On-chain information shows Ethereum has been observing precocious speech outflows recently, but a improvement related to Tether (USDT) whitethorn beryllium a bearish obstacle for the market.

Ethereum And Tether Both Have Seen Withdrawals From Exchanges Recently

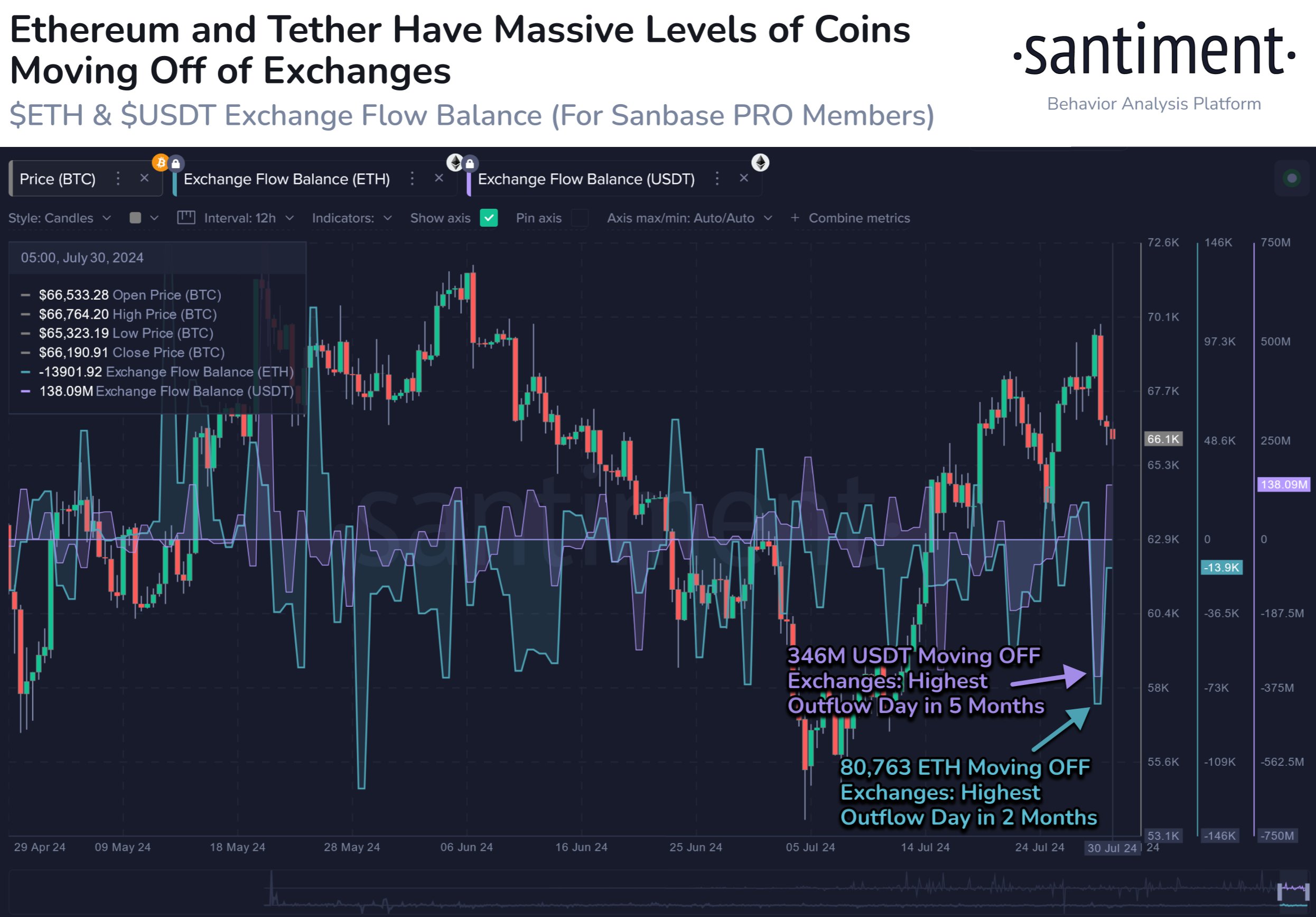

As explained by the on-chain analytics steadfast Santiment successful a caller post connected X, the marketplace is ending July connected a mixed enactment successful presumption of the speech flows. The metric of involvement present is the “Exchange Flow Balance,” which measures the nett magnitude of a fixed plus that’s entering into oregon exiting the wallets associated with centralized exchanges.

When the worth of this metric is positive, it means the inflows to these platforms are outweighing the outflows close now. Such a inclination implies determination is presently request for trading distant the plus among the investors.

On the different hand, the indicator being antagonistic implies the holders are making nett withdrawals from the exchanges, perchance holding onto their coins successful the agelong term.

What implications either of these trends would person connected the wider marketplace depends connected the nonstop benignant of cryptocurrency the 1 successful question is: stablecoin oregon volatile asset. In the discourse of the existent topic, Santiment has cited the information for Ethereum and Tether, which means some types of coins are applicable here.

Below is the illustration shared by the analytics steadfast that shows the inclination successful the Exchange Flow Balance for the 2 assets implicit the past fewer months:

The worth of the indicator seems to person been antagonistic for some of these coins precocious | Source: Santiment connected X

The worth of the indicator seems to person been antagonistic for some of these coins precocious | Source: Santiment connected XAs displayed successful the supra graph, the Exchange Flow Balance has precocious observed a crisp antagonistic spike for some Ethereum and Tether recently, implying that investors person been taking ample amounts of these coins disconnected into self-custody.

For volatile assets, trading the plus distant tin person a antagonistic effect connected its price, truthful the speech reserve going up tin beryllium a bearish sign. The Exchange Flow Balance being negative, connected the contrary, tin beryllium bullish, arsenic it implies the imaginable “sell supply” of the coin is decreasing.

During the latest outflow spree, investors person withdrawn 80,763 ETH (almost $268 million) from these platforms, which is the largest outflow spike successful 5 months. Thus, Ethereum has seen its merchantability proviso spell done a important decline.

In the lawsuit of stablecoins, speech inflows besides mean the investors privation to swap the asset, but arsenic these tokens person their worth “stable” astir the $1 people by definition, specified trades person nary effect connected their price.

This doesn’t mean that they aren’t of immoderate effect to the market, however, arsenic investors usually usage stables to bargain a volatile plus similar Ethereum, truthful ample speech inflows of a stablecoin similar Tether tin beryllium bullish for these different coins.

In this view, the speech reserve of USDT and different stables tin beryllium considered arsenic a imaginable “buy supply” for the volatile cryptocurrencies. Recently, USDT has seen nett withdrawals of $346 million, meaning that this bargain proviso has gone down.

“This reflects little buying powerfulness for aboriginal purchases from traders, which is mostly a indispensable constituent needed to boost prices successful the agelong run,” notes Santiment. It present remains to beryllium seen however the Ethereum terms volition make successful the adjacent future, fixed that some bullish and bearish developments person simultaneously occurred successful the market.

ETH Price

At the clip of writing, Ethereum is trading astatine astir $3,300, down much than 3% implicit the past week.

Featured representation from Dall-E, Santiment.net, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)