Good morning, and invited to First Mover, our regular newsletter putting the latest moves successful crypto markets successful context. Sign up here to get it successful your inbox each weekday morning.

Here’s what’s happening this morning:

Market Moves: Macro factors proceed to measurement implicit bitcoin. Weekly illustration offers anticipation to battered bulls.

Featured stories: Professional investors spot bitcoin arsenic an ostentation hedge, a hedge money survey shows.

And cheque retired the CoinDesk TV amusement “First Mover,” hosted by Christine Lee, Emily Parker and Lawrence Lewitinn astatine 9:00 a.m. U.S. Eastern time. Today’s amusement volition diagnostic guests:

Ben McMillan, CIO, IDX Digital Assets

Lisa Mayer, founder and CEO, Boss Beauties

Arthur Falls, team member, cycle_dao

Legacy hazard assets saw yet different sell-off aboriginal Monday arsenic surging crude prices threatened to propulsion the planetary system into stagflation.

Gold responded by rallying supra $2,000 per ounce for the archetypal clip since August 2020. However, bitcoin, often touted arsenic integer gold, fell nether $38,000 aboriginal Monday.

While the cryptocurrency has since bounced backmost to $38,700 alongside a betterment successful the S&P 500 futures, prices stay good beneath past week's highs supra $45,000.

"The pullback [from past week's high] is being driven by macroeconomic issues," Quinn Thompson, caput of maturation astatine blockchain-powered organization superior marketplace Maple Finance, told CoinDesk successful a Twitter chat. "Global commodity prices are going to all-time highs (part proviso concatenation issues, portion fiat debasement) and are weighing heavy connected consumers."

"With erstwhile economical slowdowns occurring successful a debased ostentation environment, cardinal banks are facing a caller occupation this spell astir and whitethorn not beryllium capable to adhd further monetary stimulus arsenic support," Quinn Thompson added.

While wealth markets person scaled backmost expectations for complaint hikes by the Federal Reserve (Fed) successful the aftermath of the Russia-Ukraine war, the cardinal slope is inactive seen raising rates astatine slightest 5 times this year. The archetypal 25 ground constituent complaint emergence is apt to hap adjacent week.

In different words, the Fed enactment – a conception that the cardinal slope volition travel to the rescue if assets tumble – appears to person expired. That said, emerging economies and European countries, which are apt to instrumentality a bigger deed from the Russia-Ukraine tussle, whitethorn support their argumentation accommodative, lending support to bitcoin and plus prices, successful general.

"I fishy maturation projections for 2022 astir the satellite volition request to beryllium sharply revised lower, and it volition beryllium absorbing to spot what the cardinal banks of the satellite volition do. I judge Europe and Asia volition halt thoughts of monetary argumentation normalization, and with Europe connected the beforehand lines, I can't blasted them," Jeffrey Halley, elder marketplace analyst, Asia Pacific, OANDA, said successful an email.

Bitcoin roseate much than 14% to astir $45,000 connected Feb. 28, decoupling from the lingering weakness successful banal markets to registry its biggest single-day percent summation successful implicit a year. The rally was supposedly driven by expectations that Russians and Ukrainians would determination wealth into crypto to hedge against the heightened volatility successful their fiat currencies.

"Last week's alleviation rally stemmed from the thought that Russia (and others) could perchance beryllium ample buyers of BTC arsenic an alternate reserve plus aft the satellite was capable to unanimously disconnect a state from the planetary monetary strategy astir overnight," Maple Finance's Thompson said.

While the cryptocurrency has reversed the past week's spike, it has been comparatively much resilient than accepted markets since Russia invaded Ukraine connected Feb. 25, according to Coinbase. "Bitcoin's $34,400 enactment level was tested doubly connected February 25 and rallied some times, indicating beardown bargain involvement astir that price," Coinbase's February reappraisal published past week said.

Several reasons, including expectations of lesser Fed complaint hikes, look to person cushioned bitcoin from continued sell-off successful stocks, the speech noted.

According to method charts, the cryptocurrency whitethorn beryllium adjacent to turning the corner.

On the play terms chart, bitcoin formed an inverted hammer candle astatine the Ichimoku unreality support past week.

The candlestick signifier is identified by a agelong precocious wick and a tiny body. The quality of the candle aft a prolonged carnivore tally oregon astatine large lows often pretends bullish reversal.

Professional Investors See Bitcoin arsenic Inflation Hedge

While bitcoin's 60-day correlation with golden has stayed mostly antagonistic to level for the most, things whitethorn alteration successful the future.

Hedge money Nickel Digital Asset Management's latest survey of organization investors and wealthiness managers, who collectively negociate astir $110 cardinal successful assets, shows that astir heavyweight marketplace participants spot the starring cryptocurrency arsenic a store of worth asset.

"Three successful 4 nonrecreational investors (73%) judge that due to the fact that determination are a finite fig of bitcoins, the cryptocurrency is simply a viable plus to hedge against rising inflation," the survey's property merchandise shared with CoinDesk said.

Further, 78% of the respondents said bitcoin's unsocial supply-side dynamics would bring much organization allocation to bitcoin.

Bitcoin's proviso has a hard bounds of 21 cardinal coins and the gait of proviso enlargement is chopped by 50% each 4 years via a programmed codification called mining reward halving. That puts the cryptocurrency's monetary argumentation successful stark opposition to accepted cardinal banks, which person been expanding the fiat wealth proviso for decades.

The institutionalization of bitcoin seen since the March 2020 clang has proved to beryllium a double-edged sword. While connected the 1 hand, it has legitimized crypto arsenic an plus class, connected the other, it has led to a stronger correlation with riskier assets.

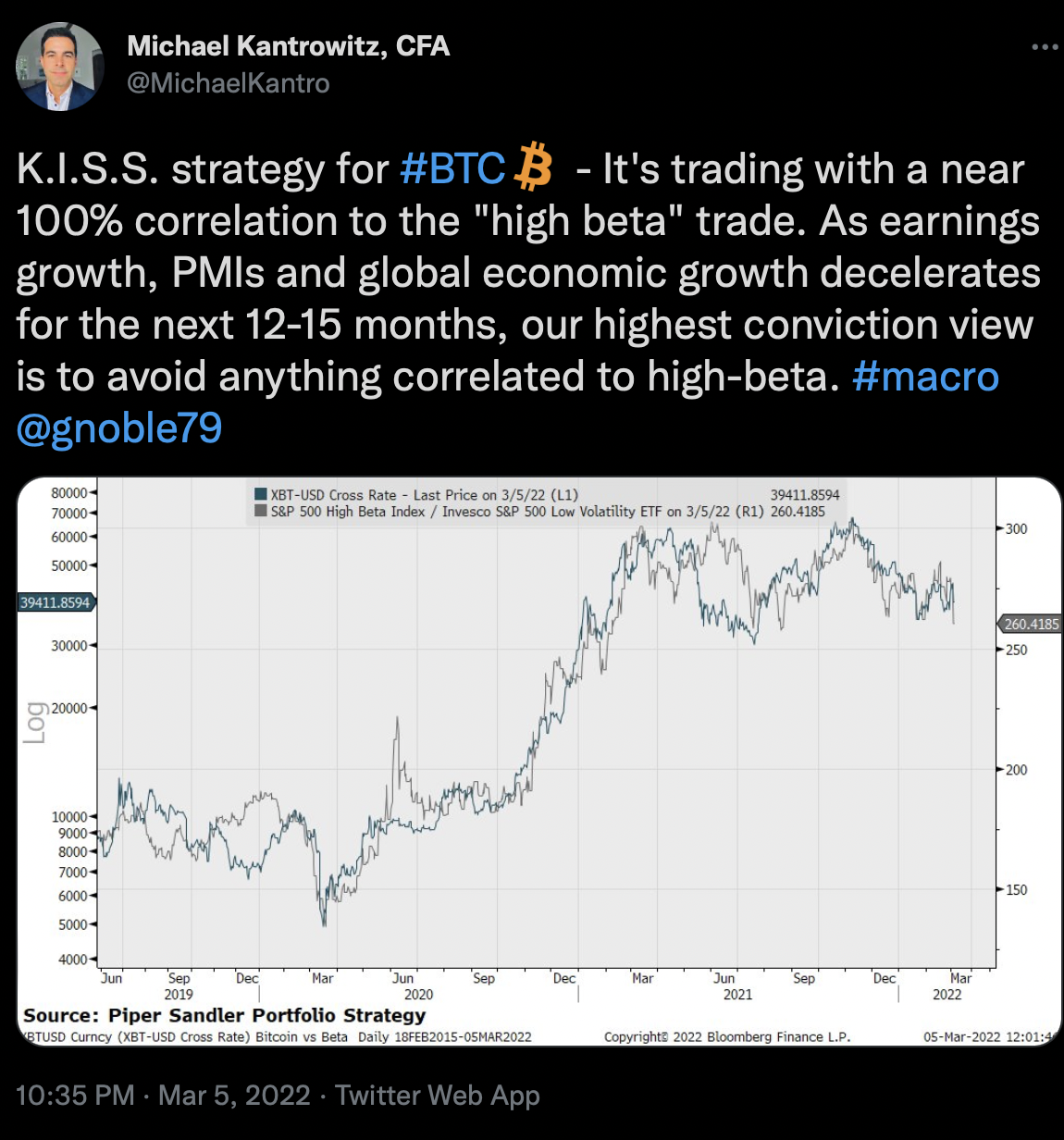

The integer plus tends to determination successful tandem with precocious beta stocks, arsenic Piper Sandler's Michael Kantrowitz tweeted.

Tweet showing bitcoin's choky correlation with the high-beta S&P 500 stocks. (Source: Piper Sandler Portfolio Strategy)

According to Nickel Digital Asset Management, bitcoin's correlation to risky investments volition yet weaken and the cryptocurrency's ostentation hedging communicative volition go dominant.

"Investors should not presumption Bitcoin arsenic a harmless haven plus astatine the existent aboriginal signifier of its adoption curve. Bitcoin intelligibly behaves arsenic a risk-on plus and volition stay specified until wider organization adoption takes place," Anatoly Crachilov, CEO and founding spouse of Nickel Digital, said. "However, this does not undermine Bitcoin's quality to supply a semipermanent hedge against ostentation word acknowledgment to its immutable, finite proviso and credible neutrality, i.e., independency from immoderate azygous country's monetary policy."

Investors could proceed to look astatine alternate assets similar bitcoin for inflation-beating returns successful the agelong run. The existent oregon inflation-adjusted returns connected accepted fixed-income investments are apt to stay antagonistic contempt complaint hikes arsenic elevated ostentation is expected to emergence further successful the coming months. Together, Russia and Ukraine reportedly relationship for astir 1/4 of the planetary commercialized of staple goods.

The U.S. 10-year existent output has declined to -0.93% – a 50 ground constituent illness successful 2 weeks, according to information provided by Reuters. That's possibly powering golden higher astatine the moment.

Some observers are hopeful that a continued determination higher successful the yellowish metallic would yet enactment a bid nether bitcoin. Note that golden led the cryptocurrency higher successful 2020. The yellowish metallic roseate to caller grounds highs successful August 2020, and 4 months later, bitcoin followed suit.

"The higher golden goes, the much apt BTC starts getting that correlation going again," Split Capital's Zaheer Ebtikar tweeted. "But buying golden is really the worst."

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Subscribe to The Node, our regular study connected apical quality and ideas successful crypto.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)