The crypto manufacture is connected the verge of a perchance important improvement arsenic cardinal figures successful the assemblage hint astatine the imminent support of a spot Ethereum ETF successful the United States, perchance triggering a notable terms rally for ETH.

Nate Geraci, president of The ETF Store, shared insights into the expected timeline for the motorboat of the archetypal spot Ethereum ETF.

According to Geraci, existent forecasts by Bloomberg foretell a mid-July launch. He elaborate the procedural timeline via X, stating, “Wen spot eth ETF? BBG sticking w/ mid-July. Amended S-1s owed July 8th. Potential last S-1s by July 12th. Would theoretically mean motorboat week of July 15th.”

In parallel, Steve Kurz, caput of plus absorption astatine Galaxy Digital, confirmed to Bloomberg connected July 2 that the U.S. Securities and Exchange Commission (SEC) mightiness greenlight a spot Ethereum ETF earlier the month’s end.

Kurz emphasized the extended groundwork laid successful collaboration with the SEC, drafting parallels betwixt the projected Ethereum ETF and Galaxy’s existing spot Bitcoin ETF (BTCO), created with Invesco. Kurz expressed assurance successful their preparedness, remarking, “We cognize the plumbing, we cognize the process… The SEC is engaged.”

Bloomberg ETF expert Eric Balchunas besides chimed in, aligning with the mid-July expectations. He highlighted the SEC’s caller instructions to Ethereum ETF issuers for amending their S-1 registration forms by July 8, suggesting imaginable further amendments. Notably, the SEC approved regularisation changes nether 19-b4 successful May, facilitating the listing and trading of specified funds, though the issuance of funds remained pending last approvals.

Ethereum Price Holds Above Key Support

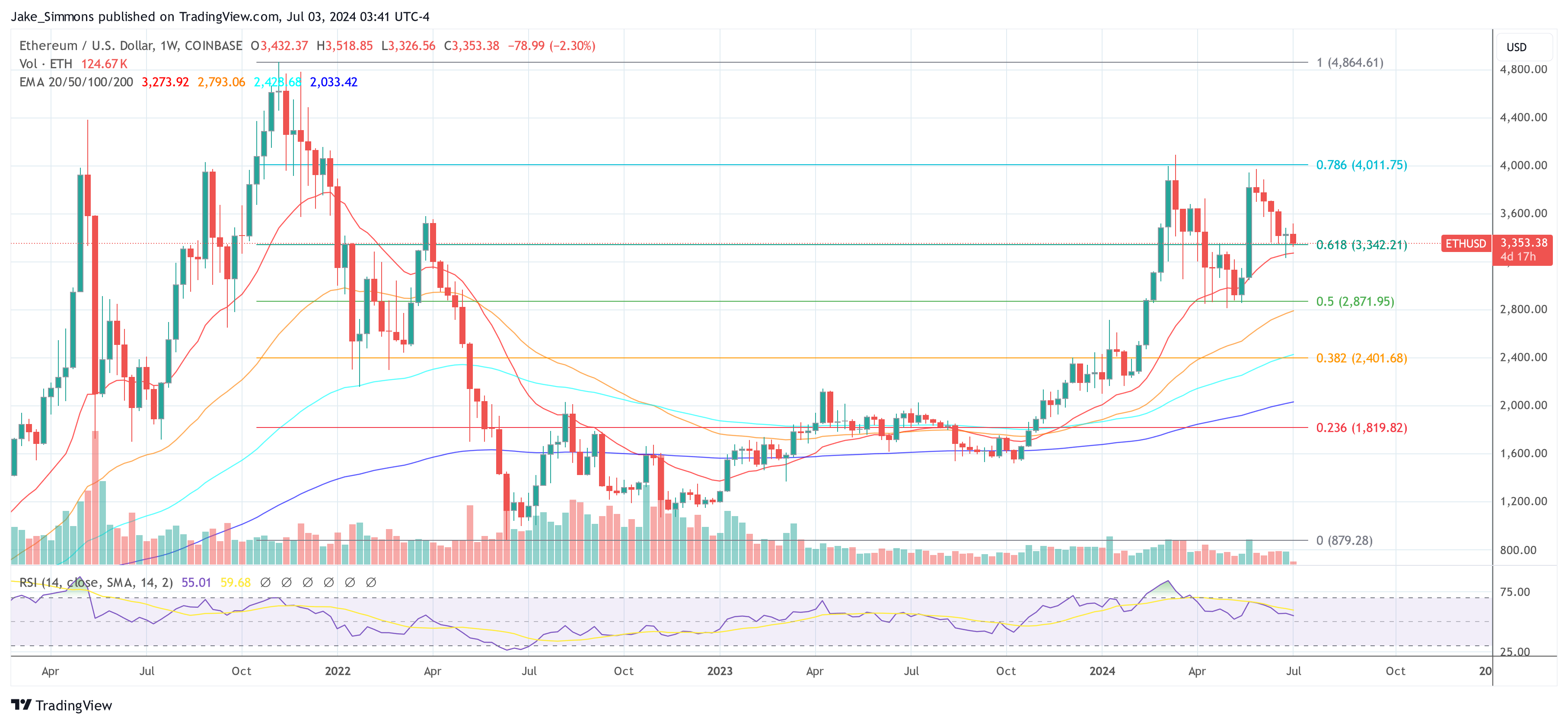

The anticipation of these approvals appears to beryllium having a stabilizing effect connected Ethereum prices. Crypto expert IncomeSharks, commenting connected Ethereum’s existent terms trajectory via X, noted optimism for a near-term breakout, stating, “ETH – Looking much optimistic for a Q3 breakout. Liking the chances of a tally towards $4,000 this oregon adjacent month.” According to the illustration shared by him, ETH terms needs to clasp the portion of $3,300 to $3,350 successful bid to rally to $4,000.

Ethereum terms investigation | Source: X @IncomeSharks

Ethereum terms investigation | Source: X @IncomeSharksSupporting this sentiment, Cold Blooded Shiller highlighted the important request for Ethereum to show momentum astatine the existent terms levels, specifically astir the $3,400 mark, arsenic a cardinal indicator for a imaginable high-time-frame impulse.

“ETH is inactive successful a good presumption but it truly needs to commencement showing immoderate momentum soon. LTF divergences astir this $3400 debased are astir apt wherever I instrumentality 1 stab astatine trying to seizure immoderate HTF impulse distant from the consolidation,” helium remarked via X.

Adding humanities perspective, expert Jelle (@CryptoJelleNL) compared the existent marketplace signifier to Ethereum’s agelong consolidation successful 2016-2017 earlier its massive rally, urging persistence and optimism: “In 2016-2017, ETH consolidated for 50+ weeks earlier rallying astir 12000 percent. Today, radical are giving up aft little than 20 weeks, with ETH ETFs close astir the corner. Stick to the program boys. The champion is yet to come.”

At property time, ETH traded astatine $3,353.

ETH holds supra the 0.618 Fib, 1-week illustration | Source: ETHUSD connected TradingView.com

ETH holds supra the 0.618 Fib, 1-week illustration | Source: ETHUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)