In a method analysis shared by noted crypto expert Josh Olszewicz connected the societal level X, determination appears to beryllium a important bullish sentiment gathering astir Bitcoin, peculiarly if it surpasses the important $72,000 mark. Olszewicz, leveraging some the Ichimoku Cloud and Fibonacci extensions, illustrates a script wherever breaking this cardinal absorption level could catapult Bitcoin towards a people of $91,500.

Here’s How Bitcoin Could Skyrocket To $91,500

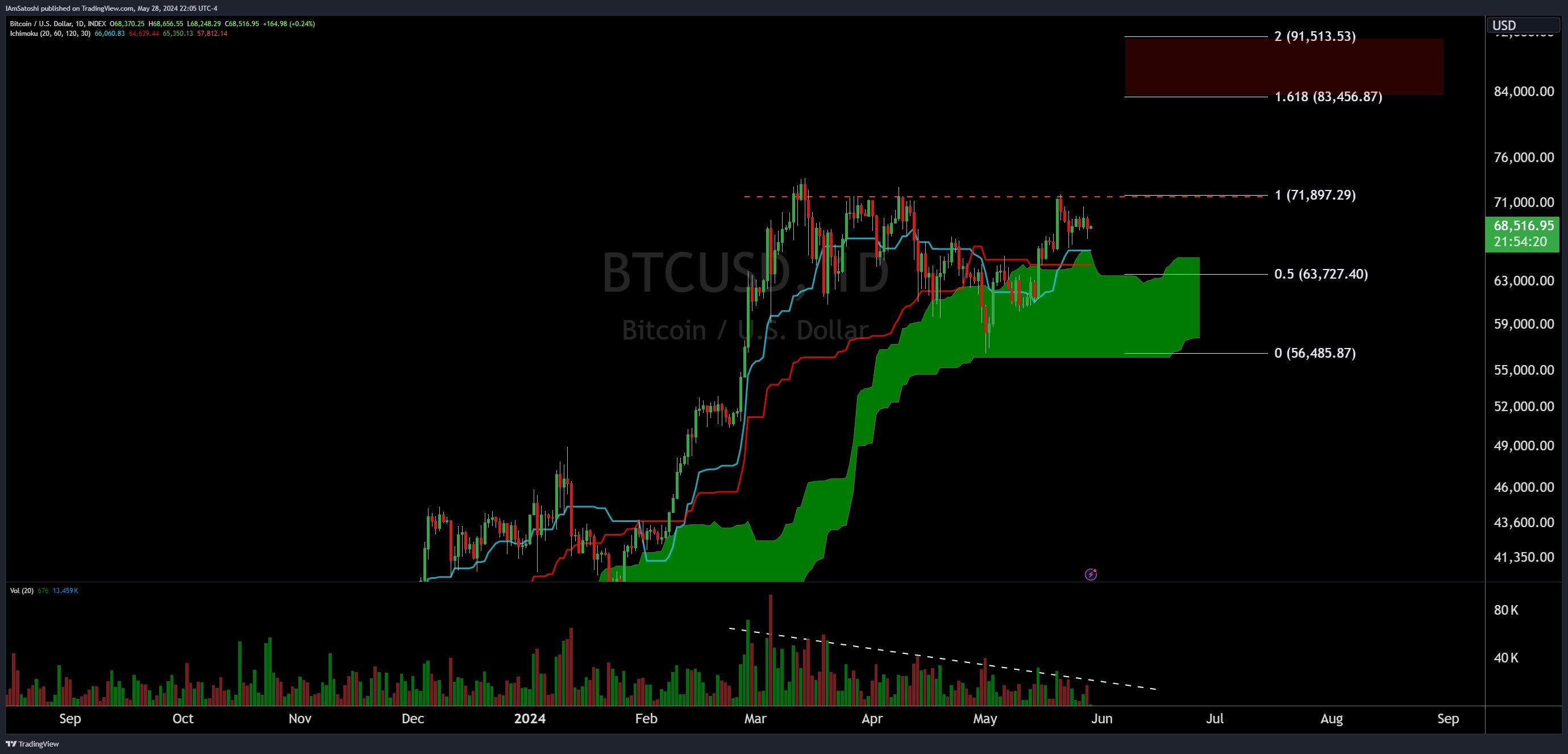

The investigation utilizes the Ichimoku Cloud, a analyzable method indicator that provides insights into the market’s momentum, inclination direction, and imaginable areas of enactment and absorption implicit antithetic clip frames. Currently, Bitcoin’s terms enactment is depicted arsenic being successful a bullish phase, situated supra the cloud. This positioning supra the unreality is traditionally viewed arsenic a bullish signal, suggesting a beardown uptrend with robust enactment levels formed by the cloud’s little boundaries.

Bitcoin terms investigation | Source: X @CarpeNoctom

Bitcoin terms investigation | Source: X @CarpeNoctomIn the Ichimoku setup, the conversion enactment (Tenkan-sen) and the baseline (Kijun-sen) transverse occasionally, providing bargain oregon merchantability signals based connected their intersection comparative to the cloud. As of the latest chart, the conversion enactment precocious crossed supra the baseline, reinforcing the bullish outlook depicted by the cloud’s positioning.

Adding different furniture to the method narrative, Fibonacci hold levels person been plotted from a important debased astatine $56,485.87 up to a high, providing imaginable targets and absorption levels. The 0.5 Fibonacci hold level is marked astatine $63,727.40, already surpassed by the current terms trajectory.

The 1.0 hold finds itself astatine $71,897.29, intimately aligning with the analyst’s noted pivotal level of $72,000. Beyond this, the 1.618 hold astatine $83,456.87 represents a lucrative archetypal terms target, portion the eventual 2.0 hold looms astatine $91,513.53.

A cardinal reflection is the measurement profile, which shows a declining inclination successful trading volume. This decreasing measurement tin often bespeak a play of accumulation, arsenic little selling unit allows prices to stabilize and perchance physique a basal for an upward breakout. The declining measurement inclination enactment underpins the consolidation phase seen successful caller months, suggesting that a crisp question could beryllium imminent erstwhile accumulation concludes.

Olszewicz’s emphatic remark, “BTC: erstwhile this babe hits $72k you’re going to spot immoderate superior shit,” underscores the precocious stakes associated with this absorption level. This is not simply a method reflection but a awesome to the marketplace that erstwhile $72,000 is decisively broken, the way to overmuch higher levels becomes progressively probable.

Such a breakout would apt activate a flurry of trading activity, arsenic some retail and organization investors mightiness spot it arsenic a confirmation of a sustained upward trend, perchance pushing the terms towards the $91,500 people indicated by the 2.0 Fibonacci extension.

At property time, BTC traded astatine $67,783.

Bitcoin price, 1-day illustration | Source: BTCUSD connected TradingView.com

Bitcoin price, 1-day illustration | Source: BTCUSD connected TradingView.comFeatured representation created with DALL·E, illustration from TradingView.com

1 year ago

1 year ago

English (US)

English (US)