Vitalik has released a blog station reviewing the quality of automated stablecoins successful which helium conducted 2 thought experiments to measure their viability beyond UST.

Cover art/illustration via CryptoSlate

Ethereum laminitis Vitalik Buterin has been successful a contemplative temper recently. After posting a bid of “open contradictions” successful his “thoughts” and “values,” Buterin has present taken his musings to the arena of “automated stablecoins.”

Commonly referred to arsenic algorithmic stablecoins, Buterin wrote a blog post this week assessing the viability of specified unbacked tokens amid the fallout of the Terra catastrophe.

An valuation of automated stablecoins

Buterin wrote the blog station successful collaboration with Paradigm caput of probe Dan Robinson, Uniswap creator Hayden Adams, and Ethereum researcher Dankrad Feist.

Buterin began the station by citing the UST de-peg events and said helium would invited a “greater level of scrutiny connected Defi fiscal mechanisms, particularly those that effort precise hard to optimize for “capital efficiency.”

The Ethereum laminitis continued with a telephone to “return to principles-based thinking,” which helium projected done 2 thought experiments:

Thought experimentation 1: tin the stablecoin, adjacent successful theory, safely “wind down” to zero users?

Thought experimentation 2: what happens if you effort to peg the stablecoin to an scale that goes up 20% per year?

What is an automated stablecoin?

Notably, the explanation of an automated stablecoin utilized by Buterin is simply a “stablecoin, which attempts to people a peculiar terms index… [using] immoderate targeting mechanism, … is wholly decentralized… [and] indispensable not trust connected plus custodians.”

He explained that the existent reasoning is the targeting mechanics indispensable beryllium immoderate signifier of a astute contract. Buterin past explained however Terra Classic worked “by having a brace of 2 coins, which we’ll telephone a stablecoin and a volatile-coin oregon volcoin (in Terra, UST is the stablecoin and LUNA is the volcoin).”

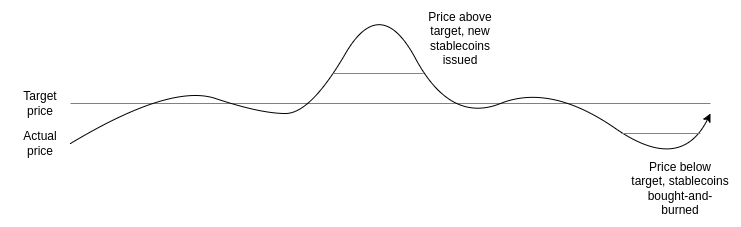

The beneath illustration visualizes the method by which Terra maintained UST’s peg.

Source: vitalik.eth

Source: vitalik.ethIn examination to UST, Buterin besides described RAI, an Ethereum-based automated stablecoin. He clarified that helium did not take DAI for his illustration arsenic RAI:

“Exemplifies the axenic “ideal type” of a collateralized automated stablecoin, backed by ETH only. DAI is simply a hybrid strategy backed by some centralized and decentralized collateral.”

Thought experimentation 1

In his archetypal thought experiment, Buterin compared businesses wrong the non-crypto world.

Companies mostly bash not thin to past forever, and erstwhile they are coiled down oregon closed, their customers are seldom wounded economically. Investors whitethorn suffer superior depending connected the method of closure, but adjacent this is not ever the lawsuit arsenic accepted insolvency processes beryllium to guarantee creditors are paid out.

Within the satellite of automated stablecoins, Buterin claimed that Terra is simply a premier illustration of users being financially impacted by the nonaccomplishment of a crypto “business.” It is hard to reason with this constituent arsenic thousands of investors worldwide person mislaid millions during the past fewer weeks.

Also, Buterin highlighted that different factors could play retired with a Terra-style stablecoin. A driblet successful enactment for the “volcoin” leads to a diminution successful marketplace cap, which subsequently causes the narration to the stablecoin to go highly fragile.

As happened with LUNA, a crisp alteration successful terms astatine this infinitesimal causes hyperinflation wrong the volcoin. Eventually, the stablecoin loses its peg arsenic it cannot grip the discrepancy. As soon arsenic the peg is lost, the seignorage method fails and creates a decease spiral for some coins.

Buterin explained that with Terra, arsenic soon arsenic the marketplace mislaid religion successful the project’s aboriginal imaginable and the marketplace headdress of LUNA began to decline, the supra became a self-fulfilling prophecy. He highlighted that a dilatory wind-down successful the marketplace headdress of LUNA could person stopped the decease spiral, but the information mechanisms successful spot did not let this to beryllium a imaginable outcome.

Buterin explained that:

“RAI’s information depends connected an plus outer to the RAI strategy (ETH), truthful RAI has a overmuch easier clip safely winding down.”

The externality means that:

“there’s nary hazard of a positive-feedback loop wherever reduced assurance successful RAI causes request for lending to decrease.”

Thought experimentation 2

In this experiment, Buterin explained that a stablecoin could beryllium pegged to a “basket” of assets similar “a user terms index, oregon immoderate arbitrarily analyzable formula.”

He past hypothesized an plus people that roseate 20% successful dollar presumption annually. What would hap if a stablecoin were pegged to specified an asset? No specified plus exists; however, arsenic a thought experiment, Buterin explained that determination are 2 ways to a 20% output asset,

- It charges immoderate benignant of antagonistic involvement complaint connected holders that equilibrates to fundamentally cancel retired the USD-denominated maturation complaint built successful to the index.

- It turns into a Ponzi, giving stablecoin holders astonishing returns for immoderate clip until 1 time it abruptly collapses with a bang.

From the supra options, Buterin claimed that LUNA acts similar constituent 1 and RAI similar constituent 2. Therefore, Buterin’s halfway constituent states:

“For a collateralized automated stablecoin to beryllium sustainable, it has to someway incorporate the anticipation of implementing a antagonistic involvement rate.”

Ultimately, helium postulated that a palmy automated stablecoin “must” person a effect mechanics to “situations wherever adjacent astatine a zero involvement rate, request for holding exceeds request for borrowing.”

Buterin sees 2 ways to execute this:

- RAI-style, having a floating people that tin driblet implicit clip if the redemption complaint is negative

- Actually having balances alteration implicit time

Conclusion

In conclusion, Buterin sees a imaginable aboriginal for automated stablecoin. However, it is fraught with method concerns and needs to determination distant from comparisons to the accepted fiscal world. Buterin seems to judge that Terra did not bash capable to measure the risks during periods of precocious volatility oregon antagonistic maturation successful the lawsuit of Terra.

He ended the station by reiterating that:

“Steady-state and extreme-case soundness should ever beryllium 1 of the archetypal things that we cheque for.”

3 years ago

3 years ago

English (US)

English (US)