Quantum computing has go the latest all-purpose mentation for Bitcoin’s caller drawdown, but NYDIG says the numbers don’t backmost the narrative. In a Feb. 17 probe note, NYDIG probe caput Greg Cipolaro argues that “quantum fears” are loud, but not a superior operator of the sell-off erstwhile you look astatine hunt behavior, cross-asset correlations, and broader hazard positioning.

Quantum Panic Didn’t Sink Bitcoin

NYDIG frames “Cryptographically Relevant Quantum Computers” arsenic the theoretical endgame hazard investors support circling. The occupation is that marketplace behaviour doesn’t look similar a repricing of an imminent existential threat.

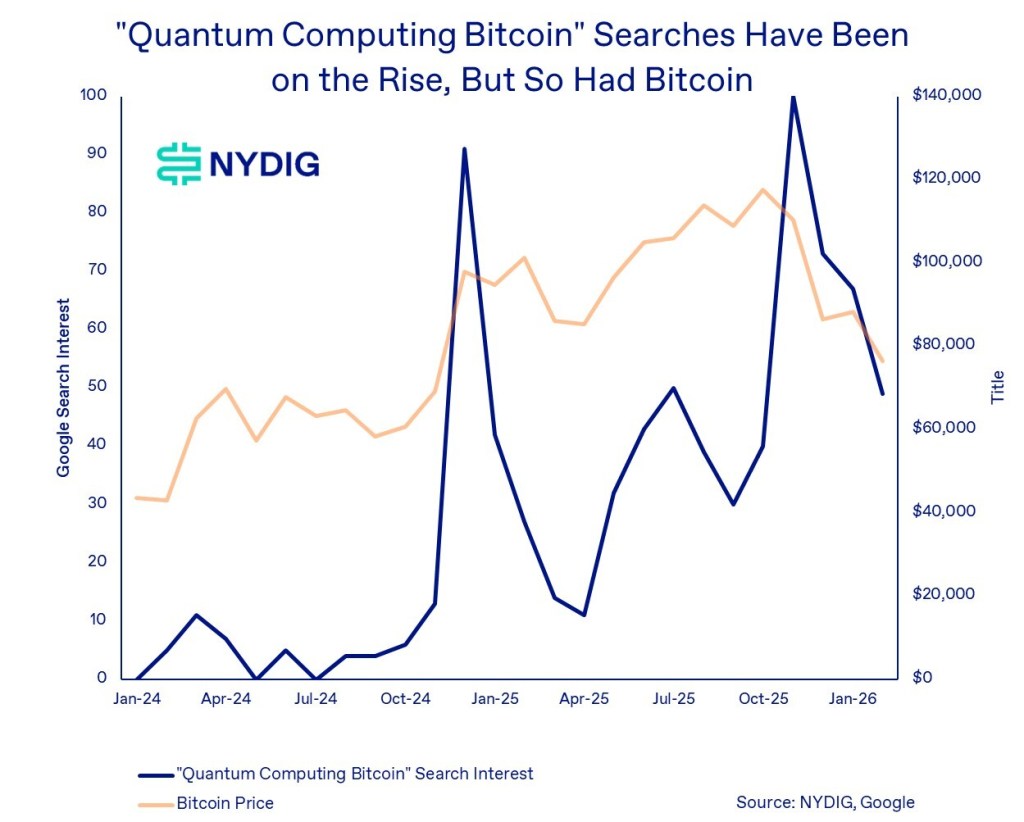

First, Cipolaro points to Google Trends. Search involvement for “quantum computing bitcoin” did rise, helium wrote, but the timing matters. “Search involvement for ‘quantum computing bitcoin’ has risen, but notably this occurred alongside bitcoin’s rally to caller all-time highs, not up of sustained weakness,” the enactment said.

Quantum computing bitcoin searches person been connected the emergence | Source: NYDIG

Quantum computing bitcoin searches person been connected the emergence | Source: NYDIG“In different words, heightened searches astir quantum risk coincided with terms spot alternatively than weakness. If the marketplace were repricing bitcoin connected an imminent technological threat, we would expect hunt strength to pb oregon amplify downside risk, not travel a play of gains.”

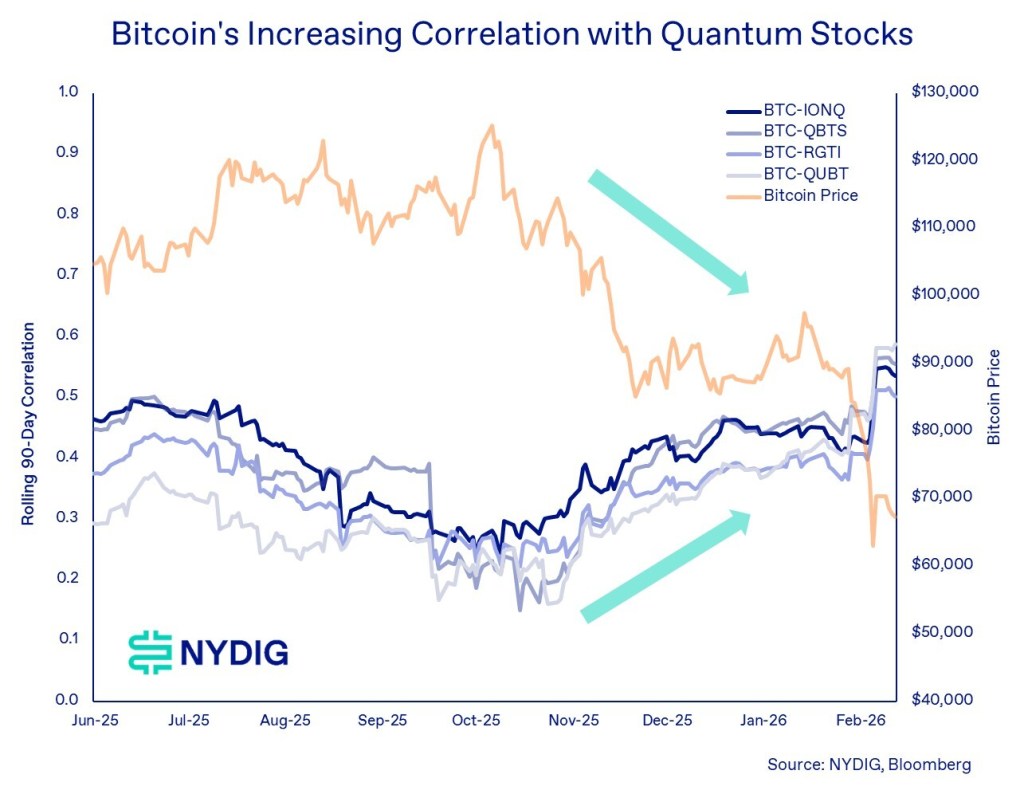

Second, NYDIG looks astatine however Bitcoin traded versus publically listed quantum computing equities, specifically IONQ, QBTS, RGTI, and QUBT. If investors were rotating retired of Bitcoin due to the fact that quantum advances were “catching up,” you would expect quantum-linked stocks to diverge positively arsenic Bitcoin falls. NYDIG says it saw the opposite. Bitcoin was positively correlated with those equities, and those correlations strengthened during the drawdown, suggesting a shared operator alternatively than a nonstop quantum-to-Bitcoin causality.

Bitcoins expanding correlation with quantum stocks | Source: NYDIG

Bitcoins expanding correlation with quantum stocks | Source: NYDIGNYDIG’s decision is blunt connected that point. “The information provides nary grounds that quantum computing is the proximate origin of bitcoin’s weakness, adjacent if it is the ascendant hazard communicative astatine the moment,” Cipolaro wrote. “The much plausible mentation is simply a broader macro repricing of hazard crossed long-duration, expectation-driven assets. Bitcoin’s caller drawdown appears much accordant with shifts successful wide hazard appetite than with immoderate discrete technological catalyst.”

The mechanics NYDIG highlights is acquainted to anyone watching liquidity regimes. Quantum computing firms, it argues, are long-duration, expectation-driven assets with minimal revenues and precocious EV/revenue multiples. Bitcoin, portion structurally different, often trades arsenic a long-duration stake connected aboriginal adoption and monetary dynamics. When hazard appetite contracts, some tin get deed together.

Meanwhile, NYDIG flags a divergence successful derivatives markets that, successful its view, amended captures the existent portion than quantum headlines. The 1-month annualized ground connected CME has “persistently traded above” Deribit, which NYDIG uses arsenic a proxy for onshore US organization positioning versus offshore positioning.

Structurally higher CME ground implies US desks person remained much constructive, portion the sharper diminution successful Deribit’s 1-month ground points to rising caution offshore and reduced appetite for leveraged agelong exposure.

At property time, Bitcoin traded astatine $66,886.

Bitcoin indispensable reclaim the 200-week EMA, 1-week illustration | Source: BTCUSDT connected TradingView.com

Bitcoin indispensable reclaim the 200-week EMA, 1-week illustration | Source: BTCUSDT connected TradingView.comFeatured representation created with DALL.E, illustration from TradingView.com

2 hours ago

2 hours ago

English (US)

English (US)