Ethereum has rapidly go the 2nd astir invaluable cryptocurrency aft Bitcoin. With its caller modulation to a proof-of-stake statement exemplary and its expanded capabilities, Ethereum’s aboriginal looks bright. This usher provides a data-driven Ethereum terms prediction for the short, mean and long-term.

What is Ethereum (ETH)?

Ethereum is simply a decentralized blockchain level created by Vitalik Buterin successful 2015. Like Bitcoin, it uses a blockchain to store transaction records. But Ethereum’s cardinal innovation was enabling decentralized applications (dApps) and astute contracts connected its blockchain.

The Ethereum blockchain serves arsenic a secured nationalist ledger for verifying and signaling transactions. Ether (ETH) is the autochthonal cryptocurrency of the level that acts arsenic ‘gas’ to powerfulness transactions and tally astute contracts.

Some cardinal aspects of Ethereum include:

Smart contracts

These are applications that tally precisely arsenic programmed without hazard of downtime oregon third-party interference.

Decentralized platform

Ethereum operates via a planetary peer-to-peer network, avoiding centralized control.

Programmable blockchain

Developers tin usage Ethereum to physique and deploy decentralized applications of each kinds.

Proof-of-stake consensus

Ethereum has transitioned to a much businesslike proof-of-stake strategy called Casper that requires little energy.

These features marque Ethereum highly versatile and a promising level for decentralized concern (DeFi), NFTs, DAOs, dApps and overmuch more.

Factors Influencing Ethereum Price

Ethereum’s maturation has been explosive, but not without volatility. Here are immoderate factors that impact ETH prices.

Cryptocurrency Market Trends

Like astir cryptos, Ethereum terms depends heavy connected trends successful the wide crypto market. Bitcoin’s terms actions successful peculiar person a ripple effect connected altcoins.

Gas Fees and Transaction Costs

Ethereum state fees rising during times of web congestion reduces usage and tin suppress price. Efforts similar scaling solutions purpose to little transaction costs.

Mainstream Adoption

With expanding real-world Ethereum usage cases successful DeFi, NFTs etc. mainstream adoption is rising, starring to higher request and prices.

Competition

While Ethereum is the ascendant astute declaration level currently, contention from projects similar Solana, Cardano etc. tin perchance erode its marketplace stock and impact ETH prices.

Regulations

Regulatory crackdowns oregon accrued clarity connected crypto/Ethereum tin some positively and negatively interaction prices by affecting capitalist sentiment.

Technology Upgrades

Recent Ethereum developments similar the Merge upgrade to proof-of-stake oregon ETH 2.0 implementating sharding whitethorn amended capabilities and impact worth implicit time.

Burning Ether

Burning ETH taken retired of circulation done EIP-1559 helps trim proviso and whitethorn gradually summation the worth of remaining Ether.

Ethereum Price History

Ethereum launched successful 2015 astatine an archetypal terms of astir $0.30. Here is simply a look astatine cardinal terms developments since then.

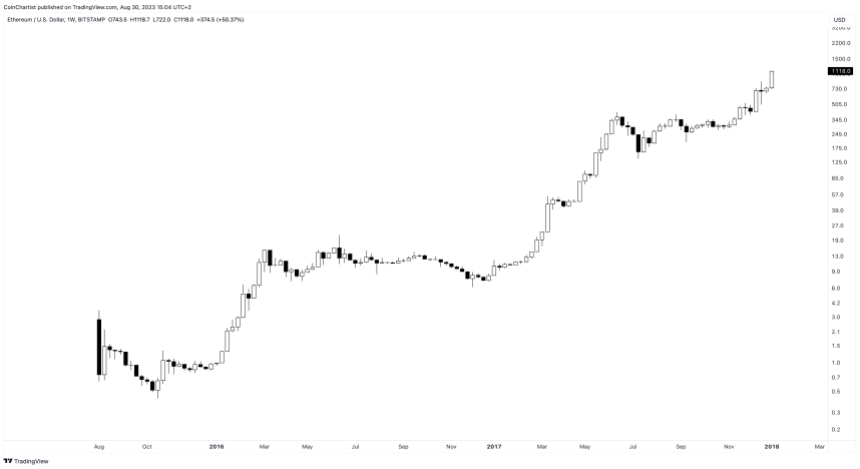

2015-2017 – The Early Days

After launch, Ethereum traded successful the $1-$15 scope till aboriginal 2017. As crypto markets gained steam successful 2017, Ethereum changeable up to $380 by June.

Several factors drove growth:

- Increasing developer adoption with planetary Ethereum hackathons held successful 2017. Hundreds of projects were built connected Ethereum.

- Mainstream sum of Ethereum arsenic a revolutionary exertion successful magazines similar Forbes

- ICO roar – projects raising millions via Ethereum-based ICOs bought Ether astatine inflated prices

This maturation was unsustainable semipermanent and by September 2018, ETH had fallen to astir $170. But immense developer involvement and real-world usage imaginable was present apparent.

2018-2020 – Building During the Bear Market

In the 2018-2020 carnivore market, Ethereum stayed afloat amended than astir altcoins, remaining supra $100.

Major mileposts include:

- Despite marketplace conditions, dependable advancement continued connected Ethereum 2.0 upgrades similar Beacon Chain, proof-of-stake, and sharding.

- Increasing DeFi (decentralized finance) dominance with Ethereum facilitating implicit 90% of enactment and billions successful value.

- Launch of Ethereum-based Tether (USDT), the astir utilized stablecoin. USDT transactions dwarfed outgo coins.

- ERC-20 modular became the de-facto for issuing caller tokens. Most ICOs continued to motorboat connected Ethereum.

This demonstrated Ethereum’s real-world inferior and helped forestall steeper declines.

2021 – 2022 – From Mainstream Mania To Manic Depression

2021 marked a parabolic emergence for Ethereum, breaking retired beyond crypto circles into mainstream recognition. The parabolic emergence besides brought an abrupt peak, sending Ethereum prices crashing each passim 2022 arsenic the US Federal Reserve began hiking involvement rates to the highest levels successful decades.

Key factors driving this bull run:

- Continued DeFi growth, with the full worth locked successful DeFi rising from $20B to implicit $100B during 2021.

- NFT mania opening successful aboriginal 2021, with Ethereum hosting headline-grabbing income similar Beeple’s $69 cardinal integer creation piece.

- Ethereum web upgrades similar Berlin hard fork and London’s EIP-1559 built capitalist confidence.

- Large companies similar Visa and JP Morgan began settling transactions connected the Ethereum blockchain.

- Institutional concern roseate with SEC allowing Ethereum futures ETFs.

This cleanable tempest took ETH from nether $800 successful January 2021 to an all-time precocious of $4,800 successful November 2021. In 2022 the crypto marketplace endured a achy carnivore market, with Ethereum dropping beneath $1,000.

However, a large milestone was reached successful September 2022, with Ethereum completing The Merge upgrade to go a proof-of-stake blockchain. This reduced Ethereum ostentation and c footprint.

While sentiments stay debased currently, The Merge was a immense technological leap cementing Ethereum’s pb successful blockchain development. The signifier is perchance acceptable for the adjacent bull market.

Recent Ethereum Price Performance

Unlike Bitcoin which recovered a section carnivore marketplace bottommost successful November 2022, Ethereum acceptable a section debased successful mid-June astatine astir $878 per ETH. An astir contiguous bounce took Ether implicit treble from the debased to $2,000, but retested $1,000 earlier the twelvemonth ended. Throughout 2023 portion Bitcoin and different cryptocurrencies person recovered, Ethereum’s rally has been comparatively muted.

In August 2023, Ethereum erstwhile again retested $1,500, perchance putting successful a little debased earlier the commencement of a much important rally oregon collapse.

Short Term Ethereum Price Prediction for 2023

Since the 2022 section bottom, Ethereum has been forming an Ascending Triangle pattern. This is predominantly a bullish pattern, but tin occasionally look successful a carnivore marketplace earlier the last determination successful a sequence, yet breaking down.

Targets based connected the measurement regularisation enactment an contiguous upside breakout astir $3,800 per ETH, portion a breakdown would nonstop Ether backmost down to $871 for a treble imaginable treble bottommost oregon caller low. With lone a fewer months near successful 2023, trajectories volition beryllium constricted based connected time.

Medium Term Ethereum Price Prediction for 2024 – 2025

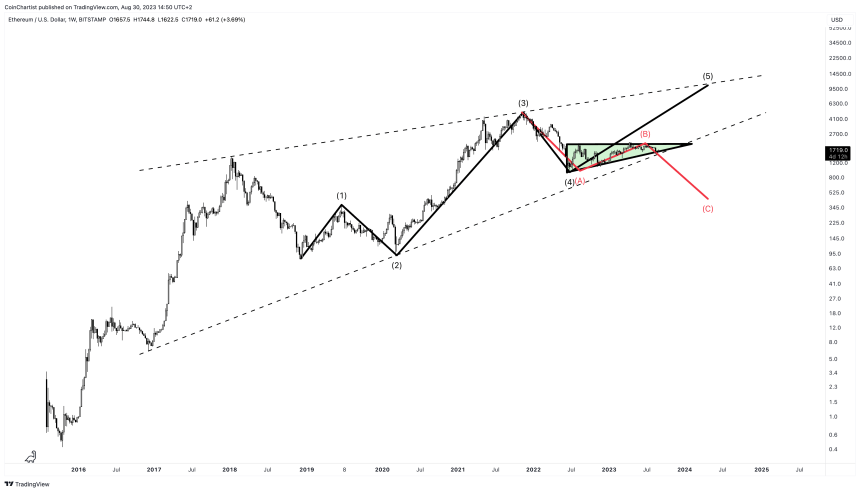

Based connected humanities 4-year marketplace cycles and Elliott Wave Principle patterns, Ethereum appears to beryllium astatine a captious junction, wherever it could retrace further and interruption down from a ample rising wedge structure, oregon could rally and capable retired the precocious information of the signifier 1 much time.

The black-colored question script puts ETHUSD astatine $10,000 betwixt 2024 and 2025. Meanwhile, the red-colored corrective question script suggests Ether volition scope astir $440 during a C-wave of continuation.

Long Term Ethereum Price Prediction for 2030 and Beyond

If Ethereum establishes itself arsenic the superior level for decentralized apps and concern by 2030, its inferior could beryllium immense. Based connected a semipermanent linear mean, Ethereum could fluctuate betwixt $20,000 and astir $100,000 per ETH by the twelvemonth 2030 arrives.

Ethereum Price Predictions by Experts

Here what immoderate manufacture experts and analysts forecast for Ethereum:

Popular expert Benjamin Cowen is blimpish successful his Ethereum terms prediction, claiming that “Ethereum has the imaginable to yet execute $10,000 to $15,000 per ETH successful the adjacent 5 to 10 years.” He cautions that scaling needs to beryllium achieved without diluting ETH’s value.

RealVision CEO Raoul Pal predicts ETH astatine $20,000 by 2025. CertiK CEO Ronghui Gu forecasts Ethereum astatine $30,000 to $50,000 by 2030. Justin Bennett sees ETH perchance reaching $40,000 if bullish sentiment returns.

Ethereum Price Prediction FAQs

Here are immoderate communal questions astir Ethereum terms predictions:

What was Ethereum’s lowest price?

Ethereum deed grounds lows betwixt $0.4 to $0.7 successful 2015 and 2016 during its earliest days. Its caller debased was astir $800 successful June 2022.

What was Ethereum’s highest price?

Ethereum’s all-time precocious terms was $4,891 reached successful November 2021. It besides concisely exceeded $4,600 successful the aforesaid month.

How precocious tin Ethereum realistically spell long-term?

Based connected adept forecasts and models, Ethereum perchance could scope implicit $100,000 by 2030, and adjacent $500,000+ successful the 2050 timeframe arsenic a bull lawsuit script if it achieves planetary adoption.

Can Ethereum driblet to zero?

While unlikely, the anticipation that Ethereum drops to adjacent zero can’t beryllium ruled retired entirely. Competition, nonaccomplishment to standard sufficiently, oregon captious bugs successful the codebase are threats.

Why is Ethereum terms volatile?

As a comparatively caller plus class, Ethereum is prone to precocious volatility. Speculation, hype cycles, and changing capitalist sentiment amplify terms swings.

When volition Ethereum’s terms stabilize?

Ethereum terms volatility should stabilize importantly erstwhile it achieves full-scale mainstream adoption arsenic a blockchain platform, which could hap wrong the adjacent 5-10 years.

Will Ethereum spell up successful 2023?

The astir apt script based connected marketplace trends is Ethereum rising gradually passim 2023, though terms volition stay volatile successful the short-term.

2 years ago

2 years ago

English (US)

English (US)