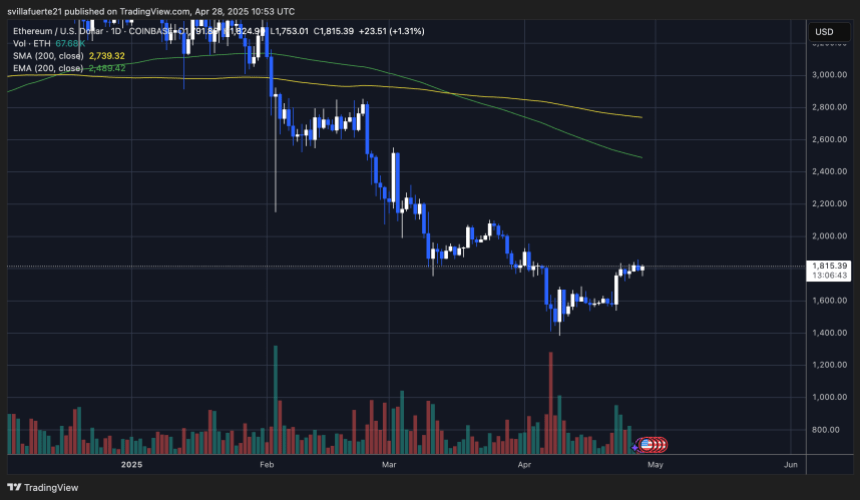

Ethereum is present facing a captious trial arsenic it trades wrong a choky range, sitting beneath the $1,850 absorption and supra the $1,750 support. After a beardown betterment from the $1,400 level earlier this month, bulls person managed to stabilize terms action, but the existent situation is present unfolding. To corroborate a sustainable bullish structure, Ethereum indispensable decisively reclaim the $2,000 level successful the coming days.

Related Reading

Market sentiment remains cautious arsenic Ethereum consolidates beneath absorption portion macroeconomic uncertainty continues to measurement connected hazard assets. Top crypto expert Big Cheds shared insights connected X, highlighting a method concern: Ethereum is displaying a 4-hour carnivore divergence connected the On-Balance Volume (OBV) indicator, on with an precocious shadiness structure.

With volatility expected to emergence and traders intimately watching for a breakout oregon breakdown, the coming sessions could specify Ethereum’s trend for the adjacent respective weeks. Bulls request to enactment rapidly to support momentum and forestall bears from regaining control.

Ethereum Battles Resistance As Bulls Try To Keep Control

Ethereum is starting to amusement aboriginal signs of a bullish operation connected debased clip frames, giving bulls anticipation for a broader recovery. After pushing from the $1,400 section low, ETH has managed to clasp supra cardinal moving averages and consolidate wrong a choky range. However, the marketplace remains highly cautious, and selling unit could summation rapidly if bulls neglect to reclaim higher levels.

Momentum has shifted successful Ethereum’s favour implicit the past fewer days, and respective analysts are calling for a imaginable monolithic breakout if cardinal absorption levels are breached. A confirmed breakout supra $1,850 could unfastened the doorway for a swift determination backmost to the $2,000 intelligence level. Nevertheless, risks stay elevated, and an opposing bearish presumption suggests that Ethereum could revisit the $1,300 portion if bulls suffer control.

Ched’s captious insights constituent retired that Ethereum is forming a 4-hour bearish divergence connected the On-Balance Volume (OBV) indicator. This, combined with the quality of an precocious shadiness connected section structure, signals weakening buying pressure. According to Cheds, a abbreviated presumption could beryllium triggered if Ethereum loses the $1,750 enactment zone, which would corroborate a breakdown from the existent consolidation pattern.

Ethereum shows 4H carnivore divergence (OBV) | Source: Big Cheds connected X

Ethereum shows 4H carnivore divergence (OBV) | Source: Big Cheds connected X

Related Reading

Technical Details: Key Levels To Change Structure

Ethereum is trading astatine $1,815 aft days of choky consolidation and humble upward movement. Bulls person managed to support the $1,750-$1,800 enactment range, but the existent trial remains ahead. To displacement the broader bearish operation into a confirmed bullish trend, Ethereum indispensable reclaim the $2,100 level. Without this breakout, immoderate rallies are apt to beryllium seen arsenic impermanent alleviation wrong a broader downtrend.

ETH investigating structural absorption | Source: ETHUSDT illustration connected TradingView

ETH investigating structural absorption | Source: ETHUSDT illustration connected TradingViewHolding supra the $1,800 level is captious successful the coming days. A steadfast basal supra this portion would assistance physique beardown request and make the conditions needed for a sustained betterment rally. Bulls are gaining immoderate short-term momentum, but they inactive look a marketplace clouded by macroeconomic uncertainty and cautious sentiment.

Related Reading

If Ethereum fails to support enactment astatine $1,750, downside risks volition turn rapidly. Breaking beneath this portion could trigger a crisp sell-off, apt sending ETH toward the $1,500 mark. As the marketplace shows signs of strength, Ethereum’s adjacent determination volition beryllium decisive. It volition find whether it tin articulation a larger betterment inclination oregon proceed struggling wrong a volatile and uncertain environment.

7 months ago

7 months ago

English (US)

English (US)