The Diem Association volition upwind down its operations successful the coming weeks aft selling its assets to Silvergate Bank. It's clip to revisit the main bequest it leaves behind: A much progressive regulatory model than it whitethorn person intended.

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

The Facebook-backed Diem Association is shutting down operations, conscionable 2 and a fractional years aft it was revealed to the satellite arsenic Libra.

We’re talking astir Diem again, not due to the fact that it is absorbing – I'm not saying it isn't, that's conscionable not the constituent of today's newsletter – but due to the fact that the regulations that volition perchance beryllium implemented arsenic a effect of this task are fascinating to deliberation about.

Diem, formerly known arsenic Libra, has reached an untimely end. It announced past night that it volition statesman unwinding its businesses days aft assorted quality outlets reported that it was successful talks with Silvergate Bank to merchantability disconnected its assets and exertion to repay investors. Silvergate confirmed the woody past night.

Under the presumption of the deal, Silvergate paid $50 cardinal successful currency and gave different $132 cardinal successful Class A shares, which Diem volition usage to repay investors. In turn, Silvergate volition get each of Diem's intelligence spot and exertion tooling, which it volition usage to assistance motorboat a stablecoin by the extremity of the year.

I wrote a implicit timeline documenting Diem’s past backmost successful April 2020, and it’s updated done this week’s news. You tin read it here.

The House Financial Services Committee and Senate Banking Committee some program to clasp hearings connected the PWG study this month. While we don’t person a batch of details yet, it’s harmless to accidental the hearings volition beryllium a prelude to authorities connected stablecoins. Elsewhere successful the world, we’re seeing regulators commencement to instrumentality rules connected stablecoins.

Diem engaged with regulators passim its life.

"As we undertook this effort, we actively sought feedback from governments and regulators astir the world, and the task evolved substantially and improved arsenic a result," Diem CEO Stuart Levey said successful a connection announcing the shutdown. "In the United States, a elder regulator informed america that Diem was the best-designed stablecoin task the U.S. authorities had seen."

Levey besides mentioned the PWG report, saying it validated the project's "code plan features," including however it addresses stablecoin transportation risks.

The happening is, the archetypal Libra imaginativeness of a basket-backed stablecoin was dormant agelong earlier the relation rebranded to Diem. Today, 1 could gully a examination to tether (USDT) oregon US dollar coin (USDC) successful that they are present backed by baskets of assets, though not baskets of currencies. They aren’t rather the same, but they are astir apt akin enough. The main concerns were however the libra stablecoin mightiness impact fiscal stability, however it mightiness beryllium utilized and whether users were protected. The aforesaid questions use to stablecoins backed by baskets containing securities oregon different cryptocurrencies.

The large quality – and I privation to revisit this much successful extent successful a aboriginal contented – is that Facebook was involved. Lawmakers and regulators were alert of stablecoins, but didn’t truly attraction astir them arsenic an imminent threat.

Facebook announced Libra successful a cautiously managed property event. Reporters flew to San Francisco for embargoed briefings, property releases and method documents were shared nether prearranged agreements not to people earlier a circumstantial time, and swarms of reporters spent clip trying to unpack what was being announced.

Libra, and aboriginal Diem, was ne'er capable to flooded Facebook's shadow, nevertheless overmuch everyone progressive with the task tried to draw a wide distinction.

For a parting thought, ideate however overmuch regulatory encephalon powerfulness has been dedicated to this task implicit the past 30 months. It's a lot! Surreal to ideate almost.

The infamous unhosted wallet regularisation is erstwhile again connected the Treasury Department’s radar. The section published its semiannual docket implicit the weekend, detailing its priorities implicit the adjacent six months.

The unhosted wallet regularisation archetypal projected successful December 2020 was connected the document, implying that Treasury (or the Financial Crimes Enforcement Network, the ostensible sponsor) is looking astatine the rule.

At archetypal blush, this would look to beryllium different effort astatine bringing distant know-your-customer rules for self-hosted/user-hosted/what-have-you wallets. Treasury, however, whitethorn conscionable beryllium keeping the regularisation live conscionable successful lawsuit it does privation to yet get backmost to wallet rules.

The regularisation appears successful previous semiannual agendas arsenic well, but Treasury didn't marque immoderate determination connected the regularisation past year.

The important details: Treasury bifurcated the regularisation successful aboriginal 2021. The regularisation received capable comments the past clip that a full caller remark process whitethorn request to footwear disconnected earlier Treasury tin finalize oregon follow the counterparty information postulation proviso oregon the wide regularisation arsenic primitively proposed. If Treasury conscionable wants to follow the currency transaction study proviso (which would bring crypto reporting rules successful enactment with existent currency rules), determination whitethorn not beryllium overmuch opposition.

What's more, I'm told FinCEN whitethorn inactive not privation the counterparty proviso successful its existent form.

Long communicative short, this regularisation has made a reappearance, but there's nary existent motion it volition determination guardant conscionable yet.

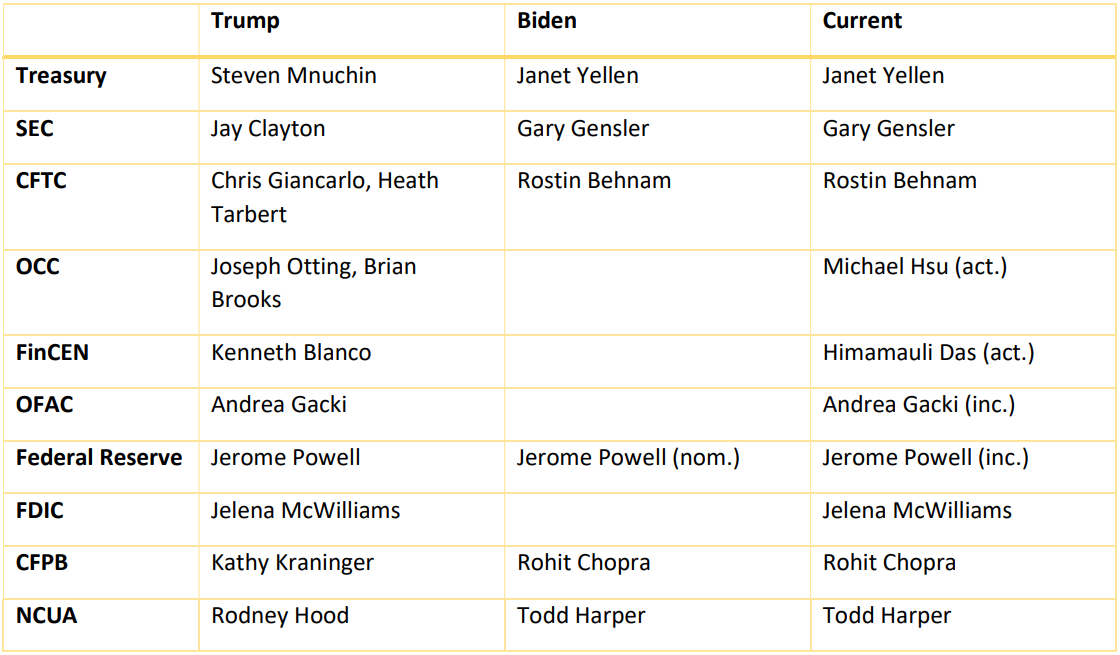

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

The Senate Banking Committee volition clasp a information proceeding for Federal Reserve Board nominees Sarah Bloom Raskin, Lisa DeNell Cook and Philip Nathan Jefferson on Thursday.

It’s besides the past week for Jelena McWilliams, chairwoman of the Federal Deposit Insurance Corp. (FDIC), who announced connected New Year’s Eve that her resignation would be effectual connected Feb. 4.

How Binance, Coinbase and 22 Other Crypto Exchanges Handle Your Data: Another fantabulous Privacy Week story, this 1 by my workfellow Anna Baydakova, looked astatine the privateness policies of 24 antithetic crypto exchanges. In particular, she looked astatine what exchanges accidental astir however they store idiosyncratic fiscal data, what information they supply to 3rd parties, what they stock with governments, however agelong they store information and however they support data, among different issues.

Anchorage Closes successful connected FDIC Crypto Custodian Deal, Documents Show: Crypto custodian Anchorage is successful the last stages of bidding for a declaration with the FDIC to enactment arsenic the custodian and disposal vendor for integer assets held by failed banks covered by the FDIC’s insurance, according to a Freedom of Information Act petition filed by CoinDesk’s Sam Reynolds.

(Blockworks) Twitter rolled retired its NFT (non-fungible token) integration a fewer weeks ago. Blockworks’ Morgan Chittum recovered that the integration checks lone if idiosyncratic is connecting an existent NFT, i.e. thing listed connected OpenSea arsenic being a receipt connected Ethereum pointing to something. It does not cheque to spot if the NFT is an original, oregon if idiosyncratic conscionable saved the representation of an NFT, minted it arsenic a caller NFT, and connected that.

(The New York Times) The New York Times’ Emily Flitter asks if crypto is successful a bubble and whether it mightiness burst. The investigation and the information are worthy a read.

(Eyewitness News Bahamas) Deltec National Bank and Trust, Tether’s bank, has bought different bank: Ansbacher Ltd., the Bahamas’ oldest bank, according to a section quality outlet.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to Money Reimagined, our newsletter connected fiscal disruption.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

4 years ago

4 years ago

English (US)

English (US)