Holy heck, was past week engaged oregon what? Legislation successful India and Europe took halfway stage, but there's a batch happening beauteous widely. I’m going to instrumentality a 2nd to shamelessly plug the CoinDesk regulatory squad present due to the fact that there's excessively overmuch to tally done successful 1 newsletter – if you’re not pursuing these folks, you’re missing out: Sandali Handagama, Jesse Hamilton, Cheyenne Ligon, Amitoj Singh, Lavender Au, and Jack Schickler.

You’re speechmaking State of Crypto, a CoinDesk newsletter looking astatine the intersection of cryptocurrency and government. Click here to motion up for aboriginal editions.

The European Union is advancing its Markets successful Crypto Assets (MiCA) authorities but lawmakers and projected rules astir anonymous transactions whitethorn beryllium a much pressing interest for the industry.

MiCA seems to beryllium moving forward. If implemented, it promises to dramatically streamline the motorboat process for crypto companies trying to acceptable up store successful much than 1 of the European Union’s 27 subordinate nations. However, abstracted from MiCA, different acceptable of projected rules that volition beryllium voted connected this week committedness to marque utilizing crypto a spot much hard for companies and users.

Bitcoiners tin respire a suspiration of relief. A arguable connection to bounds proof-of-work mining successful the European Union volition not beryllium portion of its landmark Markets successful Crypto Assets (MiCA) regulatory framework.

MiCA has advanced from a dialog signifier wherever lawmakers projected and debated antithetic provisions to a constituent wherever the antithetic branches of the European authorities volition sermon the bill. We are present going to spot what's called a trilogue, which my workfellow Sandali Handagama explains is erstwhile the European Parliament, the European Commission and the European Council each statement and hold connected the authorities arsenic it presently stands.

Meanwhile, a mates 1000 miles distant successful India, a arguable and arsenic disliked tax connection has go law aft the nation’s parliament adopted it precocious past week. This taxation proviso volition instrumentality a 30% superior gains taxation connected each crypto transactions arsenic good arsenic a 1% taxation deducted astatine source. Advocates for the manufacture feared that this volition pb to “brain drain” oregon an exodus of developers and entrepreneurs successful the cryptosphere from India to different friendlier jurisdictions.

So basically, it was a beauteous large week past week.

What we're seeing present is conscionable a continuation of this thought that regulators judge that crypto is present to enactment and privation to bash thing astir it. In India’s case, overmuch similar past year’s U.S. infrastructure measure debate, that “something” is “tax the industry,” adjacent if the circumstantial circumstances are a spot different.

However, crypto manufacture participants successful India person said they’re concerned by the information the state hasn’t enactment guardant immoderate benignant of guidance oregon regulations for startups and different businesses to run under, alternatively leaving the regulatory model astatine conscionable the taxation level issue.

Europe’s MiCA is simply a vastly antithetic attack successful that regard. The cardinal payment for the manufacture should MiCA beryllium implemented is the common licence for crypto businesses, allowing a institution to run crossed borders.

“Members of the European Parliament are apt to ballot to extremity the anonymity of adjacent tiny crypto payments astatine a committee gathering to beryllium held adjacent week, documents seen by CoinDesk show.

Lawmakers astatine the Economic Affairs Committee are besides poised to see crypto transfers to self-hosted oregon backstage wallets (also referred to arsenic unhosted wallets) successful anti-money laundering (AML) checks, and privation to halt crypto transfers betwixt the EU and jurisdictions similar Turkey and Hong Kong.”

These projected rules would necessitate exchanges to place the recipients of crypto transfers. At present, recipients of slope transfers worthy much than 1,000 euros person to beryllium identified, but the projected authorities would region that minimum bounds for crypto transactions.

The caller projected rules whitethorn besides marque it hard for crypto exchanges to let transactions to taxation havens, which see the Virgin Islands (both U.S. and U.K.), Turkey, Hong Kong, Iran and others.

And successful an occurrence that galore readers of this newsletter mightiness remember, the EU besides wants to enforce anti-money laundering (AML) checks connected private/self-hosted (or unhosted oregon immoderate you’d similar to telephone them) wallets.

Wallet owners would request to beryllium identified, according to the projected rules.

The manufacture is already pushing back against these rules, claiming they would marque it hard for radical to usage self-hosted wallets and enforce strict surveillance against crypto exchanges.

Statements specified arsenic those made by European Central Bank President Christine Lagarde, Tracfin Director Guillaume Valette-Valla oregon the Bank of England underscore that galore successful the EU whitethorn not beryllium comfy with the crypto manufacture yet.

U.S. President Joe Biden unveiled his fiscal twelvemonth 2023 budget petition yesterday, outlining an ambitious plan to tackle ongoing proviso concatenation issues, taxation billionaires and boost constabulary budgets. And helium whitethorn rise immoderate $11 cardinal implicit the adjacent 10 years by modernizing integer plus taxation rules.

The modernization would see amending mark-to-market rules for integer assets, modifying rules outlining the loans of securities and amending securities indebtedness nonrecognition rules.

“The connection would amend the securities indebtedness nonrecognition rules to supply that they use to loans of actively traded integer assets recorded connected cryptographically secured distributed ledgers, provided that the indebtedness has presumption akin to those presently required for loans of securities,” the Treasury Department’s Green Book (explanation of the fund asks) said.

Another proviso addresses Foreign Account Tax Compliance Act (FATCA) requirements and different overseas account-holders, similar to past year’s fund proposal.

“In addition, taxation evasion utilizing integer assets is simply a rapidly increasing problem. Since the manufacture is wholly digital, taxpayers tin transact with offshore integer plus exchanges and wallet providers without leaving the United States,” the Green Book said.

The fund connection besides includes a proviso expanding the Department of Justice’s fund by $52 cardinal to tackle investigations, including its ransomware enactment and combating illicit uses of cryptocurrency.

While it doesn’t explicitly notation crypto, the connection would besides boost the Securities and Exchange Commission’s enforcement budget, which I ideate volition spell astatine slightest successful portion to furthering crypto investigations and enforcement actions.

Other fund increases see $210 cardinal for the Financial Crimes Enforcement Network (FinCEN), $1.1 cardinal wide for the IRS and boosts for different agencies.

The Commodity Futures Trading Commission (CFTC) presented its ain fund request, saying it “expects to registry and oversee a increasing fig of derivatives exchanges offering caller and analyzable products,” including cryptocurrency-related products.

The CFTC besides expects immoderate decentralized exchanges oregon peer-to-peer networks to effort and commercialized cryptocurrency derivatives without registering with the bureau successful the U.S.

It remains to beryllium seen whether immoderate of this comes to fruition: Congress would person to authorize the fund done legislation, alternatively than footwear the tin down the roadworthy with impermanent continuing resolutions as we’ve seen implicit the past year.

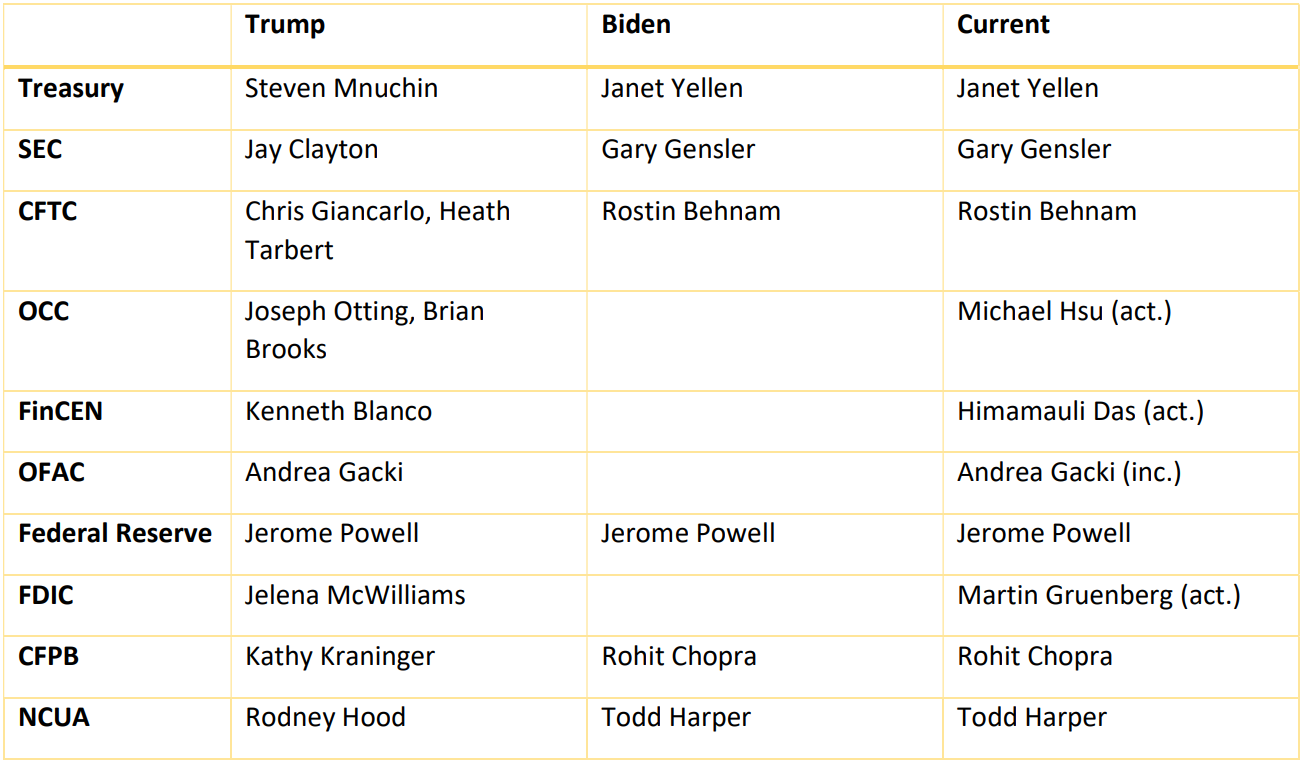

Key: (nom.) = nominee, (rum.) = rumored, (act.) = acting, (inc.) = incumbent (no replacement anticipated)

CFTC Chairman Rostin Behnam volition attest earlier the House Agriculture Committee connected Thursday. It’s not yet wide whether crypto volition travel up but I ideate it will, fixed the Congressional agriculture committees person oversight jurisdiction implicit the Commodity Futures Trading Commission.

Speaking of which, the CFTC is astatine afloat strength. The U.S. Senate confirmed Christy Goldsmith Romero, Kristin Johnson, Summer Kristine Mersinger and Caroline Pham arsenic CFTC Commissioners. Two of them – Goldsmith Romero and Johnson – highlighted their enactment with cryptocurrencies successful their opening remarks earlier a confirmation proceeding earlier this month.

Will Belarus Lure Crypto Miners Amid Sanctions, Russia-Ukraine War?: Belarus participated successful Russia’s penetration of Ukraine past period and was instantly slapped with sanctions. These sanctions, arsenic good arsenic imaginable caller ones, whitethorn interaction the country’s quality to go a harmless haven for crypto miners and different firms, Eliza Gkritsi reports.

‘Correctly’ Was Wrong: Circle’s Accountant Tweaks Fine Print of USDC Attestation: Grant Thornton LLP, the accountant which publishes regular attestations saying Circle’s USDC stablecoin is backed by dollars (and different assets), tweaked the connection successful its attestations recently. Prior to January 2022, GT said the reserve accounts were “correctly stated.” Now, the steadfast says the accounts are “fairly stated.” It’s a tiny alteration with a important impact, Lawrence Lewitinn reports.

Kraken Hits Key Milestone successful Quest to Gain Fed Account, Equal Treatment With Traditional Banks: Kraken Bank received an American Bankers Association routing number, but I deliberation the existent quality whitethorn beryllium the Fed published a supplemental petition for accusation past week asking for nationalist input connected a projected three-tiered strategy for evaluating whether fiscal entities should person entree to maestro accounts. Recall that the Fed archetypal published an RFI past twelvemonth outlining immoderate of its considerations for maestro accounts.

White House Wants Public Comments connected Crypto’s Energy Use and Environmental Impact: So this is portion of U.S. President Joe Biden’s enforcement bid connected crypto, but it’s absorbing that the White House is asking for remark and – likewise to the EO itself – not explicitly saying crypto is starring to clime change. “Digital assets whitethorn contiguous a cardinal biology situation … On the different hand, integer assets mightiness besides person a affirmative interaction connected the climate. For example, they whitethorn supply caller opportunities successful c accounting and verification, expanding spot successful c measurement and creating a caller accidental for addressing clime change,” the RFI says.

(Platformer) Casey Newton took a look astatine ApeCoin and its relation successful the broader Bored Ape ecosystem – specifically, the relation task superior firms mightiness play successful it.

(The Washington Post) The Washington Post and CBS News reported that blimpish activistic Virginia Thomas, who besides happens to beryllium joined to Supreme Court Justice Clarence Thomas, was actively texting erstwhile White House Chief of Staff Mark Meadows successful enactment of a present repeatedly-debunked conspiracy mentation that Joe Biden stole the 2020 statesmanlike election.

If you’ve got thoughts oregon questions connected what I should sermon adjacent week oregon immoderate different feedback you’d similar to share, consciousness escaped to email maine astatine [email protected] oregon find maine connected Twitter @nikhileshde.

You tin besides articulation the radical speech connected Telegram.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for State of Crypto, our play newsletter examining the intersection of cryptocurrency and government

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)