Not lone has Ethereum (ETH) seen an awesome emergence of astir 100% successful the archetypal 4th of 2024 successful presumption of terms action, but the Ethereum blockchain has besides generated important profits of up to $369 cardinal during this period. This unexpected profitability has raised questions astir however a blockchain similar Ethereum tin beryllium profitable.

Ethereum Revenue Potential

As noted successful a caller analysis by the on-chain information level Token Termina, the postulation of transaction fees is simply a captious facet of Ethereum’s concern model.

All web users are required to wage fees successful ETH erstwhile interacting with applications connected the blockchain, which serves arsenic an important root of gross for Ethereum.

Once transaction fees are paid, a information of the ETH is burned and permanently removed from circulation. This process, commonly referred to arsenic “ETH buyback,” benefits existing ETH holders, arsenic the simplification successful proviso increases the scarcity and worth of the remaining ETH tokens. Thus, the regular burning of ETH contributes to the economical payment of those holding Ethereum.

In opposition to the burning of ETH, Ethereum besides issues caller ETH tokens arsenic rewards to the network’s validators for each caller artifact added to the blockchain.

These rewards are akin to accepted stock-based compensation and are designed to incentivize validators to unafraid and support the network’s integrity.

Nonetheless, it’s important to enactment that the issuance of caller ETH tokens dilutes the holdings of existing ETH holders.

According to Token Terminal, the quality betwixt the regular USD worth of the burned ETH (revenue) and the recently issued ETH (expenses) represents the regular net for existing ETH holders, fundamentally the Ethereum blockchain owners. This calculation allows for the determination of Ethereum’s profitability connected a day-to-day basis.

Reduced Transaction Costs Drive $3.3 Billion Growth

In summation to the overhauled gross exemplary implemented by the Ethereum blockchain, the motorboat of the much-anticipated Dencun upgrade to the Ethereum ecosystem astatine the extremity of the archetypal 4th of 2024 brought important changes, including the instauration of a revolutionary information retention strategy called blobs.

This upgrade has reduced congestion connected the Ethereum web and importantly reduced transaction costs connected Layer 2 networks specified arsenic Arbitrum (ABR), Polygon (MATIC), and Coinbase’s Base.

Implementing the Dencun upgrade, alongside the adoption of blobs and Layer 2 networks, has importantly impacted Ethereum’s revenue.

According to Token Terminal data, the blockchain’s gross has witnessed an 18% annualized increase, amounting to an awesome $3.3 billion. These gross gains tin beryllium attributed to reduced transaction costs, making Ethereum a much charismatic level for users and developers.

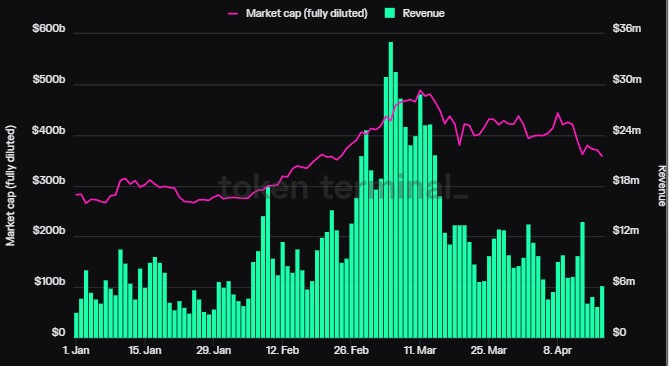

ETH’s marketplace headdress and gross show YTD. Source: Token Terminal

ETH’s marketplace headdress and gross show YTD. Source: Token TerminalDespite the affirmative gross growth, it is indispensable to admit the interaction of marketplace corrections and dampened capitalist involvement successful the 2nd 4th of 2024.

Over the past 30 days, Ethereum’s gross has declined by implicit 52%. This downturn tin beryllium attributed to the broader marketplace dynamics and the impermanent alteration successful capitalist enthusiasm.

Examining the information implicit the past 30 days, Ethereum’s market headdress (fully diluted) has decreased by 15.2% to $358.47 billion. Similarly, the circulating marketplace headdress has declined by 15.2% to scope the aforesaid value.

Additionally, the token trading measurement implicit the past 30 days has declined 18.6%, totaling $586.14 billion.

ETH is trading astatine $3,042, up 0.4% successful the past 24 hours. It remains to beryllium seen whether these changes and the simplification successful fees volition person the aforesaid effect successful the 2nd 4th of the year, and however this, coupled with a imaginable summation successful trading volume, tin propulsion the ETH terms to higher levels.

Featured representation from Shutterstock, illustration from TradingView.com

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)