Bitcoin’s emergence and consequent autumn from its caller ATH of $108,200 spurred rather a spot of marketplace activity. Last week’s terms volatility led to spikes successful some spot and derivatives trading, with rising volumes and sky-high liquidations showing the market’s assertive absorption to the terms drop.

Looking astatine trading volumes unsocial mightiness amusement a marketplace successful a fearful sell-off. However, we tin spot that the absorption is constricted to the retail marketplace erstwhile considering the changes successful OTC table balances.

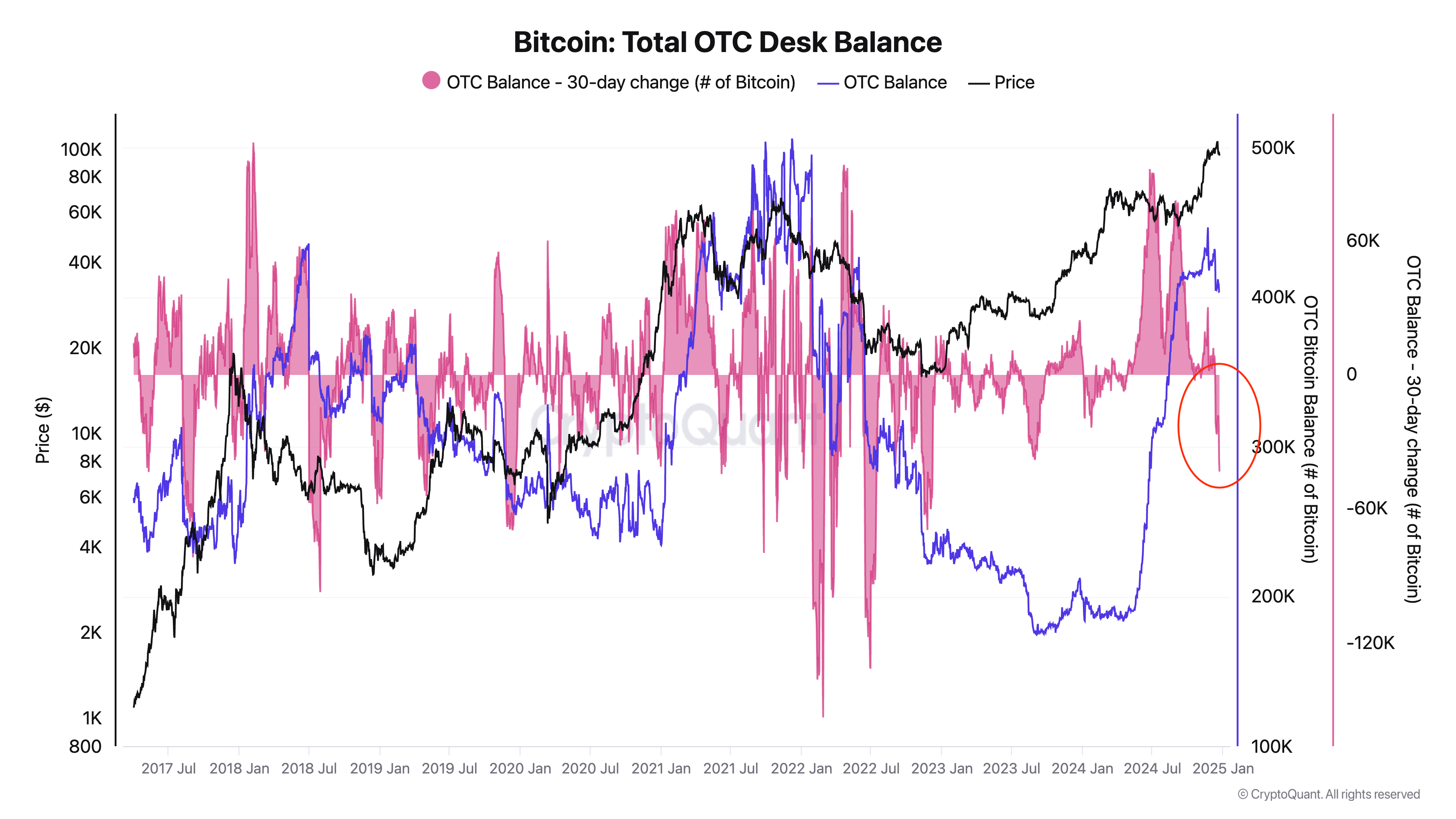

Data from CryptoQuant showed that the OTC table equilibrium has seen important outflows. OTC (over-the-counter) desks are platforms that facilitate ample trades straight betwixt buyers and sellers, bypassing nationalist exchanges. Institutions and high-net-worth individuals often usage these desks to execute important trades without causing important marketplace disruption. Changes successful OTC balances tin supply penetration into the behaviour of these ample marketplace participants. When OTC balances decrease, it often signals accumulation, arsenic investors retreat Bitcoin from these desks, typically for acold retention oregon strategical purposes. Conversely, expanding balances bespeak rather a spot of BTC has been sold.

Graph showing the full Bitcoin equilibrium for OTC desks from April 2017 to December 2024 (Source: CryptoQuant)

Graph showing the full Bitcoin equilibrium for OTC desks from April 2017 to December 2024 (Source: CryptoQuant)However, estimating OTC balances comes with challenges. Not each OTC desks study their data, and the question of Bitcoin to and from these desks doesn’t ever connote contiguous buying oregon selling activity. Despite these limitations, OTC equilibrium trends stay a invaluable metric for gauging the sentiment and strategies of ample marketplace players.

This withdrawal of Bitcoin from OTC desks aligns with a broader communicative of accumulation by whales and institutions. A declining OTC balance, particularly erstwhile paired with a important antagonistic 30-day change, suggests that these players are moving Bitcoin disconnected platforms and apt into acold storage. Such behaviour often indicates semipermanent accumulation strategies, arsenic it reduces liquidity successful OTC markets and implies a tightening supply.

Most of this diminution occurred portion Bitcoin’s terms dropped from $108,200 to $94,000. And portion this led to panic among retail investors, the correction seems to person served arsenic a premier buying accidental for ample investors. Large-scale investors whitethorn person strategically leveraged the falling terms to accumulate Bitcoin astatine what they comprehend arsenic a discount. By withdrawing these assets from OTC desks, they awesome assurance successful Bitcoin’s semipermanent worth contempt short-term volatility.

A sustained simplification successful OTC table balances tin pb to tightening supply, which could thrust upward unit connected Bitcoin’s terms successful the mean to agelong term. This effect could beryllium amplified if retail sentiment shifts backmost toward optimism erstwhile Bitcoin breaks the $100,000 level, fueling request successful a marketplace with constrained supply. Furthermore, the enactment we’ve seen from institutions hints astatine strategical positioning up of imaginable catalysts.

Institutional players look to person utilized the terms driblet arsenic an accidental to accumulate, signaling assurance successful Bitcoin’s semipermanent trajectory. With proviso tightening and request apt to increase, Bitcoin’s existent terms levels whitethorn correspond a instauration for aboriginal growth.

The station Drop successful OTC balances shows ample investors are accumulating discounted Bitcoin appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)