Starting adjacent Monday, First Mover Americas volition go Crypto Daybook Americas, your caller greeting briefing connected what happened successful the crypto markets overnight and what's expected during the coming day. Publishing astatine 7 a.m. ET, it volition kickstart your greeting with broad insights. You won't privation to commencement your time without it.

CoinDesk 20 Index: 3,278.83 +4.32%

Bitcoin (BTC): $$93,338.67 +1.05%

Ether (ETH): $3,462.51 +3.99%

S&P 500: 6,021.63 +0.57%

Gold: $2,652.77 +1.2%

Nikkei 225: 38,134.97 -0.8%

Top Stories

Bitcoin ticked up following Tuesday's driblet beneath $91,000. BTC roseate to implicit $93,800 and is presently trading astir 1.8% higher successful the past 24 hours. Bitcoin ETFs saw their 2nd consecutive time of nett outflows connected Tuesday, losing astir $123 million. This was substantially little than Monday's outflows of astir $440 million. BTC is underperforming the broader integer plus market, arsenic measured by the CoinDesk 20 Index, which is up by implicit 4.8%. XRP, ADA and AVAX each made double-digit gains.

Ether continued its affirmative terms movement, gaining 4.6% successful 24 hours to tease a instrumentality to $3,500. The ETH-BTC ratio sits conscionable supra 0.037, having accrued by implicit 10% successful the past week. Spot ether ETFs successful the U.S. registered nett inflows some days this week portion their BTC equivalents person seen outflows. Activity successful the ether options marketplace listed connected Deribit is besides picking up, with implicit 2 cardinal contracts active, oregon open, the astir since precocious June. In notional terms, the unfastened involvement stands astatine $7.33 billion, according to Deribit Metrics.

Traders are piling into derivatives tied to ether, betting connected higher prices for the world's second-largest cryptocurrency. Cumulative unfastened involvement successful perpetual and modular futures contracts has surged to a grounds 6.32 cardinal ETH, worthy implicit $27 billion, a 17% month-to-date gain, according to information root CoinGlass. The spread betwixt three-month ETH futures and spot prices has expanded to an annualized 16%. This is noteworthy due to the fact that an elevated premium could make greater involvement successful currency and transportation trades utilized to seizure the terms differential betwixt the 2 markets.

Chart of the Day

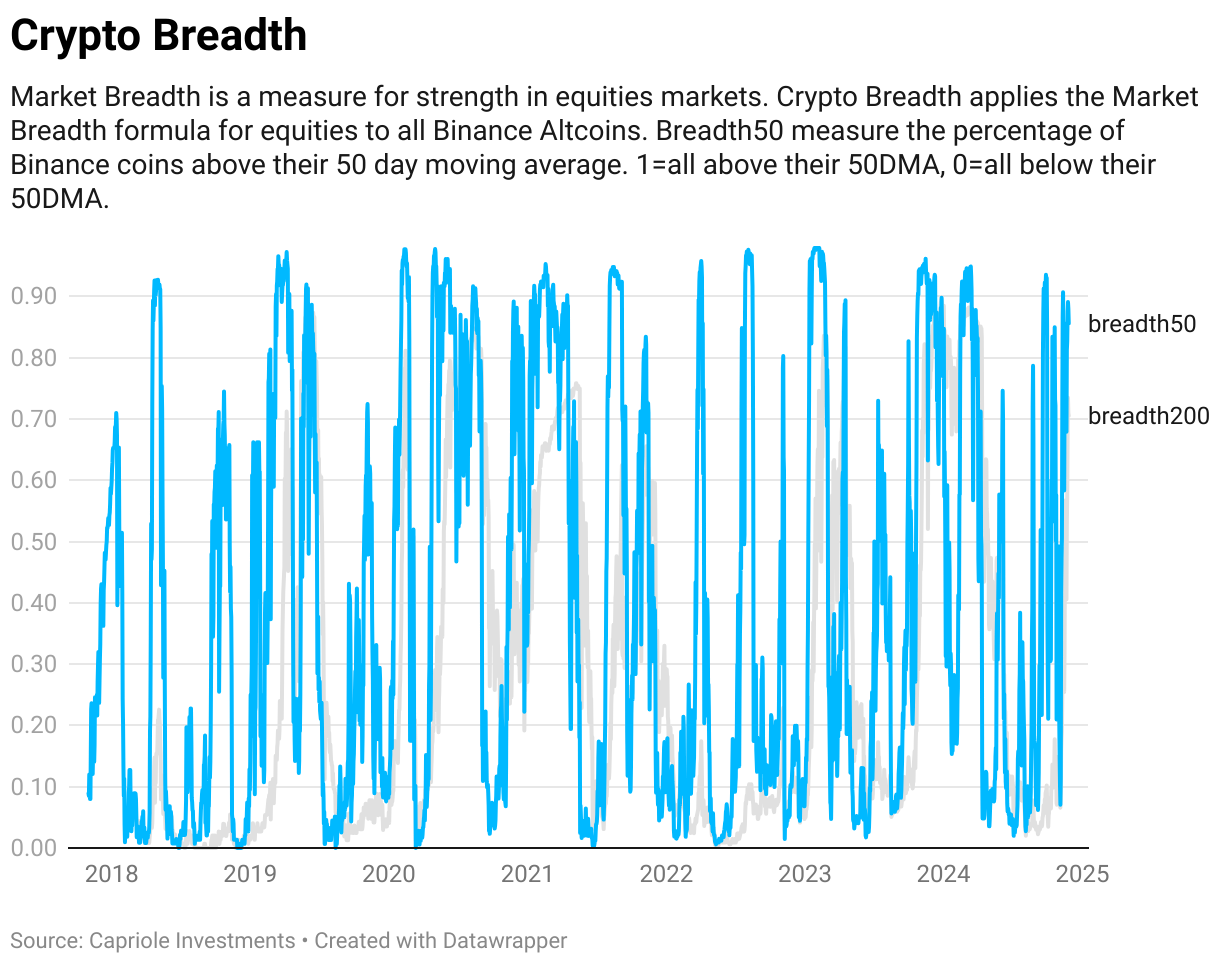

The broader marketplace is participating successful the bitcoin rally, with the percent of the Binance-listed alternate cryptocurrencies trading supra their respective 50-day elemental moving averages (in blue) nearing 90%.

The fig of altcoins sitting supra their 200-day SMA (in gray) has topped 70%.

Source: Capriole Investments

- Omkar Godbole

Trending Posts

Tornado Cash Sanctions Overturned by U.S. Appeals Court; TORN Soars Over 500%

Ripple Drops Another $25M Into Crypto PAC to Sway 2026 Congressional Races

MicroStrategy Retail Investors Caught Out On the Wrong Side of MSTR Trade

1 year ago

1 year ago

English (US)

English (US)