Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Bitcoin dips beneath $39,000 arsenic bearish macroeconomic factors proceed to overshadow bullish blockchain metrics.

Featured Story: Is bitcoin an aspirational store of value?

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9 a.m. U.S. Eastern time.

Morgen Rochard, managing member, Origin Wealth Advisers LLC

Austin Reid, main of staff, FalconX

Jake Rapaport, caput of integer plus scale research, Nasdaq

With each passing week, bitcoin's blockchain metrics diverge from bearish macroeconomic factors, offering anticipation to semipermanent holders.

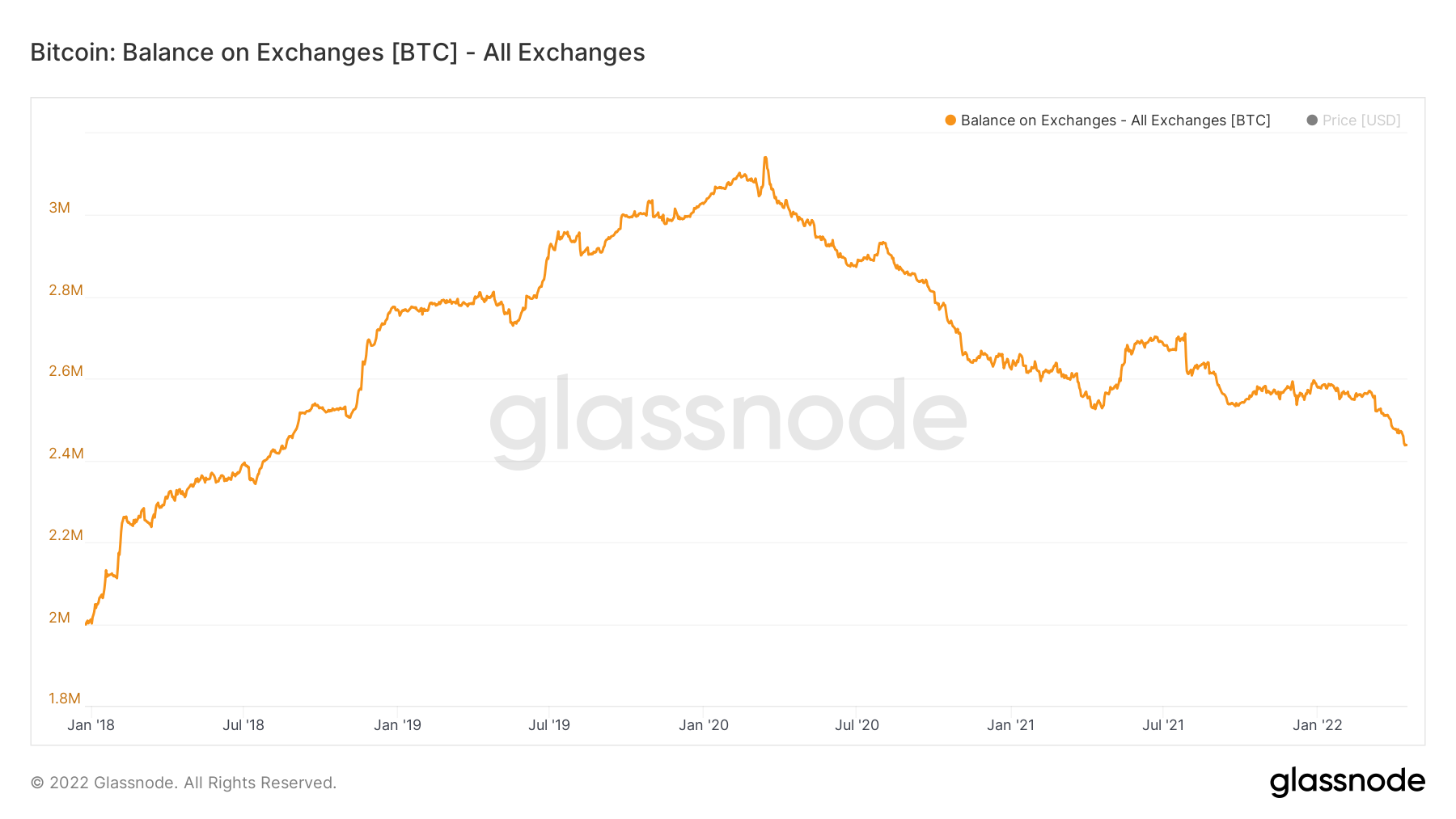

The fig of coins held connected exchanges declined by implicit 20,000 BTC to 2,449,785 BTC past week, hitting the lowest since August 2018, information provided by blockchain analytics steadfast Glassnode show. The tally has decreased by 138,266 oregon 5% this year, indicating HODLing – a crypto slang for bargain and clasp – remains a preferred strategy successful the market.

Investors typically instrumentality nonstop custody of coins erstwhile intending to clasp them for a agelong term. A continued diminution successful BTC disposable connected exchanges means fewer coins disposable for merchantability and the imaginable for an extended rally.

"Underneath the surface, determination is simply a dense signifier of accumulation on-chain," Blockware Solutions' marketplace quality newsletter published connected Friday said. "Exchange outflows person reached a complaint that has lone ever occurred 3 times earlier successful bitcoin's history: pursuing March 2020, December 2020 (a batch of which was apt GBTC), and September 2021."

Bitcoin's speech balance. (CoinDesk)

Other metrics besides overgarment a bullish picture. For instance, the percent of bitcoin inactive for astatine slightest a twelvemonth precocious reached a grounds precocious of 63.7%. At the aforesaid time, whales accumulated 1,000 BTC past week, registering the archetypal play uptick since January, per Blockware Solutions.

Even so, bitcoin fell to a one-month debased of $38,577 during the Asian hours, taking the year-to-date diminution to implicit 15%. The selling unit apt stemmed from taxation issues and macro traders liquidating holdings, tracking a continued melt-up successful authorities enslaved yields and Fed tightening scare.

Clearly, macro factors are successful the driver's seat. "For now, we'll proceed to perceive to each dependable wound from Fed officials arsenic they look to combat ostentation via scare tactics," Arca's CIO Jeff Dorman noted past week. "But 1 twelvemonth from now, it's doubtful that the precocious correlation betwixt rates, equities, and integer assets volition beryllium thing too different footnoted narration that didn't hold."

Bitcoin's three-day chart, wherever each candle represents terms enactment for 3 days, shows the cryptocurrency is flirting with the 200-period elemental moving mean (SMA). It's the captious level to ticker retired for, fixed bears person repeatedly failed to found a foothold nether the method enactment since precocious January.

Should they win this time, much chart-driven selling whitethorn beryllium seen. A breakdown would exposure enactment astatine $30,000. The existent three-day candle is acceptable to adjacent astatine 23:59 UTC connected Monday.

Bitcoin's 3-day chart. (TradingView)

Is Bitcoin an Aspirational Store of Value?

In times of precocious ostentation and economical uncertainty, investors spell risk-off, and there’s a “flight to quality.” In practice, erstwhile sentiment flips risk-off, investors merchantability their risky tech stocks and bargain thing similar bonds, oregon if they truly fearfulness inflation, thing dependable similar gold.

And you cognize what’s amended than gold? Gold 2.0 of course. Bitcoin (or the Reserve Asset 3.0). We person precocious inflation, and truthful everyone piled into bitcoin and its terms changeable up, right? Not quite…

What gives? This is dependable money, right? This is simply a store of worth with a known existent proviso and emissions schedule, right? Isn’t bitcoin provably scarce? I thought the emissions docket of bitcoin didn’t alteration arsenic request for the plus increased?

That’s each true: Bitcoin has a known monetary argumentation with a hard headdress and a predetermined minting schedule; anyone with a full node (a basal machine with immoderate software) tin archer you however galore bitcoins are successful circulation and if the terms of bitcoin went to $1 cardinal tomorrow, the coins wouldn’t beryllium mined immoderate faster than they are today.

But there’s 1 happening missing. Narrative.

On a 60-day lookback, bitcoin’s terms has been somewhat correlated (> 0.20 correlation coefficient) with the exertion stocks successful the Nasdaq for astir 50% of trading days successful 2022.

I deliberation the crushed for that is rather simple. While bitcoin’s hard wealth properties marque it a risk-off plus for its supporters, investors spot a risk-on plus due to the fact that of its volatility and technology-like asymmetric terms upside. When investors privation to chopped risk, they merchantability stocks alongside bitcoin. So bitcoin isn’t a risk-off oregon risk-on plus yet. Instead, I deliberation it’s amended to telephone it “risk everything.”

As such, it is astir apt much close to notation to bitcoin arsenic an aspirational store of value.

Today’s newsletter was edited by Omkar Godbole and produced by Parikshit Mishra and Stephen Alpher.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)