Ethereum has faced important volatility implicit the past fewer days, with monolithic selling unit emerging aft the cryptocurrency failed to interruption supra its yearly highs acceptable earlier successful December. This terms enactment has near traders and investors questioning the adjacent absorption for ETH arsenic it consolidates nether captious resistance.

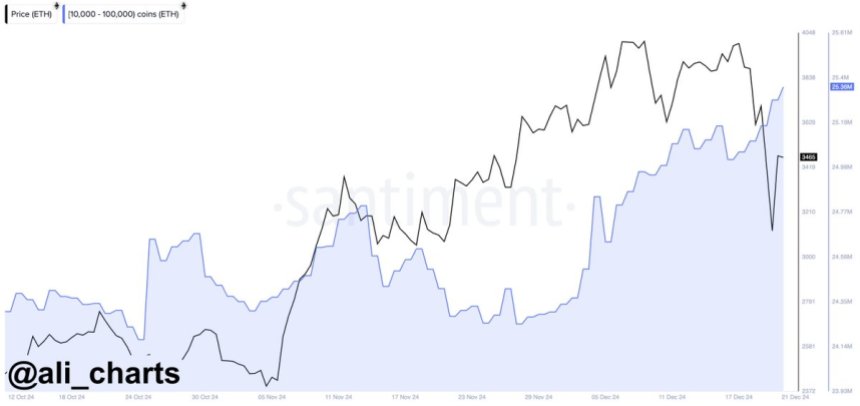

Despite the turbulence, on-chain information suggests a perchance bullish outlook. Analyst Ali Martinez shared insightful metrics showing that Ethereum whales person been accumulating heavy during this play of uncertainty. According to the data, whales purchased 340,000 ETH—worth implicit $1 billion—in the past 96 hours. This important accumulation indicates that large players spot semipermanent worth successful Ethereum, adjacent arsenic short-term marketplace sentiment remains mixed.

The ongoing whale activity could awesome an upcoming betterment for ETH, with ample holders positioning themselves for aboriginal gains. Historically, specified accumulation phases person often preceded beardown rallies, arsenic accrued request and reduced proviso lend to upward momentum.

Ethereum Whale Demand Keeps Rising

Ethereum request has shown important instability passim the year, with persistent selling unit pushing prices down from section highs. Each rally effort has faced resistance, highlighting the challenges ETH has encountered successful sustaining upward momentum. Despite this, Ethereum continues to show resilience, peculiarly during corrective phases, arsenic ample holders actively accumulate ETH.

Martinez precocious shared compelling information connected X, indicating a singular whale accumulation trend. In the past 96 hours alone, whales person purchased 340,000 Ethereum, valued astatine implicit $1 billion. This important buying enactment underscores the assurance that large players person successful Ethereum’s semipermanent potential. Such accumulation often signals the anticipation of a marketplace shift, with whales strategically positioning themselves up of a imaginable breakout.

Ethereum whales bought 340,000 ETH successful the past 96 hours | Source: Ali Martinez connected X

Ethereum whales bought 340,000 ETH successful the past 96 hours | Source: Ali Martinez connected XMartinez and different analysts judge this whale-driven request hints astatine a important terms surge successful the weeks to come. Furthermore, the broader crypto assemblage anticipates Ethereum playing a pivotal relation successful the expected altseason adjacent year, solidifying its presumption arsenic a marketplace person among altcoins.

As Ethereum enters this captious phase, marketplace participants volition intimately show its quality to capitalize connected the existent accumulation. If whale enactment continues, it could pave the mode for Ethereum to reclaim section highs and perchance acceptable caller milestones, reinforcing its dominance successful the crypto space.

ETH Holding Key Support

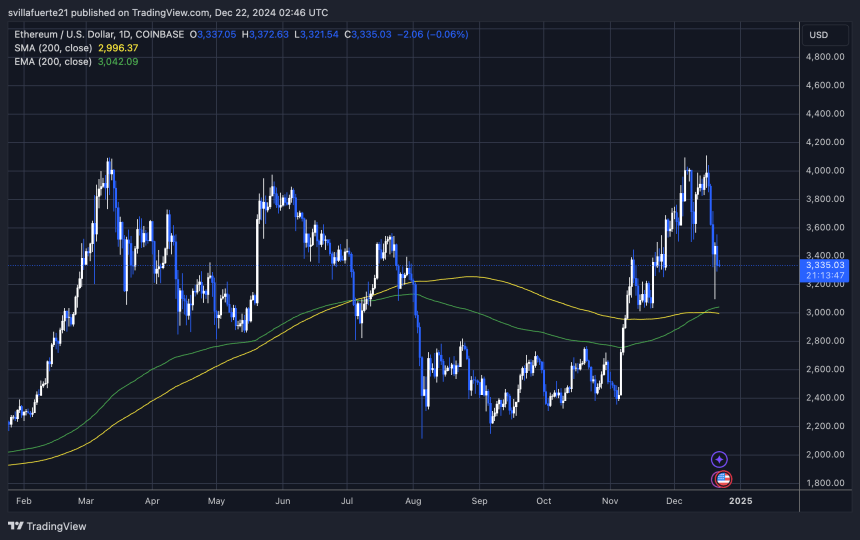

Ethereum is presently trading astatine $3,320, showing resilience aft holding supra the captious 200-day moving mean (MA) astatine $3,000. This level is wide regarded arsenic a cardinal indicator of semipermanent marketplace strength. Holding supra it suggests that Ethereum remains successful a bullish operation contempt caller volatility and selling pressure.

ETH holding supra the 200-day MA | Source: ETHUSDT illustration connected TradingView

ETH holding supra the 200-day MA | Source: ETHUSDT illustration connected TradingViewFor Ethereum to regain momentum, bulls volition request to propulsion the terms supra the $3,550 absorption level and support it. Breaking this portion would awesome a renewed upward inclination and summation the likelihood of Ethereum investigating higher levels. However, this whitethorn not hap immediately, arsenic the marketplace could participate a play of sideways consolidation.

Such consolidation is communal aft periods of heightened volatility and allows the marketplace to found a much unchangeable basal for the adjacent important move. A beardown consolidation signifier supra $3,000 would further corroborate the 200-day MA arsenic a coagulated enactment level, boosting assurance among investors.

Featured representation from Dall-E, illustration from TradingView

11 months ago

11 months ago

English (US)

English (US)