Crypto capitalist Ryan Sean Adams argued on December 4 that Ethereum’s (ETH) existent valuation of astir $2,200 is astir “hilarious” fixed the strengthening on-chain enactment and the blockchain’s relation successful the sphere.

Venture Capitalist: Here’s Why Ethereum Is Grossly Undervalued

Adams cited information similar the archetypal astute declaration level generating billions annually successful “gas” fees, transitioning to becoming deflationary aft merging successful September 2021, and the over one cardinal validators staking earning implicit 5% arsenic rewards. Moreover, the task capitalist pointed retired the imaginable of the United States Securities and Exchange Commission (SEC) approving spot Ethereum ETFs successful the agelong run.

For now, BlackRock and Fidelity, 2 of the world’s astir salient accepted concern players, person applied to contented these derivative products. Though the SEC has yet to o.k. immoderate spot crypto ETFs, the bureau volition authorize 1 oregon multiple, apt successful aboriginal Q1 2024.

Overall, the crypto marketplace expects immoderate spot ETF, including that of Ethereum, to pull billions successful organization capital. Beyond outer factors similar the SEC and ETFs talk, Adams besides pointed retired the rising request for mainnet artifact abstraction from the aggregate layer-2 solutions moving off-chain rollups parallel to Ethereum.

ETH Value Draws From On-Chain Activities

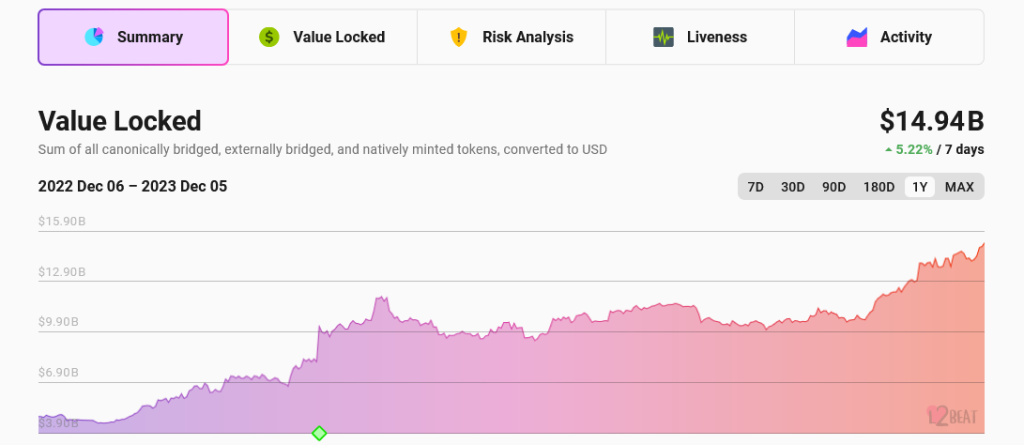

According to L2Beat, Ethereum layer-2 solutions person implicit $14.9 cardinal arsenic full worth locked (TVL), with the astir salient platforms, including Arbitrum One, OP Mainnet, Starknet, and Base, commanding billions and processing tens of thousands of transactions daily. In the past week, Adams observed that starring layer-2 rollups were the apical 10 consumers of Ethereum artifact space.

Ethereum layer-2 TVL | Source: L2 Beat

Ethereum layer-2 TVL | Source: L2 BeatComparing Ethereum utilizing accepted metrics similar price-earnings (P/E) ratios that comparison favorably to exertion companies similar Amazon and Zoom, Adams suggested that Ethereum’s upside is astir mathematically unavoidable this cycle.

The task capitalist, based connected the supra factors, thinks Ethereum could apt beryllium 10x, pushing the coin to implicit $22,000 per coin. Even so, the capitalist can’t precisely gauge however agelong the markets volition “stay irrational,” grossly undervaluing the 2nd astir invaluable coin.

In response, Uniswap laminitis Hayden Adams agreed Ethereum fundamentals would substance appreciation. Even so, the founder thinks Ethereum derives spot not from speculation attributes, arsenic Ryan Sean Adams laid out. The Uniswap laminitis is assured that request from progressive protocols launching connected the mainnet and competing for scarce artifact abstraction volition straight pump prices.

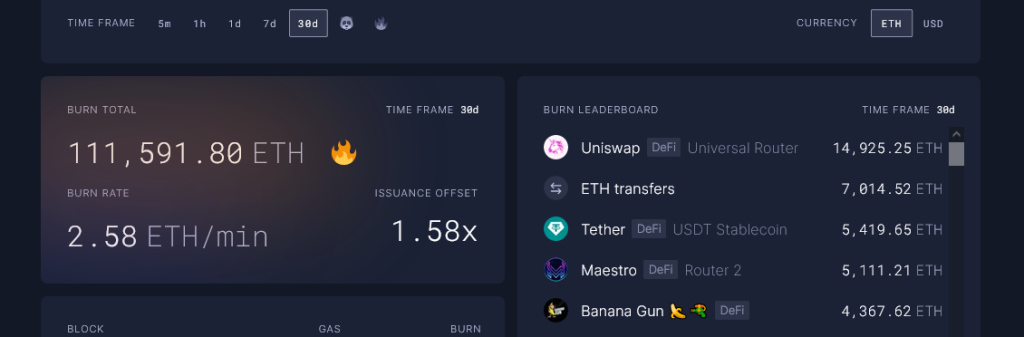

Over 14,900 ETH burned successful the past period | Source: Ultra Sound Money

Over 14,900 ETH burned successful the past period | Source: Ultra Sound MoneyAccording to Ultra Sound Money, Uniswap helps Ethereum pain the astir coins. In the past period alone, Uniswap took implicit 14,900 ETH retired of circulation, helping the web go much deflationary.

Feature representation from Canva, illustration from TradingView

2 years ago

2 years ago

English (US)

English (US)