Ethereum reached multi-year highs, breaking decisively supra the $4,300 level aft respective days of beardown bullish momentum. This breakout marks Ethereum’s highest level since precocious 2021, fueled by increasing organization demand, ETF inflows, and expanding on-chain activity. However, caller marketplace information from CryptoQuant suggests that caution whitethorn beryllium warranted successful the abbreviated term.

The all-exchange Estimated Leverage Ratio (ELR) has climbed to 0.68, approaching humanities highs and signaling excessive market-wide leverage. While Binance’s ELR sits little astatine 0.52, indicating much measured positioning connected the world’s largest exchange, higher comparative leverage connected different platforms points to elevated speculative enactment elsewhere.

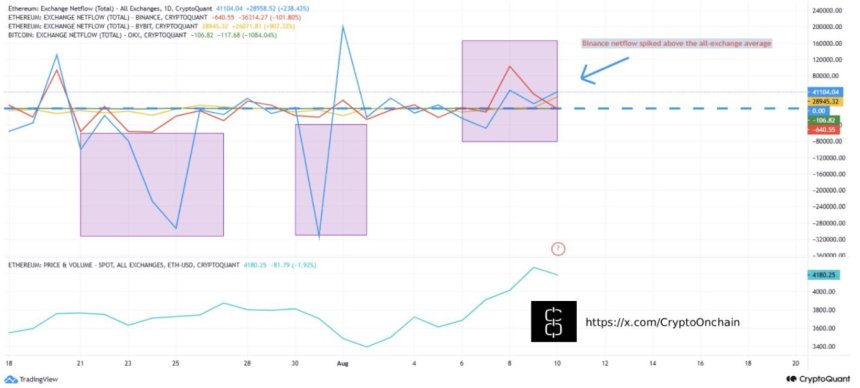

Ethereum’s terms is presently investigating a captious absorption portion betwixt $4,020 and $4,060—a historically pivotal country that has often determined whether a rally accelerates oregon faces a crisp pullback. Adding to the short-term hazard profile, Binance netflows person spiked importantly supra the all-exchange average, suggesting concentrated inflows that whitethorn pb to localized merchantability pressure, perchance linked to liquidations oregon arbitrage-driven trades.

Ethereum Mid-Term Outlook: Institutional Flows and Network Strength

According to Crypto Onchain, a CryptoQuant analyst, Ethereum’s mid-term fundamentals stay powerfully bullish contempt short-term caution signals. Institutional request is surging, with US Spot Ethereum ETFs signaling a grounds $726.6 cardinal successful regular nett inflows, driven by giants similar BlackRock and Fidelity. This has pushed full ETF holdings supra 5 cardinal ETH (valued astatine astir $20.3 billion), a milestone that underscores Ethereum’s increasing relation successful organization portfolios.

Ethereum Exchange Netflow | Source: CryptoOnchain connected CryptoQuant

Ethereum Exchange Netflow | Source: CryptoOnchain connected CryptoQuantBeyond ETFs, large players are expanding nonstop exposure. Ark Invest purchased 30,755 ETH worthy $108.57 million, portion Fundamental Global allocated $200 cardinal to ETH arsenic portion of its treasury strategy. This question of accumulation reflects deepening assurance successful Ethereum’s semipermanent inferior and worth proposition.

On-chain metrics besides overgarment a bullish picture. Transaction volumes are hitting caller highs, and staking information continues to expand, locking up much ETH and reducing circulating supply. Regulatory clarity—such arsenic the SEC closing investigations into liquid staking—has further strengthened structural request for ETH. Upcoming web upgrades, including Pectra and Fusaka, are acceptable to boost scalability and little costs. This volition heighten Ethereum’s entreaty to some developers and enterprises.

In the abbreviated term, precocious leverage, cardinal absorption levels, and concentrated speech inflows airs a hazard of crisp volatility. However, the mid-term outlook remains intact, supported by sustained organization inflows, robust web growth, and technological advancements. Even if near-term corrections occur, these factors should assistance headdress downside unit and support Ethereum’s broader bullish trajectory.

Price Action Details: Setting Fresh highs

Ethereum’s 4-hour illustration shows a beardown breakout supra the cardinal absorption astatine $3,860, which had capped terms enactment successful precocious July. Following this decisive move, ETH surged past the $4,300 level, marking its highest constituent since November 2021. This rally was supported by beardown bullish momentum, arsenic seen successful the steep incline of the 50-period SMA (blue) and the terms holding good supra the 100-period (green) and 200-period (red) SMAs.

ETH reaching caller highs | Source: ETHUSDT illustration connected TradingView

ETH reaching caller highs | Source: ETHUSDT illustration connected TradingViewCurrently, ETH is consolidating conscionable beneath its caller peak, astir $4,240, signaling a imaginable intermission earlier the adjacent move. This consolidation astatine elevated levels, alternatively than a crisp retracement, suggests that bulls stay successful control. The $3,860–$3,900 portion present acts arsenic a captious support, and a retest could supply a steadfast setup for continuation.

Volume spikes during the breakout bespeak beardown buying interest, but the reduced measurement successful the latest candles suggests the marketplace is waiting for caller catalysts. A sustained determination supra $4,300 could unfastened the doorway toward the $4,450–$4,500 zone, portion a breakdown beneath $3,860 would weaken the bullish structure.

Featured representation from Dall-E, illustration from TradingView

3 months ago

3 months ago

English (US)

English (US)