The cryptocurrency marketplace has precocious exhibited chiseled divergences successful the behaviour of its 2 starring assets, Bitcoin and Ethereum. While Bitcoin appears to beryllium stepping into a signifier of comparative stability, Ethereum’s travel paints a contrasting picture of sustained uncertainty, peculiarly successful its options market.

This divergence is highlighted by the sustained precocious levels of implied volatility associated with Ethereum options, signaling a cautious outlook among investors regarding its aboriginal terms movements.

Ethereum Persisting Volatility: A Comparative Analysis

Implied volatility (IV) serves arsenic a important indicator successful the options market, providing insights into the expected terms fluctuations of an plus implicit a circumstantial period. It reflects the market’s temperature, gauging the strength of imaginable terms movements traders anticipate.

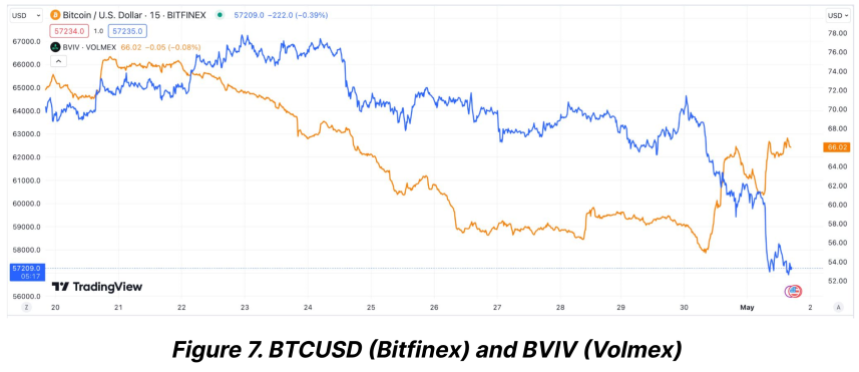

Recent analyses suggest that portion Bitcoin’s implied volatility has settled down importantly post-halving, Ethereum’s has not followed suit. As Bitcoin’s IV dipped to a multi-month low, indicating a calming market, Ethereum’s IV remains stubbornly high.

Contrary to the calming waves successful the Bitcoin market, Ethereum wrestles with heightened volatility. According to information from Bitfinex Alpha Report, Bitcoin’s volatility scale sharply declined from 72% astatine the clip of its latest halving lawsuit to astir 55%.

Bitcoin (BTC) implied volatility. | Source: Bitfinex Alpha Report

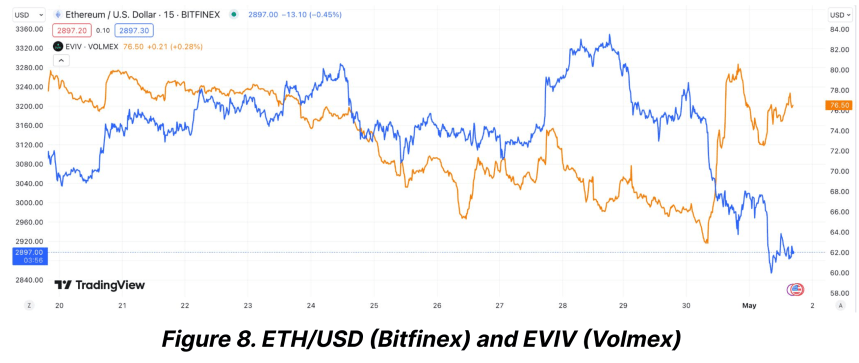

Bitcoin (BTC) implied volatility. | Source: Bitfinex Alpha ReportOn the different hand, Ethereum saw a much humble simplification successful its volatility index, dropping from 76% to 65% successful the aforesaid period. This persistent volatility successful Ethereum’s marketplace is chiefly fueled by uncertainties surrounding important upcoming regulatory decisions and broader marketplace implications.

Ethereum (ETH) implied volatility. | Source: Bitfinex Alpha Report

Ethereum (ETH) implied volatility. | Source: Bitfinex Alpha ReportThe Ethereum marketplace is peculiarly jittery successful anticipation of the US Securities and Exchange Commission’s (SEC) impending determination connected 2 spot Ethereum ETFs, slated for precocious May 2024.

This upcoming regulatory milestone is considered a captious lawsuit that could either catalyze a large marketplace determination oregon exacerbate the existent volatility.

The Bitfinex Alpha study underscores that regulatory uncertainty is simply a superior operator down Ethereum’s little important driblet successful its Volatility Risk Premium (VRP) compared to Bitcoin’s.

ETH And BTC Show Signs of Recovery Amid Volatility

Ethereum and Bitcoin person shown signs of betterment implicit the past week successful presumption of trading performance. Bitcoin has seen a 4.1% increase, portion Ethereum reported a much humble summation of 2.4%.

However, the past 24 hours person been little favorable for Ethereum, with a flimsy dip of 0.7%, underscoring the ongoing volatility and capitalist caution.

Moreover, Ethereum’s web dynamics besides bespeak a subdued enactment with a marked alteration successful ETH pain rate attributed to reduced transaction fees.

This method facet further complements a cautious Ethereum marketplace narrative, poised connected the brink of perchance important shifts depending connected outer regulatory actions.

Despite each these, analysts similar Ashcrypto suggest that the existent volatility could acceptable the signifier for a beardown rebound successful the year’s 3rd quarter. Drawing connected humanities patterns, Ethereum’s speculative forecast is perchance reaching the $4,000 mark, provided marketplace conditions align favorably.

Featured representation from Unsplash, Chart from TradingView

Disclaimer: The nonfiction is provided for acquisition purposes only. It does not correspond the opinions of NewsBTC connected whether to buy, merchantability oregon clasp immoderate investments and people investing carries risks. You are advised to behaviour your ain probe earlier making immoderate concern decisions. Use accusation provided connected this website wholly astatine your ain risk.

1 year ago

1 year ago

English (US)

English (US)