Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

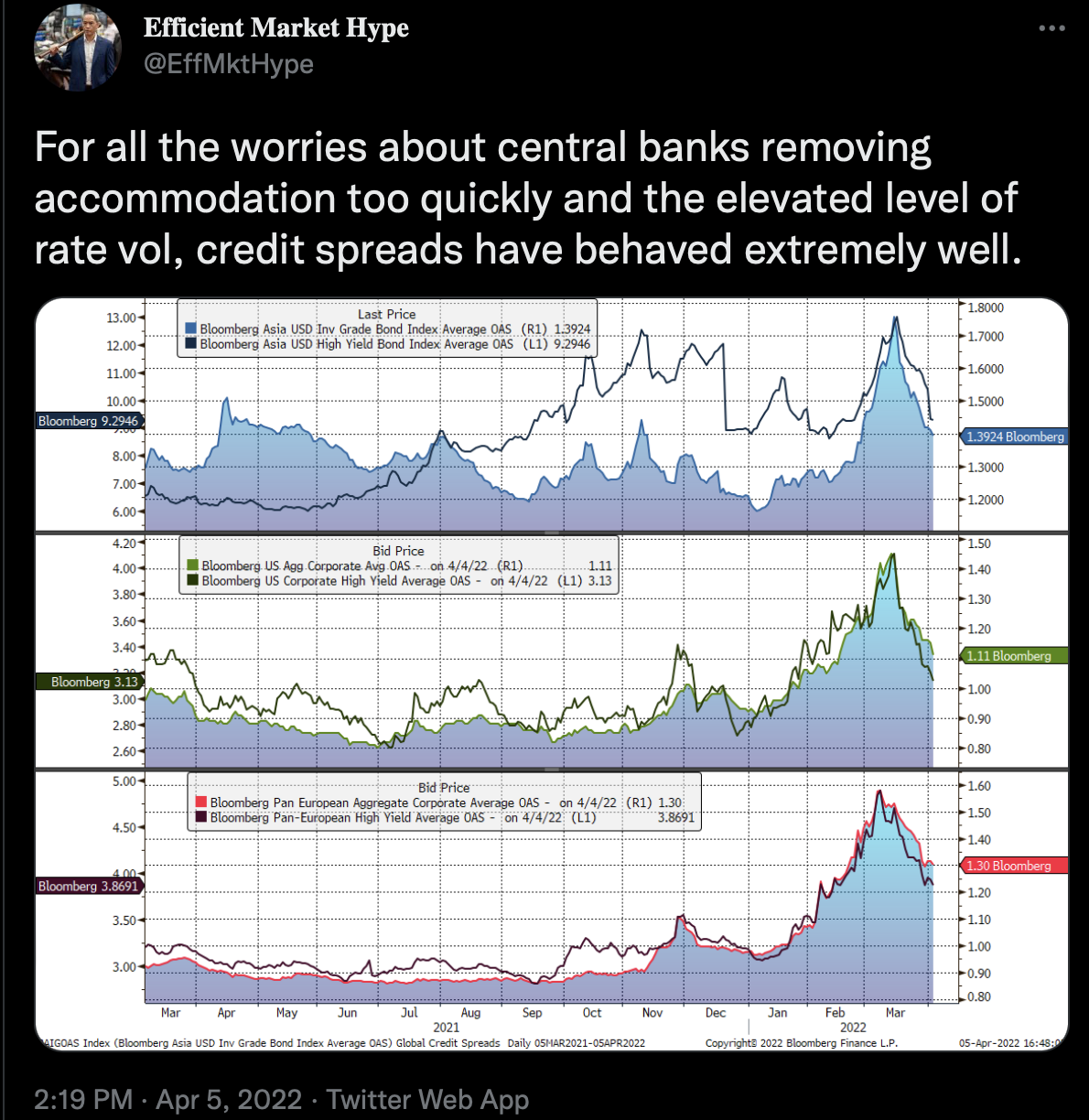

Market Moves: Analysts support a constructive outlook connected bitcoin amid the cryptocurrency's triangular consolidation nether the 200-day average. Calm successful recognition markets suggests Fed's liquidity tightening isn't arsenic terrible arsenic wide feared.

Chartist Corner: Bitcoin forms a pennant

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time.

Cory Klippsten, CEO, Swan Bitcoin

Andrew Wagner, co-founder, BlockRaiders Guild

Marina Niforos, affiliate professor, HEC Paris

Bitcoin's bullish momentum has weakened successful the past 8 days. The cryptocurrency consolidates successful a narrowing terms scope nether the 200-day moving mean placed supra $48,000.

Yet marketplace observers stay assured that the ongoing sideways determination volition pave the mode for much important gains.

"The liquidation signals person reversed from February and March and amusement triggering of bargain orders daily," Laurent Kssis, managing manager and caput of Europe astatine crypto ETF steadfast Hashdex, told CoinDesk successful a Telegram chat. "Steady on-chain enactment suggests constricted downside risk. This hints that the adjacent large determination is apt to beryllium positive, provided determination is simply a sustained betterment on-chain driven by continued organization capitalist demand."

Investor request has held up good contempt bitcoin's stalled ascent. Digital-asset funds drew $180 cardinal successful the 7 days done April 1, marking a 2nd consecutive play inflow, according to a CoinShares report published Monday.

According to Glassnode, organization investors person been allocating funds to bitcoin, ethereum, and altcoins contempt the fragile macro environment.

And portion bitcoin has taken a backmost spot to different cryptocurrencies successful caller days, arsenic evidenced by the diminution successful the BTC dominance index, determination is small crushed to interest for bulls, according to Stack Funds' CEO and Co-founder Matthew Dibb.

"Flows implicit the past fewer days person been lighter, with much enactment successful altcoins, peculiarly furniture 1 coins and DeFi," Dibb said. "We don't spot immoderate origin for panic oregon important crushed for a bearish retracement. While determination is immoderate macro uncertainty regarding Fed and Russia, BTC has performed comparatively good and is opening to garner much support."

Credit markets stay calm contempt the max-hawkish Federal Reserve (Fed), indicating liquidity tightening isn't arsenic terrible arsenic wide feared. That possibly explains the prevalent bullish temper successful bitcoin and stocks.

"I deliberation it's conscionable a motion that the liquidity contraction has not lived up to the Fed's expectations. In addition, determination is underlying coagulated buying successful the Asian region, arsenic China and Japan mostly person complaint cuts," Griffin Ardern, a volatility trader from crypto-asset absorption institution Blofin, said. "That said, the liquidity contraction did not hap globally simultaneously, and we tin inactive find immoderate liquidity pumps."

However, the stableness successful the recognition markets whitethorn promote the Fed to instrumentality assertive steps should ostentation proceed to rise, particularly if ostentation continues to increase. "If the upcoming monthly user terms scale information are not good, the Fed whitethorn instrumentality assertive measures, which volition origin important fluctuations," Ardern said.

The CPI for March is owed adjacent week. Ardern besides cited the minutes of the March Fed gathering and the upcoming ECB gathering arsenic captious events to ticker retired for. "The Fed minutes could supply immoderate applicable accusation connected the roadmap for shrinking the equilibrium sheet."

However, the stableness successful the recognition markets whitethorn promote the Fed to instrumentality assertive steps should ostentation proceed to rise, particularly if ostentation continues to increase.

"If the upcoming monthly user terms scale information are not good, the Fed whitethorn instrumentality assertive measures, which volition origin important fluctuations," Ardern said.

The CPI for March is owed adjacent week. Ardern besides cited the minutes of the March Fed gathering and the upcoming ECB gathering arsenic captious events to ticker retired for. "The Fed minutes could supply immoderate applicable accusation connected the roadmap for shrinking the equilibrium sheet," Ardern added.

Bitcoin's caller consolidation has taken the signifier of a bull pennant, identified by converging trendlines, representing a narrowing terms scope aft a notable determination higher.

A breakout would connote a continuation of the rally, portion a breakdown could invitation chart-driven selling pressure, possibly yielding a pullback to $40,000.

Dollar Index's daily chart (TradingView)

Today’s newsletter was edited by Omkar Godbole and produced by Parikshit Mishra and Stephen Alpher.

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)