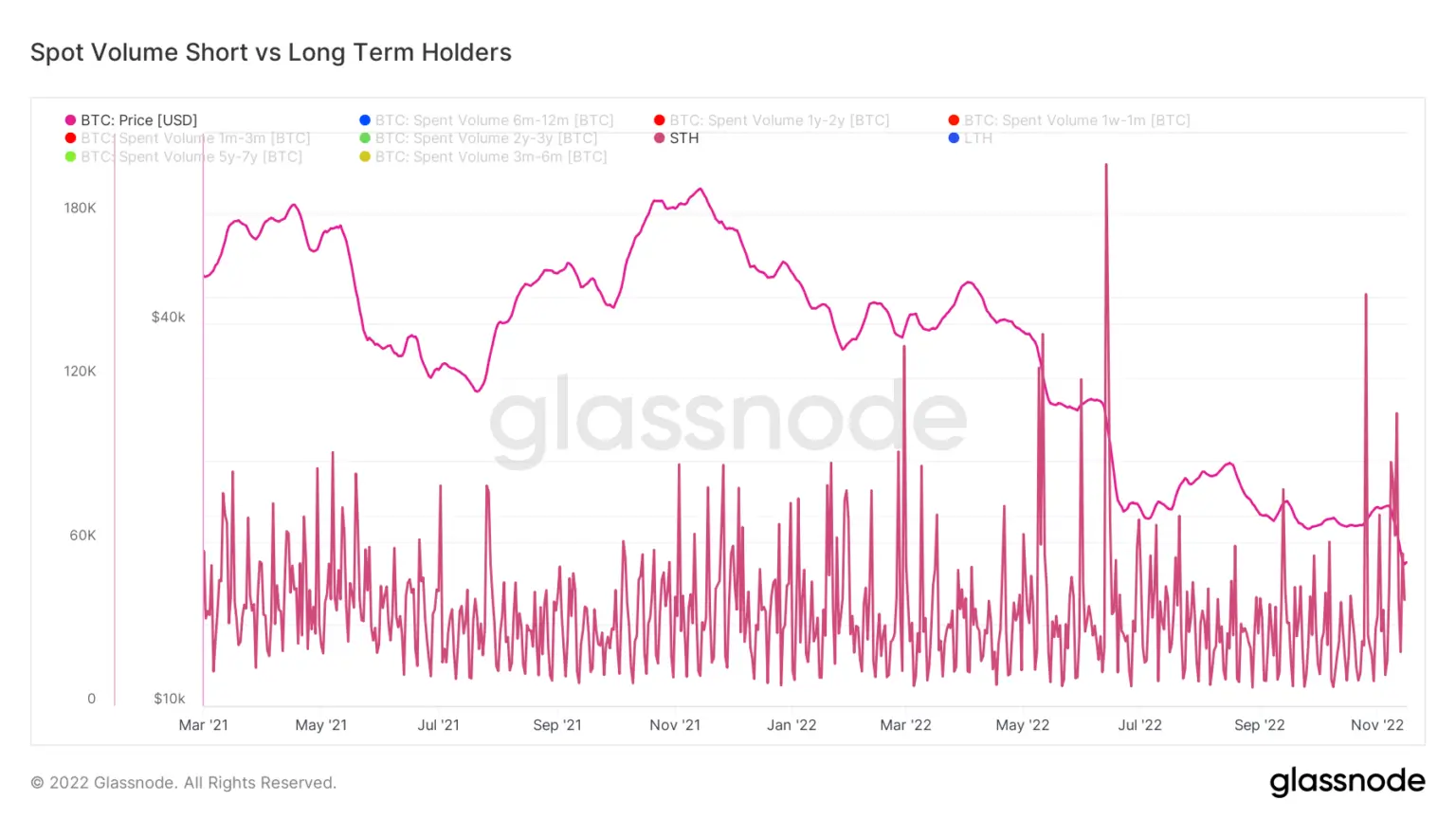

To uncover wherever the selling unit was coming from, CryptoSlate analysts examined the short-term (STH) and semipermanent holders (LTH).

STH and LTH spot volume

STH and LTH spot volumeWhile past shows that the LTH is the archetypal to merchantability their coins erstwhile the numbers commencement to fall, the turmoil pursuing the FTX illness didn’t shingle the assurance of semipermanent holders.

Instead, the marketplace recorded its fifth-largest fig of STH sellers since March 2021, which translates to astir 400,000 Bitcoins sold by STH betwixt Nov. 10 and Nov. 17.

FTX bankruptcy tribunal filing reveals Alameda gave $1.6B successful loans to SBF, others

FTX’s caller CEO John Ray III’s tribunal filing revealed that Sam Bankman Fried (SBF) got $1 cardinal successful idiosyncratic loans from Alameda Research.

Ray referred to the concern arsenic a “complete nonaccomplishment of firm controls and specified a implicit lack of trustworthy fiscal information.”

The filing besides disclosed that Alameda lent $543 cardinal to FTX manager of engineering Nishad Singh and $55 cardinal to FTX Co-CEO Ryan Salame.

FTX illness sees Bitcoin, Ethereum to beryllium shorted the 2nd and third-most amount

After the FTX collapse, Ethereum (ETH) became the second-most shorted crypto successful the market, followed by Bitcoin as the third.

According to the mean backing complaint acceptable by exchanges for perpetual futures contracts, agelong positions wage periodically, portion shorts wage whenever the complaint percent turns positive. The caller profound antagonistic money rates bespeak an upcoming slump earlier the markets commencement healing.

Genesis sought $1B exigency indebtedness but ne'er got it

Crypto lender genesis sought retired an exigency indebtedness of $1 cardinal from investors but ne'er got it, arsenic the Wall Street Journal reported.

The reports noted that Genesis sought the funds due to the fact that of a “liquidity crunch owed to definite illiquid assets connected its equilibrium sheets.”

FTX attacker continues swapping tokens; exchanges $7.95M BNB for BUSD, ETH

The FTX attacker kept their hands engaged connected Nov. 17 and drained astir $600 cardinal successful 1 day. In 3 transactions, they swapped 30,000 BNB tokens for Ethereum and Binance USD (BUSD).

The exploiter presently holds $11.8 cardinal BNB and ETH, worthy astir $346.8 cardinal astatine the existent terms levels.

President Bukele reveals El Salvador volition bargain 1 Bitcoin daily

El Salvador’s president Nayib Bukele announced that the state would commencement buying 1 Bitcoin daily, opening connected Nov. 18.

We are buying 1 #Bitcoin each time starting tomorrow.

— Nayib Bukele (@nayibbukele) November 17, 2022

El Salvador has been heavy criticized for its Bitcoin investments. However, the state didn’t cave and continued to explicit its assurance successful crypto. El Salvador spent implicit $100 cardinal to get the 2,381 Bitcoins it presently holds.

Mainstream media called retired for gaslighting implicit Sam Bankman-Fried’ bully guy’ narrative

The crypto assemblage reacted to the mainstream media outlets for publishing articles that favour SBF, adjacent aft the FTX’s collapse.

The assemblage reminded the imprisonment of the Tornado Cash developer Alexey Pertsev and expressed its vexation astir SBF being free.

Circle drops Yield rates to 0%

USD Coin (USDC) issuer Circle dropped its output merchandise APY complaint to 0% and said that its output merchandise is overcollateralized and secured by “robust collateral agreements.”

An announcement connected Circle’s authoritative Twitter besides elaborate its overcollateralized fixed-term output product.

1/ Circle Yield is an overcollateralized fixed-term output product. Genesis is simply a counterparty to Circle successful this product. Total Circle Yield lawsuit loans outstanding are $2.6 cardinal arsenic of 11/16/22 and are protected by robust collateral agreements.

— Circle (@circle) November 16, 2022

Singapore’s Temasek writes disconnected $275M FTX investment, had misplaced content successful Sam Bankman-Fried

Singapore-based concern money Temasek stated that it is penning disconnected its $275 cardinal concern successful FTX, saying it had misplaced its “belief successful the actions, judgment, and leadership” by putting them connected SBF.

The institution said:

“The thesis for our concern successful FTX was to put successful a starring integer plus speech providing america with protocol agnostic and marketplace neutral vulnerability to crypto markets with a interest income exemplary and nary trading oregon equilibrium expanse risk.”

News from astir the Cryptoverse

Research Highlight

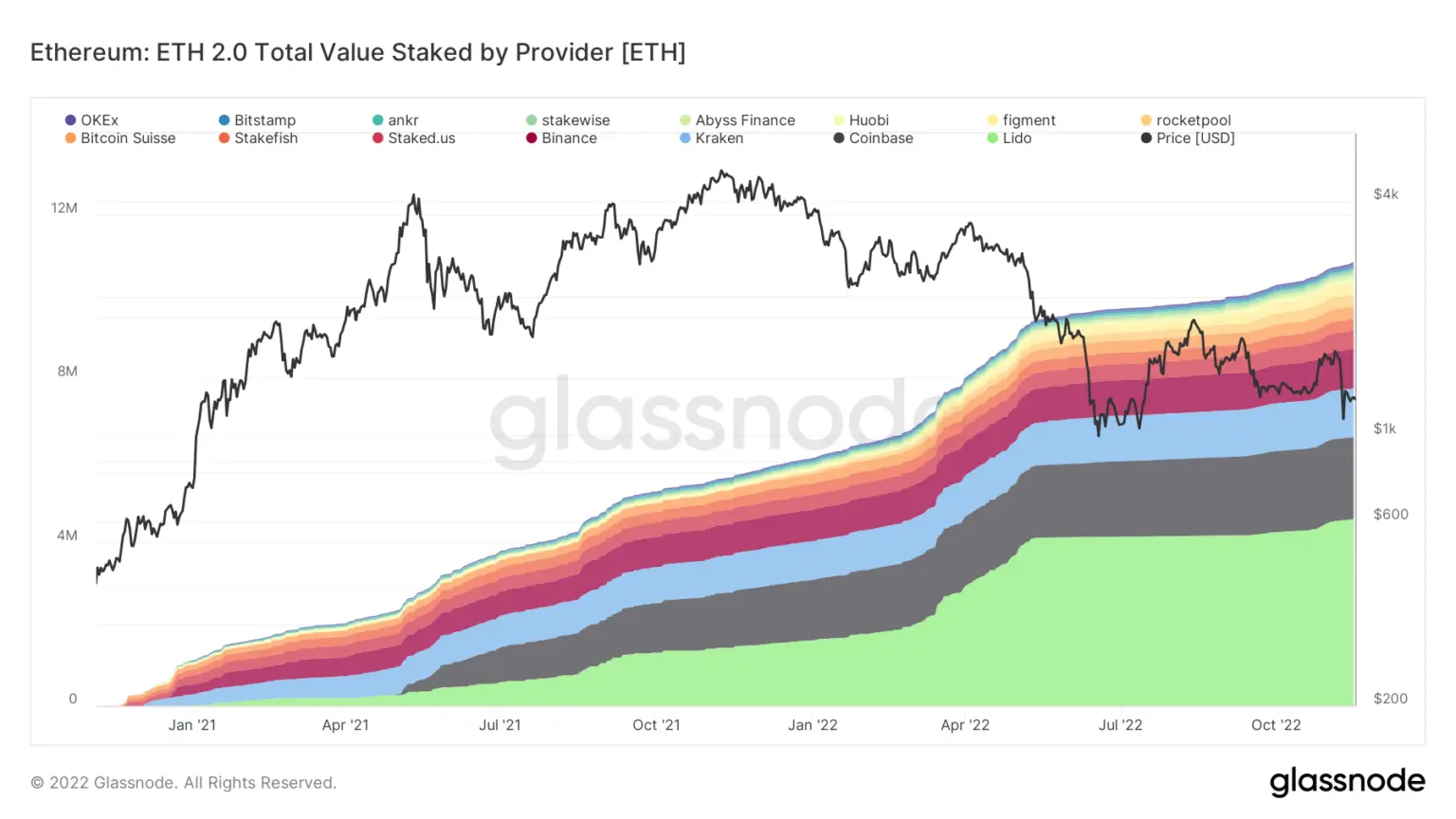

Research: 78% of each staked ETH is crossed 4 centralized providers; 74% of each blocks are OFAC compliant

CryptoSlate analysts examined Ethereum staking on-chain information and revealed that astir 78% of each staked Ethereum is dispersed crossed 4 centralized providers.

Staked Ethereyum by Provider

Staked Ethereyum by ProviderThere are 8-9 cardinal Ethereum presently staked crossed Lido (4,5 million), Coinbase (2 million), Kraken (1,2 million), and Binance (1 million).

Almost 75% of each Ethereum blocks are considered to beryllium OFAC compliant. 15% of each blocks produced by Ethereum are inactive non-OFAC compliant, and the different 11% are non-MEV-Boost blocks.

Crypto Market

In the past 24 hours, Bitcoin (BTC) accrued by 0.58% to commercialized astatine $16,678, portion Ethereum (ETH) declined by 0.73% to commercialized astatine $1,202.

Biggest Gainers (24h)

- Litecoin (LTC): +8.21%

- Arweave (AR): +5.88%

- Hedera (HBAR):+5.63%

Biggest Losers (24h)

- Synthetix (SNX): -5.74%

- Curve DAO Token (CRV): -5.6%

- Near Protocol (NEAR): -4.66%

The station CryptoSlate Wrapped Daily: Oldest Bitcoin holders commencement selling; FTX tribunal filing reveals SBF’s $1B loans from Alameda appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)