Bitcoin · Ethereum › Investments

After 9 consecutive weeks of outflows, Ethereum concern products recorded inflows totalling $21 cardinal successful the week ending February 11th.

Last week, Ethereum concern products yet broke a nine-week agelong streak of outflows, portion Bitcoin saw a 4th consecutive week of inflows, according to the latest report by organization crypto money manager CoinShares.

The report, which analyzes play flows into integer plus funds, uncovered the persisting popularity of multi-asset (coin) concern products, which saw a 5th consecutive week of inflows–totaling $19 cardinal past week.

European concern products dominating

Digital plus concern products recorded different week of inflows–totaling $75 million.

This brings the past four-week streak of inflows to $209 million–representing 0.4% of full assets nether absorption (AuM).

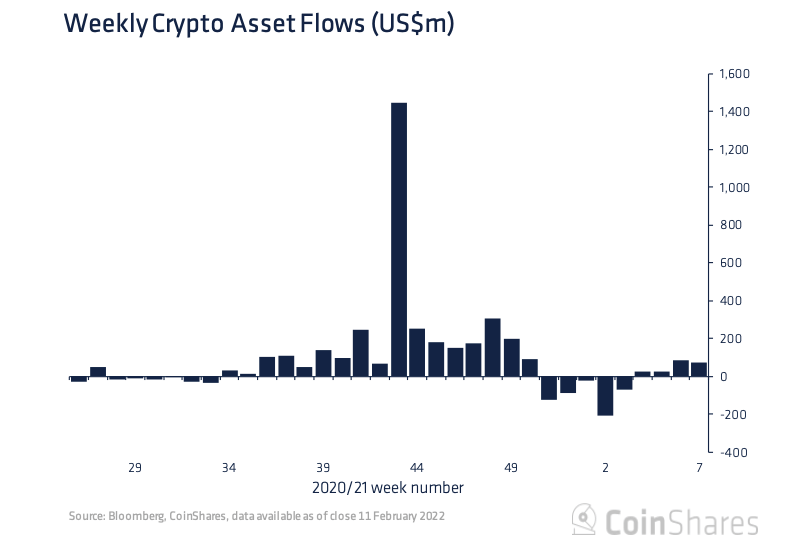

Chart showing play crypto-asset flows (Source: CoinShares)

Chart showing play crypto-asset flows (Source: CoinShares)However, contempt the affirmative inflows that the wide integer plus concern merchandise marketplace has witnessed past week, CoinShares reported that these volumes “remain comparatively minor” successful examination to the figures observed successful Q4 2021.

The organization crypto money manager besides noted observing immoderate determination variances–with $5.5 cardinal of outflows successful the Americas vs $80.7 cardinal of inflows into European concern products.

The biggest inflows successful the week ending February 11

Zooming into integer plus concern products, Bitcoin recorded a 4th consecutive week of inflows. Accounting for one-third of past week’s volume, Bitcoin inflows totaled $25 million, portion Ethereum followed, with inflows totaling $21 million.

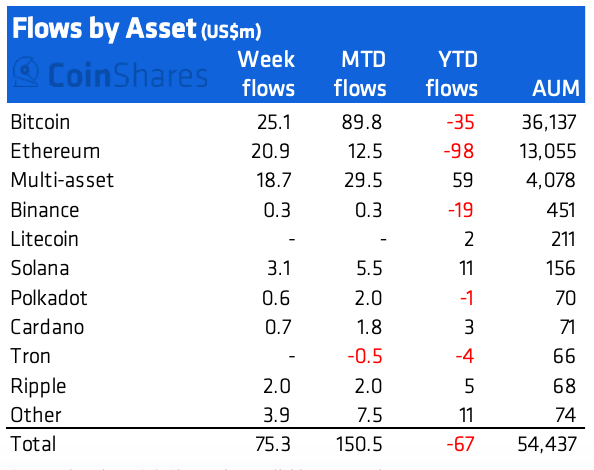

Table showing integer plus money flows by asset: Week ending February 11 (Source: CoinShares)

Table showing integer plus money flows by asset: Week ending February 11 (Source: CoinShares)With inflows totaling $19 million, past week’s third-best performers were multi-asset (coin) concern products that proceed affirming their popularity among organization investors.

In the meantime, Solana and Ripple concern products saw inflows totaling $3.1 cardinal and$ 2 cardinal respectively.

The study besides noted that precocious created altcoin concern products, Terra, Tezos and Cosmos each saw inflows past week.

While Terra saw $2.2 cardinal of inflows, Tezos and Cosmos concern products followed, signaling $0.9 cardinal and $0.6 cardinal of inflows respectively.

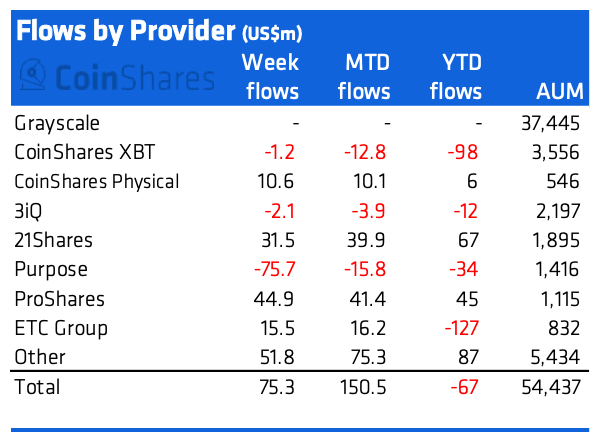

Zooming into funds revealed that ProShares saw the largest inflow past week–totaling $45 million.

Meanwhile, Purpose recorded the largest outflow of $75 million.

Table showing integer plus money flows by provider: Week ending February 11 (Source: CoinShares)

Table showing integer plus money flows by provider: Week ending February 11 (Source: CoinShares)Finally, with inflows totaling $69 cardinal past week–blockchain equity concern products saw the largest volumes since mid-December.

Equity concern products are surely 1 of the industry’s answers to regulatory roadblocks–offering vulnerability to companies progressive successful the improvement and utilization of blockchain technology.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)