Ethereum is successful a classical accumulation signifier pursuing its caller correction and is present targeting a $3,000 price. After dropping to $2,116 conscionable 20 days ago, ETH experienced a important terms surge, recovering to higher levels, suggesting bullish momentum was building.

This accumulation signifier has drawn the attraction of analysts and investors alike, who are present intimately monitoring Ethereum’s terms enactment for signs of a much important determination to the upside. The betterment from caller lows has sparked renewed optimism, with immoderate marketplace experts predicting that ETH could scope $3,000 successful the coming days.

This imaginable rally is simply a captious milestone successful Ethereum’s ongoing marketplace cycle, reflecting its spot and investors’ assurance successful its semipermanent value. As Ethereum continues to accumulate and consolidate, the marketplace is bracing for what could beryllium a large breakout, mounting the signifier for caller highs shortly.

Ethereum Price Structure Suggests A Coming Breakout

After a comparatively agelong play of consolidation, Ethereum appears poised for a determination toward higher prices.

Analyst and trader Castillo Trader shared a technical investigation connected X, highlighting a imaginable ETH trajectory shift. According to Castillo, ETH volition apt retest little request astatine $2,611 earlier targeting the important $3,000 mark. The 4-hour illustration suggests that this play of consolidation has reached a tipping point, an important determination could beryllium imminent.

ETH 4-hour investigation and cardinal levels. | Source: Castillo Trades connected X ETH/USD perp 4H illustration connected TradingView

ETH 4-hour investigation and cardinal levels. | Source: Castillo Trades connected X ETH/USD perp 4H illustration connected TradingViewThe $3,000 level is not conscionable a intelligence barrier; it has besides acted arsenic a enactment successful caller months earlier breaking down astatine the commencement of this month, making it a important absorption to break. If Ethereum successfully breaks supra this level and consolidates, it could pave the mode for a sustained uptrend.

This anticipated breakout could statesman a caller bullish signifier for Ethereum arsenic the marketplace looks to determination past the caller play of stagnation and propulsion toward caller highs. Investors and traders are intimately watching these developments, arsenic the adjacent fewer days could beryllium captious successful determining Ethereum’s direction.

ETH Technical Analysis

Ethereum is trading astatine $2,743; its adjacent determination could spell either way. ETH mightiness retest little request astir $2,500 earlier attempting to propulsion toward the $3,000 mark. This retest would let the marketplace to found a stronger instauration for a sustained uptrend. However, fixed caller volatility, there’s besides a accidental that Ethereum could bypass the retest and propulsion to $3,000.

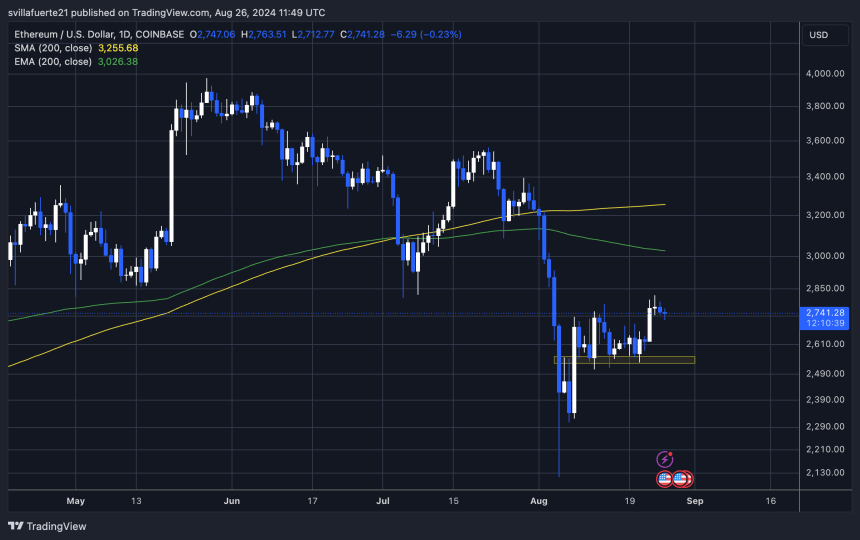

ETH is successful consolidation beneath the 1D 200 EMA. | Source: ETH/USD 1D illustration connected TradingView

ETH is successful consolidation beneath the 1D 200 EMA. | Source: ETH/USD 1D illustration connected TradingViewVolatility has shown that thing tin happen, and the accelerated terms movements are a testament to this unpredictability. A important method level to ticker is the regular 200 exponential moving mean (EMA), presently astatine $3,026. This EMA acts arsenic a absorption point, and breaking supra it would powerfully bespeak a bullish continuation for Ethereum.

It would corroborate spot if Ethereum breaks done the $3,000 intelligence level and closes supra the 200 EMA. This would solidify the bullish sentiment among traders and investors, positioning Ethereum for a much extended rally.

Featured representation created with Dall-E, illustration from Tradingview.com

1 year ago

1 year ago

English (US)

English (US)