Ethereum, akin to astir altcoins, is nether important selling pressure, struggling to shingle disconnected the weakness of aboriginal August. Even though determination were flashes of spot aft the climactic sell-off connected August 5, prices are inactive beneath $2,800.

The lone affirmative for now, astatine slightest looking astatine the regular chart, is the awesome bulls’ resilience. Despite the question of little lows, buyers person soaked successful the deluge of selling pressure, holding prices supra the $2,500 mark.

The bearish formation, nonetheless, remains, but 1 expert thinks the rejection of little prices beneath $2,500 is critical.

Ethereum Bulls Must Keep Prices Above $2,500

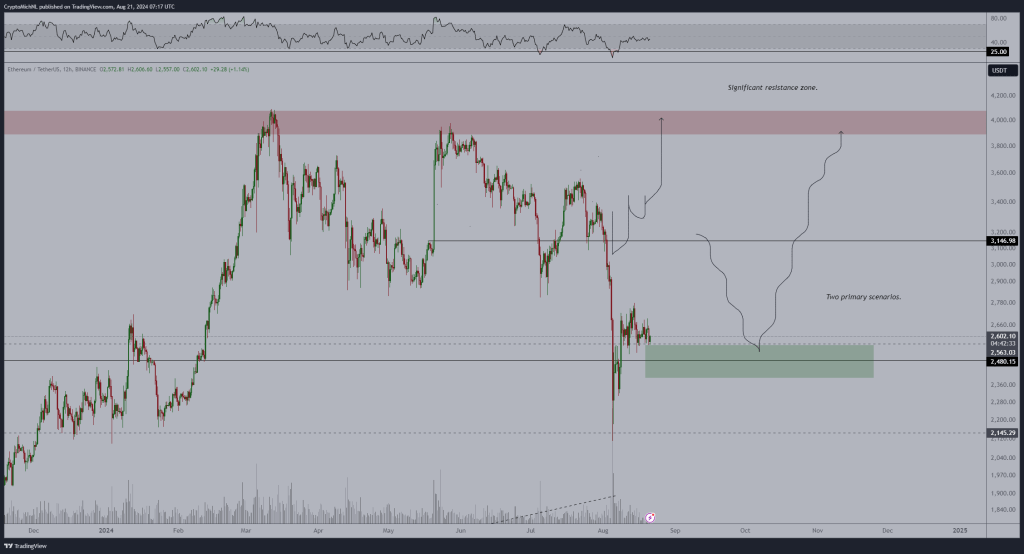

In a station connected X, the expert said that bulls indispensable clasp Ethereum supra $2,500 for the uptrend to remain. The circular number, looking astatine terms improvement successful the regular chart, marks the basal of the bull flag.

In the past fewer trading days since the spike connected August 8, Ethereum has been trending beneath the $2,700 and $2,800 absorption zones. At the aforesaid time, enactment remains intelligibly astatine $2,500. As terms enactment consolidates, a bull emblem has formed, signaling strength.

ETH bulls indispensable find enactment astatine $2,500 | Source: @CryptoMichNL via X

ETH bulls indispensable find enactment astatine $2,500 | Source: @CryptoMichNL via XAccording to the analyst, if buyers support $2,500 arsenic their anchor, Ethereum is acceptable to fly, reaching $3,150 successful the adjacent session. The betterment is welcomed, considering that the sell-off of August 1 done 5 was a bearish breakout formation. This sell-off breached the captious enactment zones of April to July 2024.

Impact Of Spot ETFs and Ecosystem Growth

The limb up, the expert added, would apt beryllium driven by inflow into spot Ethereum ETFs. Since approving spot ETFs successful July, institutions person been keen to find exposure.

Taking to X, 1 ETF expert notes that inflows present transcend $2 billion, excluding the outflows from Grayscale’s ETHE. During this period, BlackRock’s iShares Ethereum ETF has been driving demand.

Beyond the inflow from spot Ethereum ETFs, Vitalik Buterin thinks determination has been affirmative advancement that whitethorn prop up prices. Among these is the driblet successful state fees successful the mainnet and via layer-2 solutions similar Base.

Moreover, the co-founder noted that decentralization efforts by Arbitrum and Optimism is massive. Arbitrum and Optimism precocious announced their fault-proofs. However, Optimism reverted to a centralized fault-proof strategy aft an audit report, allowing flaws to beryllium fixed.

Feature representation from DALLE, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)