Starting adjacent Monday, First Mover Americas volition go Crypto Daybook Americas, your caller greeting briefing connected what happened successful the crypto markets overnight and what's expected during the coming day. Publishing astatine 7 a.m. ET, it volition kickstart your greeting with broad insights. You won't privation to commencement your time without it.

Latest Prices

CoinDesk 20 Index: 3,433.47 +3.11%

Bitcoin (BTC): $98,230.02 +0.33%

Ether (ETH): $3,483 +4.89%

S&P 500: 5,969.34 +0.35%

Gold: $2,685.55 -1.13%

Nikkei 225: 38,780.14 +1.3%

Top Stories

Bitcoin traded supra $98,000 having dropped beneath $96,000 connected Sunday. A pullback had been expected arsenic traders took profits aft past week's surge to astir $100,000. XRP and DOGE led the drop, some losing much than 5%, portion ETH, SOL and ADA fell betwixt 2%-5%. They each besides pared losses, posting gains successful the past 24 hours. The CoinDesk 20 Index, which offers a wide measurement of the integer plus market, climbed 1.7% acknowledgment to immoderate steadfast increases among smaller altcoins similar AVAX and LINK.

Crypto-tracked futures took a beating with implicit $500 cardinal successful liquidations connected some longs and shorts amid the volatility. Over $366 cardinal successful longs and $127 cardinal successful shorts evaporated, Coinglass information shows. Traders, however, don’t look to see the pullback concerning. “It's wide that Bitcoin has been starring the market, a cardinal indicator that overmuch of the request is driven by institutions buying ETFs," Jeff Mei, COO astatine crypto speech BTSE, told CoinDesk. “We besides judge that institutions volition commencement buying into the Ethereum ETFs soon and, hopefully, the Solana ones erstwhile they're approved. With the banal marketplace making dependable gains and the Trump modulation squad gathering with a fig of crypto executives to sermon pro-crypto policies, it looks promising that this rally volition proceed into 2025,” Mei added.

Brokers Bernstein and Canaccord raised their terms targets for MicroStrategy, portion maintaining their affirmative ratings for the stock. Bernstein raised its people to $600 from $290, portion Canaccord has accrued it to $510 from $300. Bernstein said it expects MicroStrategy to ain 4% of the world's bitcoin proviso by 2033. It presently has 1.7%. Michael Saylor's institution said past period that it planned to bargain $42 billion of bitcoin implicit the adjacent 3 years. "We judge bitcoin is successful a structural bull marketplace with conducive regularisation and U.S. authorities support, organization adoption and favorable macro," analysts led by Gautam Chhugani wrote.

Chart of the Day

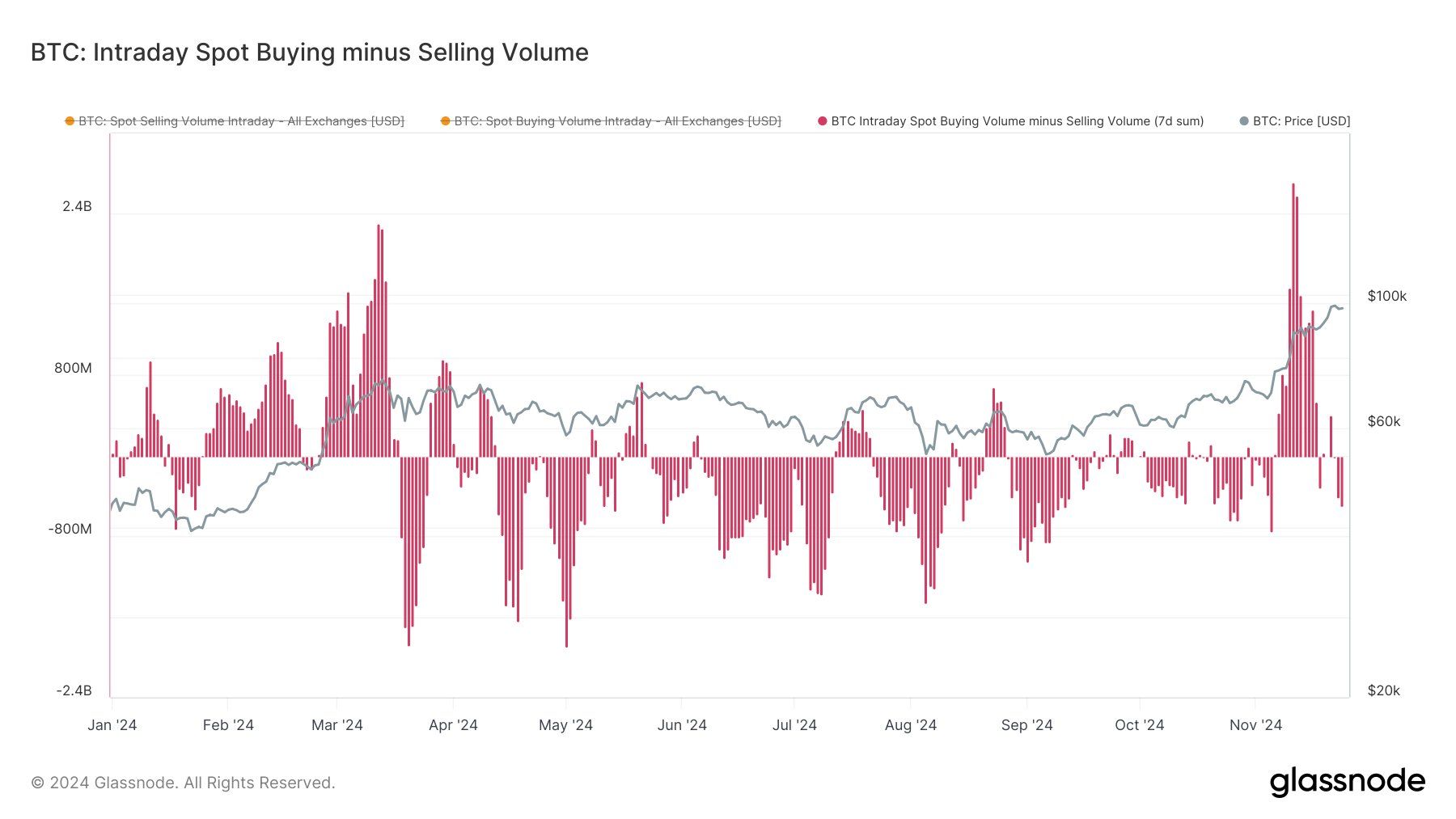

The illustration shows the quality betwixt intraday spot buying and selling volumes for bitcoin (BTC).

The nett buying measurement has flipped negative, hinting astatine profit-taking adjacent grounds highs. This partially explains BTC's conflict adjacent $100,000.

Source: Glassnode

- Omkar Godbole

Trending Posts

Koreans Go Full Monty connected DOGE, XRP, XLM After Trump's Win; Now Look to SAND Token

Tether successful Talks to Support Cantor Fitzgerald’s Planned Bitcoin Lending Program: WSJ

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

1 year ago

1 year ago

English (US)

English (US)