Spot Ethereum exchange-traded funds listed successful the United States attracted implicit $1 cardinal successful nett inflows connected Aug. 11, mounting a caller all-time high.

Data from SoSo Value showed that BlackRock’s ETHA merchandise dominated the day’s activity, pulling successful astir $640 million, the largest single-day haul since its launch. Fidelity’s FETH ranked 2nd with $276.9 million, marking its idiosyncratic best.

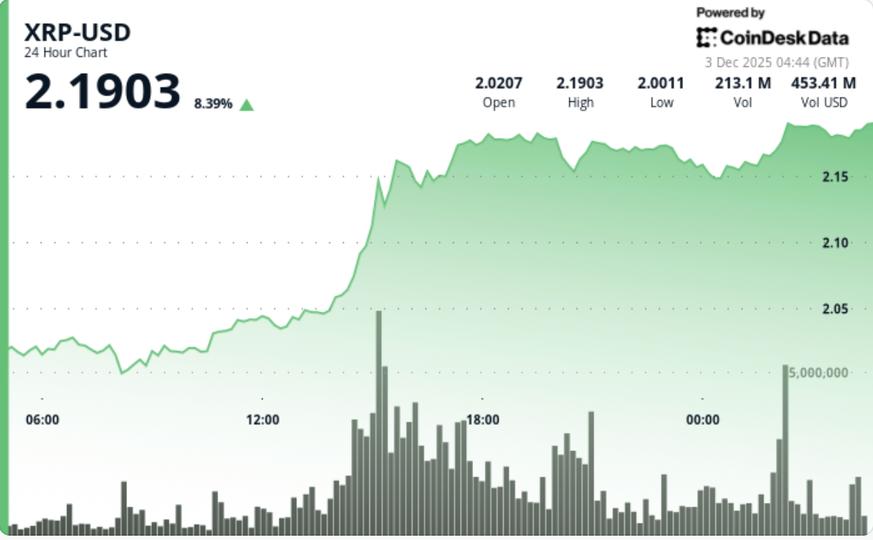

Ethereum ETFs Flows From Aug. 1 (Source: SoSo Value)

Ethereum ETFs Flows From Aug. 1 (Source: SoSo Value)Meanwhile, Grayscale’s ETH vehicle brought successful $66.6 million, portion VanEck’s ETHV secured $9.4 million. Franklin Templeton’s EZET, Bitwise’s ETHW, and 21Shares’ CETH each logged smaller but notable inflows ranging from $3.9 cardinal to $4.9 million.

Cumulatively, these across-the-board inflows surpassed the previous $726.6 cardinal acceptable connected July 14, bringing Ethereum ETF flows person to Bitcoin’s benchmarks contempt ETH’s smaller marketplace capitalization.

Considering this, marketplace analysts judge that Ethereum’s expanding prominence successful fiscal markets volition lone proceed to grow.

Nate Geraci, President of NovaDius Wealth, noted that accepted concern investors initially underestimated Ethereum owed to its much analyzable communicative than Bitcoin.

However, Geraci believes investors are resonating with the increasing designation of Ethereum’s relation successful aboriginal fiscal markets. He explained:

“BTC had bully cleanable communicative [of] ‘digital gold.’ ETH [took] much clip for investors to understand. Now they’re proceeding ‘backbone of aboriginal fiscal markets’ [and] it’s resonating.”

Bloomberg ETF expert Eric Balchunas echoed this view, adding that the travel surge volition apt spur caller Ethereum ETF offerings and grow the scope of concern products tied to the network.

Ethereum treasury firms ape in

This record-breaking inflow comes arsenic firm strategy firms ramp up their Ethereum holdings.

On Aug. 11, BitMine made headlines by purchasing 317,126 ETH successful conscionable 1 week, bringing its full holdings to 1.15 cardinal ETH, valued astatine $4.9 billion.

With this acquisition, BitMine became the archetypal firm holder of Ethereum to transcend the 1 cardinal mark, portion surpassing its closest rival by a important margin.

Meanwhile, SharpLink, the second-largest firm Ethereum holder, disclosed that it raised $900 cardinal to money further Ethereum acquisitions. The Joseph Lubin-led steadfast holds 598,800 ETH successful its coffers.

With these moves, some firms are positioning themselves arsenic cardinal players successful Ethereum’s aboriginal growth, highlighting the continued organization involvement contributing to the integer asset’s ongoing rally.

The station Ethereum ETFs gully record-breaking $1 cardinal successful a azygous day appeared archetypal connected CryptoSlate.

3 months ago

3 months ago

English (US)

English (US)