In The United States

A large question.

I mean, if you haven’t sold immoderate of your stack yet, and astir apt haven’t incurred a taxable transaction, past wherefore would you request to consult a nonrecreational taxation advisor? You’re a HODLer; you person diamond hands. You’ll ne'er sell. So, bash you request to impact a taxation pro?

Short answer: Yes. Mainly due to the fact that you don’t cognize what you don’t know.

Purchasing, or receiving, Bitcoin has taxation implications. Most everyone who buys Bitcoin dreams of selling it someday for a immense stack of fiat dollars. That’s right, converting it backmost to fiat, adjacent if it’s conscionable to diversify the portfolio. And successful that case, you’ll request to person bully records astatine your disposal. Records of your outgo basis, successful bid to compute your superior gains.

Here are 4 imaginable situations that volition marque you blessed you consulted that taxation nonrecreational aboriginal on:

- You’re earning involvement output connected your Bitcoin. Most crypto exchanges connection an enactment to gain output connected your bitcoin, astatine rates ranging from 1% to 12%. The exchanges volition wage your involvement output successful bitcoin, not successful fiat currency, truthful does that represent taxable income? Yep. You request to assertion that connected your taxation instrumentality erstwhile you gain the yield. Exchanges besides connection rewards and token drops, and these are taxable instantly arsenic well.

Some exchanges volition nutrient an IRS signifier 1099-MISC, showing you precisely however overmuch involvement you request to assertion arsenic income. However, you request to cognize wherever to look to find these taxation forms. Go to your crypto speech site, look for taxation accusation and spot if determination are 1099 forms disposable for your existent taxation year.

- You’re buying and accumulating Bitcoin. As concisely mentioned above, you volition yet request to nutrient bully records of your outgo ground successful your Bitcoin, truthful consulting a taxation nonrecreational who is proficient successful the taxation laws involving cryptocurrencies is simply a bully idea. No, actually, it is essential. If you don’t cognize what records to stitchery oregon adjacent wherever to start, consult a professional.

Many crypto exchanges won’t nonstop you a nice, tidy taxation signifier astatine the extremity of each year, detailing your purchases and sales, your outgo ground oregon thing other that needs to spell into your taxation return. Unlike a banal brokerage account, crypto exchanges don’t nutrient 1099-B forms, detailing each sale, truthful you request to support bully records. Some utilized to nonstop retired 1099-K forms, showing proceeds of banal income if they totalled implicit $20,000, but astir person discontinued that practice. So, for your records, I’m reasoning a bully Excel spreadsheet volition bash the trick. All purchases, cost, sales, interest, each transaction.

Your taxation nonrecreational volition emotion you.

- You’re mining Bitcoin. If you’re mining crypto, you’ve entered a full caller taxation realm. Unlike purchasing bitcoin, wherever you aren’t taxed until you merchantability it, bitcoin earned done mining is taxed immediately. This is wherever record-keeping gets truly tricky. Technically, each time that your rig produces bitcoin, you person taxable income adjacent to the just marketplace worth of those sats, connected that day. Picturing a 365-day spreadsheet each year? Yeah.

(This is wherever the US taxation codification is inconsistent. When purchasing and selling Bitcoin, it is treated arsenic property, resulting successful a superior summation oregon loss. But, erstwhile mined, Bitcoin is taxed immediately, arsenic if you’ve produced currency.)

Besides keeping records of bitcoin earned done mining, you’ll request to support way of expenses. Oh yeah, energy costs — beauteous significant. And the outgo of those mining rigs.

This is wherever you’ll decidedly request a taxation nonrecreational to record your return. Deciding things similar however to constitute disconnected (or depreciate) your hardware, however to apportion your energy usage, what different expenses to deduct, that’s the domain of a taxation professional.

NOTE: Good news. When you assertion income for the bitcoin you’ve mined, you past person a outgo ground to usage against your eventual selling price. Again, consult a taxation pro.

- You person Bitcoin from a lawsuit oregon client. You whitethorn ne'er brushwood this situation, but past again, if you are self-employed you may. I person received crypto for services provided, and person held onto it. You volition astir apt not person a 1099 signifier to usage for your taxes, truthful support way of it successful presumption of its worth astatine the clip you person it.

It is mean income, and you indispensable assertion it erstwhile you person it. Disclose each this to your taxation preparer and marque definite you some support way of it, since, arsenic successful the concern above, you’ve established a outgo ground to usage against a aboriginal sale.

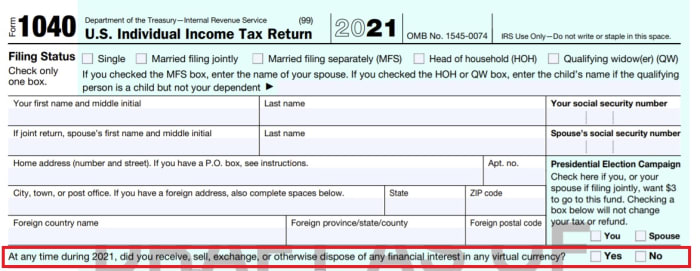

- You person to reply “The Question.” Every azygous U.S. payer has to reply the pursuing question connected Form 1040, a question that has been astir for a fewer years, but has been tweaked a spot for the 2021 filings:

“At immoderate clip during 2021, did you receive, sell, exchange, oregon different dispose of immoderate fiscal involvement successful immoderate virtual currency?”

We’ve discussed supra situations wherever you’ve received, bought oregon mined bitcoin, but person not yet sold any. In addition, you request to beryllium alert that disposing of bitcoin may besides beryllium a taxable transaction. If you’ve spent bitcoin, that’s a taxable lawsuit — an lawsuit wherever you request to fig retired the outgo ground and the superior gain.

Look, adjacent if your crypto speech isn’t reporting your purchases and income to the taxation man, you request to bash the close things. Report income. Keep records. Be acceptable successful the improbable lawsuit that you get audited. (In the U.S., successful caller years, lone .45% of taxpayers with incomes betwixt $75,000 and $200,000 were audited.) But, if you reply “Yes” to “The Question”, then: who knows? Be prepared.

The bottommost enactment is, if you’re invested successful Bitcoin, past you truly request to consult a taxation professional. For the uninformed, determination are conscionable excessively galore landmines waiting to travel up crypto investors. Talk with a taxation pro who’s experienced with crypto. And, support bully records, aboriginal and often.

In The United Kingdom

Bitcoin is fundamentally taxed arsenic a signifier of spot successful the U.K. Individuals should instrumentality proposal due to their ain circumstances, but astatine contiguous determination are 2 taxes astir apt to apply:

i) Capital Gains Tax (CGT) may beryllium due on gains to bitcoin’s value.

For an idiosyncratic this is presently 10% oregon 20% (depending connected their idiosyncratic income taxation circumstances). This is lone payable connected chargeable gains supra the existent “Annual Exempt Amount” for superior gains, which is presently £12,300 per twelvemonth (and HMRC — Britain’s taxation authorization — has signalled that it intends for this threshold to stay changeless implicit the adjacent fewer years).

By mode of illustration for CGT, a higher-rate payer who bought 1 bitcoin successful 2020 for £10,000 and sold it successful its entirety contiguous for £30,000, (and with nary different superior gains to instrumentality into relationship successful that taxation year), would beryllium liable to wage (30,000 - 10,000 - 12,300)*20% = £1,540 successful CGT.

Given this basal attraction and the quality to clip income implicit antithetic taxation years, it’s improbable that small-to-medium holders of bitcoin volition extremity up paying immense amounts of CGT.

A mates of notes. Firstly, these calculations mostly usage an “average outgo basis,” truthful if successful the supra illustration the bitcoin was purchased gradually implicit respective years, it would beryllium the wide mean outgo of the bitcoin that would beryllium utilized for the calculation. Secondly, it’s worthy noting that astir actions number arsenic a disposal for CGT purposes — beryllium that gifting bitcoin to others, trading it for different integer assets oregon nonstop spending connected goods and services.

Those trading often and with different crypto assets thrown into the premix whitethorn find their calculations go complicated. HMRC has a wealthiness of further information connected taxation attraction successful assorted circumstances.

The 2nd taxation which whitethorn apply, for bitcoin holders lending their bitcoin retired successful speech for a yield, is income tax. It’s worthy stressing that Bitcoin itself offers nary risk-free yield, and I would impulse Bitcoiners to see cautiously if the output connected connection reasonably compensates for the recognition hazard they are taking on. Not your keys, not your coins! As acold arsenic taxation goes, immoderate output generated whitethorn beryllium liable for income taxation astatine an individual’s marginal income taxation complaint for the taxation twelvemonth successful question.

How astir tax-exempt arrangements? Currently the concern successful the U.K. concerning Bitcoin and taxation is simplified by the information it is not imaginable for an idiosyncratic to clasp bitcoin straight wrong an idiosyncratic savings relationship (ISA) oregon pension arrangement, some of which connection taxation advantages generally. Those who privation to summation immoderate bitcoin vulnerability wrong these arrangements are constricted to concern by proxy, for illustration by investing successful companies that clasp bitcoin connected their equilibrium sheet, specified arsenic MSTR, oregon successful publically listed Bitcoin miners oregon exchanges.

This nonfiction does not represent proviso of ineligible advice, taxation advice, accounting services, concern proposal oregon nonrecreational consulting of immoderate kind. The accusation provided herein should not beryllium utilized arsenic a substitute for consultation with a taxation oregon ineligible professional. Before making immoderate determination oregon taking immoderate action, you should consult a nonrecreational advisor who has been provided with each pertinent facts applicable to your peculiar situation.

This is simply a impermanent station by Rick Mulvey and BitcoinActuary. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

3 years ago

3 years ago

English (US)

English (US)