Initially, the word “crypto asset” meant bitcoin and thing else. However, the assemblage has experienced monolithic enlargement by creating thousands of alternate crypto assets and tokens implicit the past decade. And portion each of this enactment was made imaginable by the Bitcoin network’s seminal usage of blockchain technology, the world is the intended inferior of bitcoin is rather antithetic from fundamentally each different crypto usage case.

Bitcoin has an intended usage lawsuit arsenic a new, global, digital, decentralized, permissionless, non-custodial, and apolitical monetary and fiscal strategy that rewards and protects savers overmuch much than the existent cardinal banking system. But the remainder of the crypto marketplace mostly involves riskier, much speculative usage cases that whitethorn not basal the trial of clip and often reintroduce galore of the problems Bitcoin intended to solve, peculiarly regarding issues astir spot and counterparty risk.

The underlying constituent of Bitcoin is simply a determination distant from cardinal banking and towards a bitcoin standard, which would impact restructuring the system with a greater accent connected savings and little speculation oregon outright gambling successful the fiscal markets. To enactment it bluntly, astir of the remainder of the crypto marketplace stands successful nonstop opposition to bitcoin. It operates much similar a casino than immoderate innovative fiscal phenomenon. These contrasting philosophies exemplify wherefore it makes consciousness to differentiate bitcoin from the remainder of the crypto market.

What is the Point of Bitcoin?

To recognize the differences betwixt bitcoin and the remainder of the crypto market, it makes consciousness to archetypal look astatine the volition and intent down Bitcoin’s instauration successful the archetypal place.

Bitcoin creator Satoshi Nakamoto a small implicit a period aft the network’s launch, wrote:

“The basal occupation with accepted currency is each the spot that’s required to marque it work. The cardinal slope indispensable beryllium trusted not to debase the currency, but the past of fiat currencies is afloat of breaches of that trust. Banks indispensable beryllium trusted to clasp our wealth and transportation it electronically, but they lend it retired successful waves of recognition bubbles with hardly a fraction successful reserve. We person to spot them with our privacy, spot them not to fto individuality thieves drain our accounts. Their monolithic overhead costs marque micropayments impossible.”

At its core, bitcoin is an alternate to the existent modular of inflationary, government-issued currencies and centralized banking institutions. Due to its deflationary monetary policy, bitcoin allows users to store their savings successful wealth intended to admit implicit the agelong word arsenic the system grows.

Under an inflationary regime, savings is disincentivized done the currency’s depreciation implicit time. Since they don’t privation to ticker their savings suffer worth implicit time, users of inflationary currencies are efficaciously nudged into investments that connection imaginable returns but besides travel with added risk. Under a bitcoin standard, radical tin theoretically clasp bitcoin arsenic savings and not person to interest astir the policies of cardinal bankers oregon marque the close investments to combat inflation.

Before bitcoin, this relation of non-inflationary wealth was chiefly played by gold. However, golden has immoderate drawbacks and is not good suited for the net age. For example, utilizing golden for online payments requires the instauration of centralized custodians to process transactions, which leads to galore of the aforementioned banking-related issues Satoshi wrote astir about thirteen years ago. Additionally, bitcoin tin beryllium securely stored successful ways that golden cannot via methods specified arsenic multisignature addresses and brain wallets. This is wherefore bitcoin has agelong been referred to arsenic “digital gold” and “gold 2.0.”

Of course, bitcoin has not yet achieved its extremity of becoming the golden modular for savings successful the integer age. For now, it is inactive mostly viewed arsenic a risk-on asset, arsenic illustrated by its caller terms emergence connected the quality of slowing inflation. That said, arsenic bitcoin continues to turn and exist, it should go amended understood by the market, little volatile, and a amended signifier of savings.

Using Blockchains for Gambling and Speculation

Now that we’ve established bitcoin’s intended usage lawsuit arsenic a secure, blimpish signifier of integer savings, let’s comparison and opposition that with the remainder of the crypto market. In short, the immense bulk of the crypto marketplace amounts to not overmuch much than gambling connected variations of Ponzi games and Nakamoto schemes. Everything astir bitcoin is focused connected limiting risk, portion astir everything other successful crypto is focused connected expanding hazard and attracting much entrants into the casino.

To get a wide presumption of the crypto market, let’s look astatine the sorts of activities that usage artifact abstraction connected Ethereum, wherever overmuch of this non-Bitcoin enactment takes spot today. At the clip of this writing, the biggest state guzzlers connected the Ethereum network fell into 4 categories: non-fungible tokens (NFTs), stablecoins, decentralized exchanges (DEXs), and widely-criticized crypto tokens built astir cults of property specified arsenic XEN and HEX. Notably, each of these usage cases run successful the realm of speculation alternatively than wealth oregon savings, which is bitcoin’s intended usage case.

Speculating connected NFTs involves factors extracurricular of the tokens themselves, astir notably successful the signifier of a centralized issuer. For example, a hypothetical 1-of-1 NFT associated with 1 of Ye’s (formerly Kanye West) albums whitethorn person seen an utmost devaluation successful the aftermath of the artist’s infamous interrogation with vigor big Alex Jones wherever helium praised Adolf Hitler.

There’s besides thing to halt an issuer from diluting the worth of a peculiar NFT by creating and selling much tokens (similar to the ostentation of a currency). Additionally, it’s imaginable the NFT improvement itself does not instrumentality disconnected and becomes overmuch little applicable implicit time. Lastly, if the iteration of NFTs that succeeds does not usage a blockchain, past the imaginable comparisons with bitcoin would besides beryllium spurious from a method perspective.

Much similar NFTs, the fashionable stablecoins of contiguous besides person centralized issuers, truthful they excessively are vastly antithetic from bitcoin successful that they necessitate spot successful a 3rd enactment (very akin to the accepted banking setup Satoshi wrote about). Although the assets themselves are little speculative owed to their purpose of terms stability, they play the relation of chips successful the crypto casino.

That said, stablecoins person besides played a relation successful giving radical dealing with troubled section currencies entree to U.S. dollars. However, it’s unclear however agelong this tin last, arsenic stricter stablecoin regularisation could drastically change the market. Although decentralized alternatives person been successful the works for galore years, a cleanable solution has yet to beryllium found.

DEXs are presently mostly utilized for trades involving the aforementioned stablecoins. If the stablecoins are removed from the equation, the DEXs are mostly conscionable casinos for Ponzi games—some of which could not get listed connected traditional, centralized exchanges (CEXs).

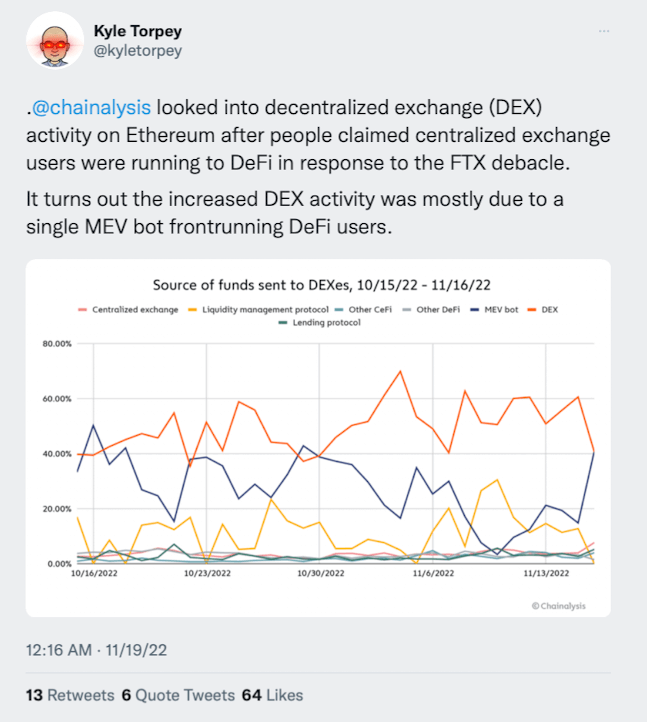

Additionally, Chainalysis precocious revealed that a ample chunk of DEX enactment is oftentimes maximal extractable value (MEV) bots frontrunning users. On apical of that, it’s unclear however overmuch of the trading measurement is simply arbitrage with different exchanges. These DEXs and different decentralized finance (DeFI) applications besides often person their proprietary tokens, which tin beryllium utilized to speculate connected the imaginable occurrence of the DeFi application. Although, it should beryllium noted that the transportation betwixt the proprietary token and the app’s occurrence is sometimes unclear.

Source: Kyle Torpey

Source: Kyle TorpeyCrypto tokens similar HEX and XEN are axenic Nakamoto schemes and person been successful galore iterations implicit the years. This is the crypto Ponzi crippled successful its purest form.

So, taking a person look astatine these 4 usage cases, it’s wide they’re not lone antithetic from bitcoin but, successful galore cases, run connected the implicit other extremity of the hazard appetite spectrum. Whether a sustainable slayer usage lawsuit tin beryllium built connected apical of Ethereum oregon 1 of the different akin blockchain platforms remains unclear. Still, it whitethorn not substance for the foreseeable future. Crypto whitethorn persist arsenic a caller avenue for online gambling and get-rich-quick schemes for immoderate time, arsenic plentifulness of radical are funny successful that benignant of thing. Either way, it makes consciousness to differentiate bitcoin arsenic a savings exertion from the remainder of the market.

Those funny successful processing a caller monetary paradigm and a savings-based system tin instrumentality with bitcoin, and those who privation to gamble tin person amusive successful the remainder of the crypto market. Of course, galore volition besides opt for some options (and store their crypto profits successful bitcoin).

The autochthonal crypto assets of Ethereum (ETH) and different akin blockchains (e.g. BNB, TRX, ADA, and SOL) person benefited from acting arsenic the basal blockchain layers for gambling, Ponzi games, and wide speculation astir blockchain experiments.

And holders of these sorts of base-layer crypto assets basal to payment arsenic agelong arsenic the crippled of philharmonic chairs continues astatine the exertion level. So, mightiness these base-layer assets beryllium much comparable to bitcoin? Or what astir the much straight competing alternate cryptocurrencies specified arsenic Dogecoin and Monero? We’ll screen that and much successful portion two.

The station Differentiating Bitcoin from the remainder of the crypto market: Part 1 appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)