Quick take:

- The Ethereum Foundation has released its 2022 yearly report

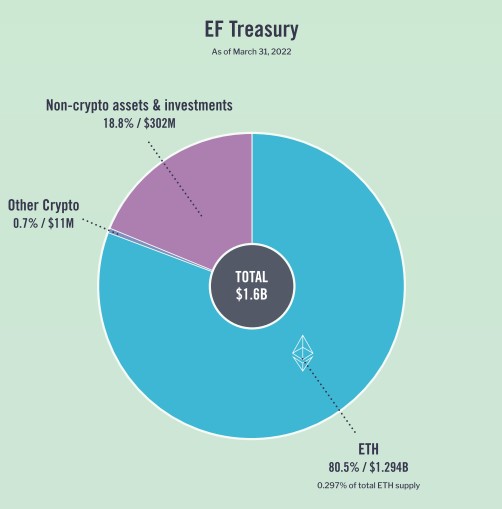

- As of March 31st, 2022, the Ethereum Foundation holds astir $1.6 cardinal successful its treasury

- $1.3 Billion is successful crypto and $300 cardinal successful non-crypto investments and assets

- 99.1% of its crypto holdings are successful ETH, representing 0.297% of the full proviso and 80.5% of its treasury

- The Ethereum Foundation wants its interaction to span decades and centuries

The Ethereum Foundation has released its 2022 yearly report.

The study hopes to assistance the assemblage recognize the Ethereum Foundation, its doctrine and halfway principles, and its imaginativeness for Ethereum.

According to the report, the Ethereum Foundation is simply a non-profit enactment that supports the Ethereum ecosystem. The instauration describes itself arsenic not being a tech institution oregon an mean non-profit. It prefers to see itself a ‘new benignant of enactment that supports a blockchain without controlling it.’

Ethereum Foundation Holds $1.6B successful its Treasury, $1.3B oregon 80.5% successful ETH, Which is 0.3% of the Total Supply

In the fiscal summary of the report, the Ethereum Foundation declares that arsenic of March 31, 2022, it has astir $1.6 cardinal successful its treasury. Of this amount, $1.3 Billion is successful crypto assets, with the remaining $300 cardinal successful non-crypto investments and assets.

Of the $1.3 Billion successful crypto assets, 99.1% is held successful ETH, representing 0.297% of the full Ethereum proviso arsenic of March 31, 2022. Additionally, this magnitude of Ethereum represents 80.5% of its treasury.

Breakdown of the Ethereum Foundation’s treasury

Breakdown of the Ethereum Foundation’s treasuryEthereum Foundation Believes successful ETH’s Potential

The Ethereum Foundation explains successful the study that it follows a blimpish treasury absorption argumentation to money its halfway objectives, peculiarly during a multi-year marketplace downturn. Such a argumentation guarantees that its fund is immune to the changes successful the terms of ETH.

As explained below, the instauration besides states that it has accrued its non-crypto savings arsenic a hedge against marketplace volatility.

We besides summation our non-crypto savings successful effect to rising ETH prices, which provides a greater information borderline for our halfway fund and would alteration america to proceed backing non-core but precocious leverage projects done a marketplace downturn.

We take to clasp the remainder of our treasury successful ETH. The EF believes successful Ethereum’s potential, and our ETH holdings correspond that semipermanent perspective.

Ethereum Foundation Impact to Span Decades and Centuries

Its attack to finances further reinforces the Ethereum Foundation’s halfway rule of ‘long word thinking’. It wants its interaction ‘measured successful decades and centuries – not quarters and fiscal years.’

‘Like a gardener,’ the Ethereum Foundation is ‘planting seeds that [they] mightiness not unrecorded to spot grow.’

3 years ago

3 years ago

English (US)

English (US)