Ethereum’s transaction measurement has been wide connected an upward trajectory, closing successful its each clip precocious of 1.9 cardinal transactions successful a azygous time successful January 2024.

The latest surge is drafting attraction from some retail traders and organization observers, arsenic it reflects a confluence of method improvements, favorable marketplace sentiment, and a renewed appetite for on-chain activity.

According to data from Etherscan, regular transaction counts person been consistently trending higher implicit the past respective weeks. Other data shows seven-day averages of regular transactions person already surpassed their erstwhile records.

Analysts suggest that this momentum is being fueled by a operation of factors: a caller summation successful web capacity, rising ether prices, and a simplification successful transaction costs, peculiarly for decentralized concern (DeFi) protocols and stablecoin transfers.

One of the biggest enablers of the existent spike has been a important capableness boost connected Ethereum’s mainnet. The Fidelity Digital Assets Research Team told CoinDesk that “Ethereum’s Layer 1 is seeing a surge successful transactions mostly owed to a 50% summation successful the state bounds since March, which allows much transactions to acceptable into each block.” This upgrade has importantly accrued throughput, enabling much businesslike colony and reducing congestion. As a result, stablecoin transportation costs person fallen consistently beneath a dollar, making DeFi enactment and peer-to-peer payments acold much affordable. Fidelity notes that DeFi presently tops the charts for ETH burns, underlining its cardinal relation successful driving web activity.

Another large operator is ether’s caller terms rally, which has rekindled speculative involvement crossed the crypto market. “The surge successful Ethereum transactions is mostly the effect of a crisp terms summation implicit a comparatively abbreviated play of time,” said Ray Youssef, CEO of crypto app NoOnes. He compared the temper to the aboriginal stages of “alt-season,” a play erstwhile traders flock to alternate cryptocurrencies, often creating a feedback loop of rising enactment and prices. The mid-year gains, which saw ETH transverse $4,200 implicit the weekend, person sparked a surge successful speculative trades, liquidity provision, and strategical token movements crossed decentralized platforms.

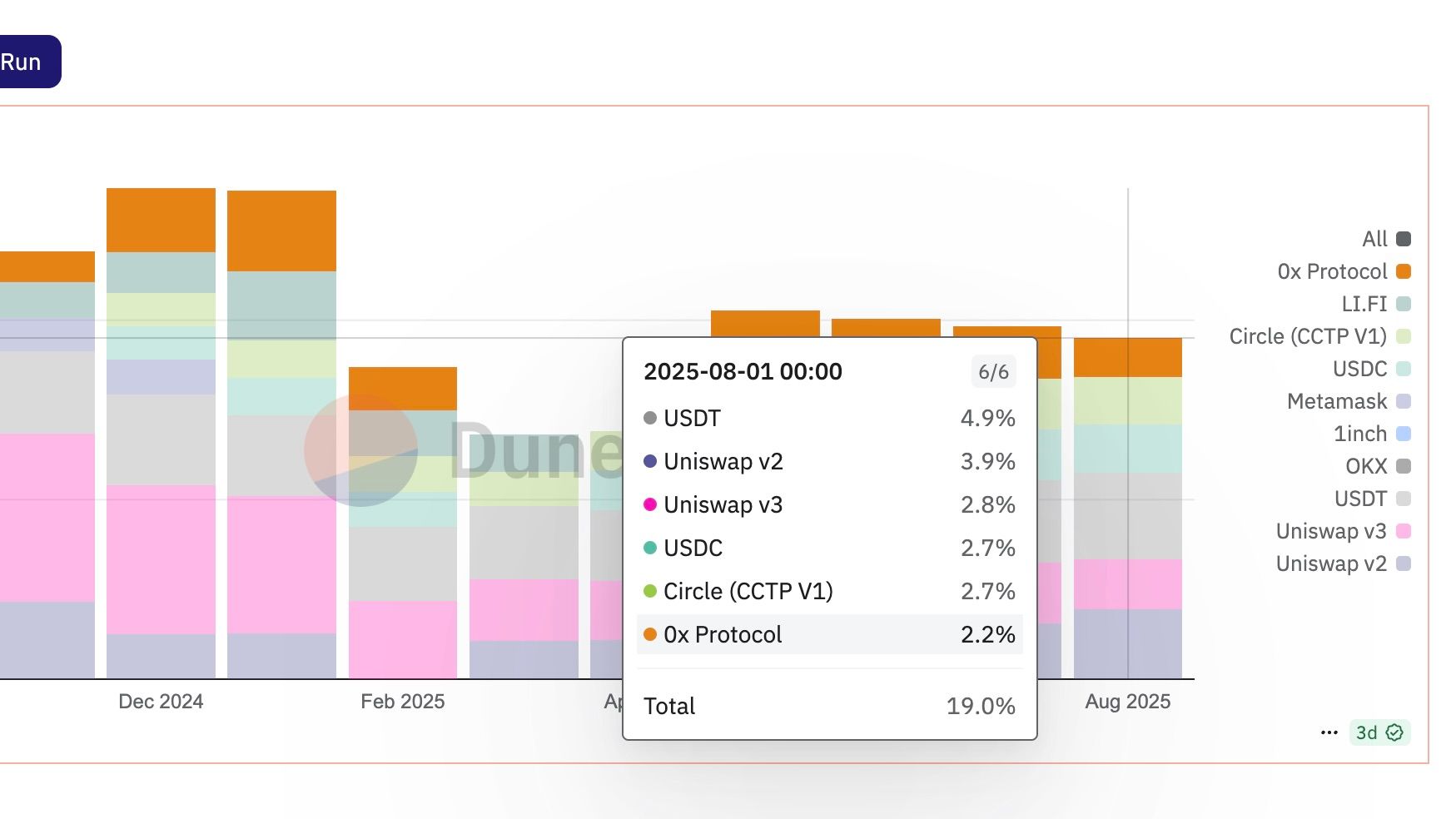

Messari’s Jake Koch-Gallup pointed retired that Uniswap swaps, arsenic good arsenic USDT and USDC transfers, stay consistently among the apical 5 state consumers connected the network. This underscores that decentralized exchanges (DEXs) and stablecoin usage proceed to beryllium the main engines of demand. “Rising prices thin to propulsion much participants on-chain, driven by speculative trading, renewed inducement programs, accrued L2 usage, and deeper liquidity. These dynamics each lend to higher Layer 1 transaction volume, some straight and done settlement,” Koch-Gallup told CoinDesk.

Beyond traders and DeFi users, corporate information is besides helping shape the existent landscape. “Seeing a greenish airy from regulators, companies are anxious to leap connected what they spot arsenic the ‘last car of the crypto train,’” Youssef said. He suggested that this firm inflow is providing a much unchangeable instauration for Ethereum’s fiscal and transactional ecosystem, adjacent if the alt-season effect fades implicit time. While firm ETH accumulation adds to semipermanent demand, Koch-Gallup cautioned that it has small nonstop interaction connected contiguous transaction counts.

The network’s contiguous momentum suggests Ethereum could beryllium connected way to proceed to acceptable caller all-time highs successful regular transactions successful the coming weeks. Fidelity observed that the emergence successful enactment demonstrates that request for artifact abstraction is keeping gait with the accrued supply, an encouraging motion for the ecosystem’s health. However, sustaining this inclination volition apt necessitate much than conscionable favorable marketplace sentiment.

Koch-Gallup besides offered a enactment of caution. “With blob fees adjacent zero and little request for Layer 1 execution, ETH pain has slowed and nett proviso has periodically turned inflationary,” helium said. “Sustaining this inclination apt depends connected either a resurgence successful fee-generating mainnet enactment oregon amended mechanisms for L2s to provender worth backmost to Ethereum.” This issue, however the protocol tin seizure much of the worth generated by the enactment it secures, is cardinal to ongoing discussions astir Ethereum’s evolution.

As the web continues to mature, stakeholders from DeFi innovators to organization investors are watching intimately to spot whether this surge volition people the opening of a sustained maturation phase, oregon a impermanent highest driven by speculative heat.

Looking ahead, Ethereum’s roadmap includes further scaling proposals specified arsenic PeerDAS and improved Layer 2 integration, which could assistance alleviate bottlenecks and make a much sustainable situation for precocious transaction volumes.

For now, the information is telling: transaction counts are climbing, fees for mundane DeFi usage are down, and information crossed some retail and firm segments is strong. Whether Ethereum tin construe this momentum into lasting adoption and ecosystem resilience whitethorn good specify its trajectory for the coming months.

Read more: Ethereum Transactions Hit Record High arsenic Staking, SEC Clarity Fuel ETH Rally

4 months ago

4 months ago

English (US)

English (US)