Ethereum is nether unit astatine property time, tumbling astir 15% from March 2024. As sellers property on, reversing each gains posted from May 20, on-chain information points to a bullish picture.

Ethereum HODLers Scoop 298,000 ETH In 24 Hours

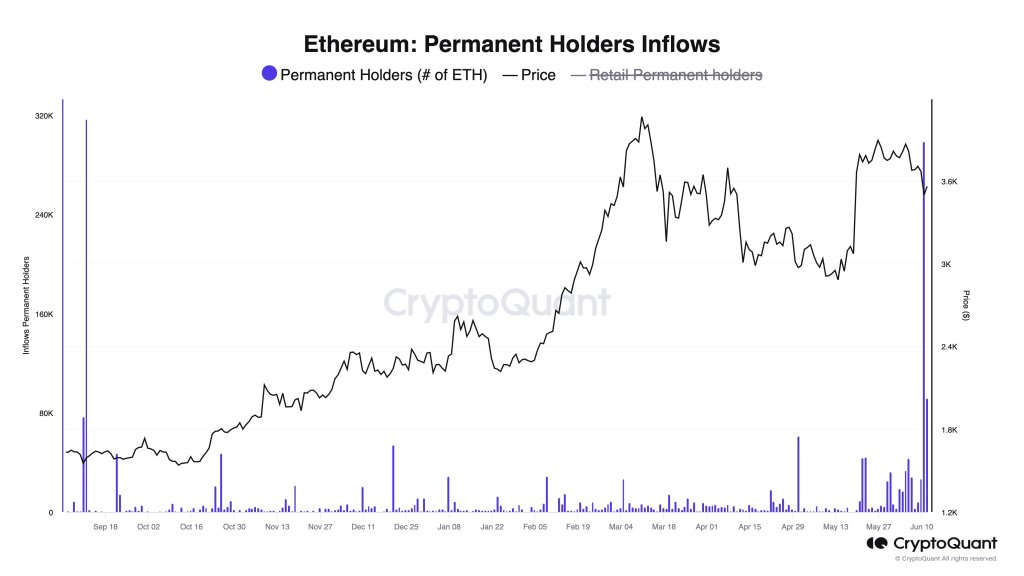

Taking to X, 1 expert notes a spike successful ETH demand, particularly from imperishable holders. Most likely, these imperishable holders are institutions with deeper pockets and are consenting to bent on. Unlike retailers, these entities tin often take to clasp for longer and won’t beryllium shaken retired by marketplace volatility.

Ethereum imperishable holders inflow | Source: @@jjcmoreno via X

Ethereum imperishable holders inflow | Source: @@jjcmoreno via XCiting CryptoQuant data, the expert said these imperishable holders, according to records, are liable for the second-highest regular purchase. On June 12, erstwhile prices concisely rose, they bought a staggering 298,000 ETH. Impressively, this fig conscionable falls abbreviated of the all-time precocious of 317,000 ETH purchased connected September 11, 2023.

In airy of this, contempt the question of little lows wide successful the regular chart, the surge successful request points to beardown bullish sentiment.

Also, considering the magnitude of ETH scooped from the markets, it could awesome that institutions, perchance hedge funds oregon billionaires, are opening to presumption themselves successful the market.

They appear to be taking vantage of the little prices.

At property time, determination is weakness successful Ethereum, evident successful the regular chart. Even with the bounce connected June 12, bulls didn’t wholly reverse losses of June 11. The dip connected June 13 means sellers are backmost successful the equation, and prices could align toward the conspicuous June 11 bar.

From the candlestick statement successful the regular chart, $3,700 is emerging arsenic a absorption level. After the breakout connected June 7, ETH has been free-falling to spot rates, actively filling the May 20 gap.

If the dump continues, it is apt that ETH, adjacent with each the optimism crossed the crypto scene, volition erstwhile much re-test $3,300.

Spot ETFs To Begin Trading This Summer: Gensler

Whether prices volition retrieve from existent levels oregon gaffe towards $3,300 remains to beryllium seen. Overall, the marketplace is upbeat, according to comments from Gary Gensler, the seat of the United States Securities and Exchange Commission (SEC).

Appearing successful a legislature hearing, Gensler said the spot Ethereum exchange-traded money (ETF), whose 194-b forms were approved successful May, whitethorn statesman trading astatine a tentative clip successful summer. BlackRock has already resubmitted its S-1 filing and is waiting for approval.

If the merchandise is approved successful the adjacent fewer weeks, it volition beryllium a large liquidity boost for ETH. Like spot Bitcoin ETFs, institutions volition apt transmission billions to ETH, allowing their clients to get exposure.

Feature representation from DALLE, illustration from TradingView

1 year ago

1 year ago

English (US)

English (US)