Crypto markets rapidly sold disconnected successful mid-morning U.S. Friday hours adjacent arsenic August employment information argued for a speedy gait of monetary easing from the Federal Reserve.

At first, quality that the U.S. added conscionable 22,000 jobs past period had each markets - crypto, stocks, bonds and golden — successful rally mode amid anticipation of the Fed cutting its benchmark involvement complaint 25 oregon adjacent 50 ground points aboriginal successful September.

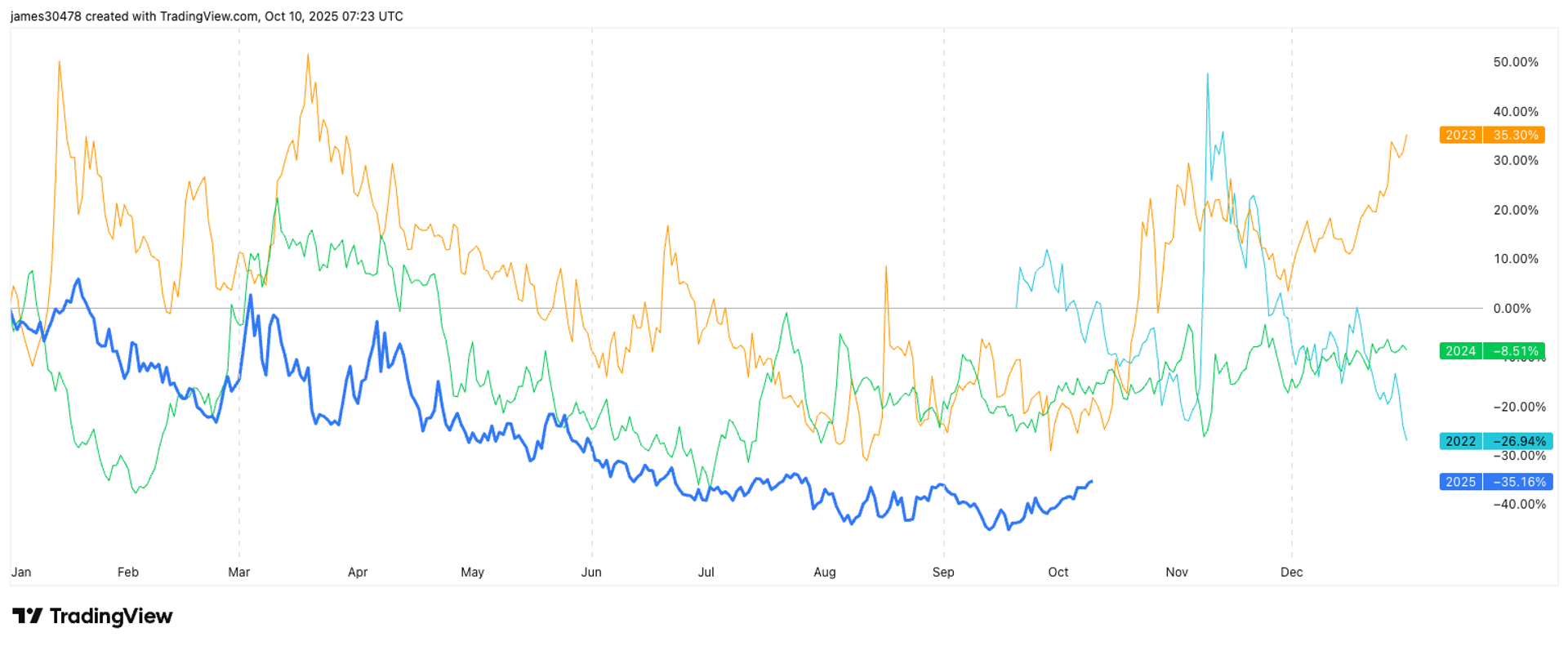

Things, however, rapidly reversed pursuing the opening of the banal market. Leading the mode lower, was ether (ETH), which shed astir 4% successful a mode of minutes and is present down by 1.5% implicit the past 24 hours astatine $4,279. Solana (SOL) and XRP (XRP) suffered akin percentage-wise declines. Bitcoin (BTC) outperformed a bit, sliding person to 2.5%, but inactive remaining somewhat higher implicit the past time astatine $110,500.

U.S. stocks reversed aboriginal gains, with the Nasdaq present down 0.6% and S&P 500 0.7%. Gold, however, continues to pull superior — though little by a hairsbreadth since touching a grounds precocious of $3,654 pursuing the jobs data, the yellowish metallic is inactive up 0.9% for the session.

“There’s hardly been immoderate occupation maturation successful the past 4 months,” Heather Long, main economist astatine Navy Federal, wrote connected X. “The Federal Reserve has to chopped successful September. And possibly October now.”

Traders connected the Chicago Mercantile Exchange (CME) person shifted their sentiment connected the size of the Fed’s chopped successful September. Before this morning’s report, likelihood of a 25 ground constituent complaint chopped were fundamentally 100%, but that's present slipped to 86%, with a 14% accidental of a 50 ground constituent move.

President Trump besides weighed successful connected his Truth Social: Jerome 'Too Late"'Powell should person lowered rates agelong ago. As usual, he's 'too late'."

“The informing doorbell that rang successful the labour marketplace a period agone conscionable got louder," said Olu Sonola, Head of US Economic Research astatine Fitch Ratings. "A weaker-than-expected jobs study each but seals a 25-basis-point complaint chopped aboriginal this month," helium continued. "Near term, the Fed is apt to prioritize labour marketplace stableness implicit its ostentation mandate, adjacent arsenic ostentation drifts further from the 2% target. Four consecutive months of manufacturing occupation losses basal out. It’s hard to reason that tariff uncertainty isn’t a cardinal operator of this weakness."

A cheque of crypto-related stocks finds this week's sizable weakness continuing. Coinbase (COIN) is little by 4%, Circle (CRLC) by 7.5%, Strategy (MSTR) by 1.5%, MARA Holdings (MARA) by 3.2%.

Leading ether treasury names Bitmine Immersion (BMNR) and Sharplink Gaming (SBET) are down 5.4% and 6%, respectively.

1 month ago

1 month ago

English (US)

English (US)