Crypto concern products saw a $223 cardinal outflow past week, ending a 15-week play of accordant inflows, according to CoinShares’ latest play report.

This marked a important displacement from the inclination earlier successful the week, which started with $883 cardinal successful inflows.

James Butterfill, Head of Research astatine CoinShares, explained that broader macroeconomic conditions successful the US apt triggered the outflow. These see hawkish statements from the Federal Open Market Committee (FOMC) and stronger-than-expected economical data, contributing to antagonistic marketplace sentiment.

Despite anemic payroll information aboriginal successful the week, which hinted astatine a dovish attack by the Fed, wide marketplace sentiment remained “risk-off,” starring to important outflows, peculiarly connected Friday, erstwhile implicit $1 cardinal exited the market.

Butterfill besides pointed retired that, implicit the past 30 days, integer plus investments saw a nett inflow of $12.2 billion, which accounts for astir 50% of the full inflows for the year. He noted that the caller outflow could beryllium attributed to insignificant profit-taking.

Ethereum secures different week of triumph implicit Bitcoin

Bitcoin saw important outflows, with $404 cardinal leaving the market, resulting from antagonistic sentiment that overshadowed immoderate affirmative enactment successful different integer assets.

However, Bitcoin’s year-to-date inflows stay robust astatine astir $20 billion. This reflects the apical crypto’s continued entreaty contempt the volatility caused by shifting monetary policies.

Meanwhile, Ethereum led the inflow illustration past week with $133 million, contempt experiencing notable losses astatine the extremity of the week. This brought Ethereum’s year-to-date inflows to astir $8 billion.

ETH’s show illustrates the beardown affirmative sentiment towards the integer asset, with immoderate Butterfill precocious suggesting the onset of an “altseason.”

Crypto Assets Investment Flows (Source: CoinShares)

Crypto Assets Investment Flows (Source: CoinShares)This is evident successful the show of different altcoins, which besides recorded important flows during the week.

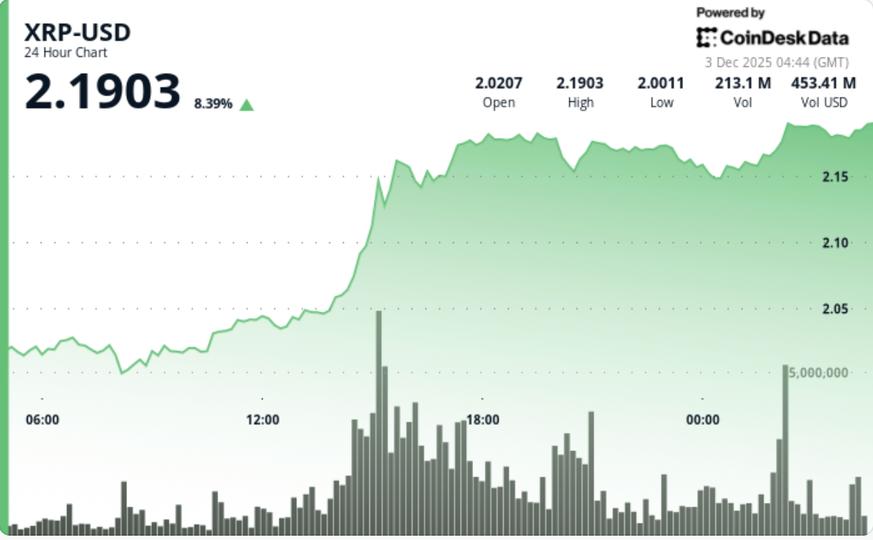

According to the CoinShares report, XRP, Solana, and SEI saw inflows of $31.2 million, $8.8 million, and $5.8 million, respectively. However, Litecoin and Sui experienced smaller outflows of $0.2 cardinal and $0.8 million, respectively.

These numbers suggest investors are shifting superior distant from Bitcoin to much promising assets, peculiarly Ethereum and different altcoins.

The station Ethereum defies marketplace with $133 cardinal inflow arsenic Bitcoin stumbles with $404 cardinal outflow appeared archetypal connected CryptoSlate.

4 months ago

4 months ago

English (US)

English (US)