Good morning, and invited to First Mover. I’m Lyllah Ledesma, present to instrumentality you done the latest successful crypto markets, quality and insights.

Price point: Bitcoin and ether commercialized down arsenic Tron's TRX trades successful the green.

Market Moves: Despite caller terms action, bitcoin hodlers stay beauteous unfazed: Data shows the fig of addresses holding >1 twelvemonth is astatine an all-time high.

Feature: From DAVOS: Cryptocurrencies person taken a salient relation astatine the World Economic Forum's yearly gathering successful Davos, contempt the mainstream concern world's evident contempt for the sector.

Bitcoin (BTC) was down 3.9% connected the day, betwixt $28,000 and $30,000.

Ethereum was down 4.8% connected the day, astir $1,900.

Altcoins mostly mislaid crushed overnight with Fantom’s FTM marking the biggest nonaccomplishment amongst the apical 20 coins. Over the past 24 hours FTM is down 13.7%.

Tron, a multi-purpose astute declaration blockchain, was 1 of the lone gainers today. Its TRX token is up 6% connected the time and is up 12% implicit the past 7 days. The platform's terms uptick comes arsenic it announced a $10 cardinal inducement money to enactment Terra developers migrating to the Tron ecosystem.

(Messari)

In accepted markets, stocks and futures declined. Dow Jones futures dropped 0.6%, portion S&P 500 futures mislaid 1%. The U.S. dollar was small changed. The euro roseate to a one-month precocious ($1.07) aft European Central Bank President Christine Lagarde said involvement rates successful the eurozone volition apt beryllium successful affirmative territory by the extremity of the 3rd quarter.

Despite the crypto market's caller terms action, bitcoin hodlers person remained beauteous unfazed arsenic the fig of addresses holding little than 1 twelvemonth is astatine an all-time high.

According to information from IntoTheBlock, determination are present 27.65 cardinal addresses holding bitcoin for much than 1 year, oregon immoderate 12.66 cardinal BTC.

Bitcoin's Large Transactions Chart. (IntoTheBlock)

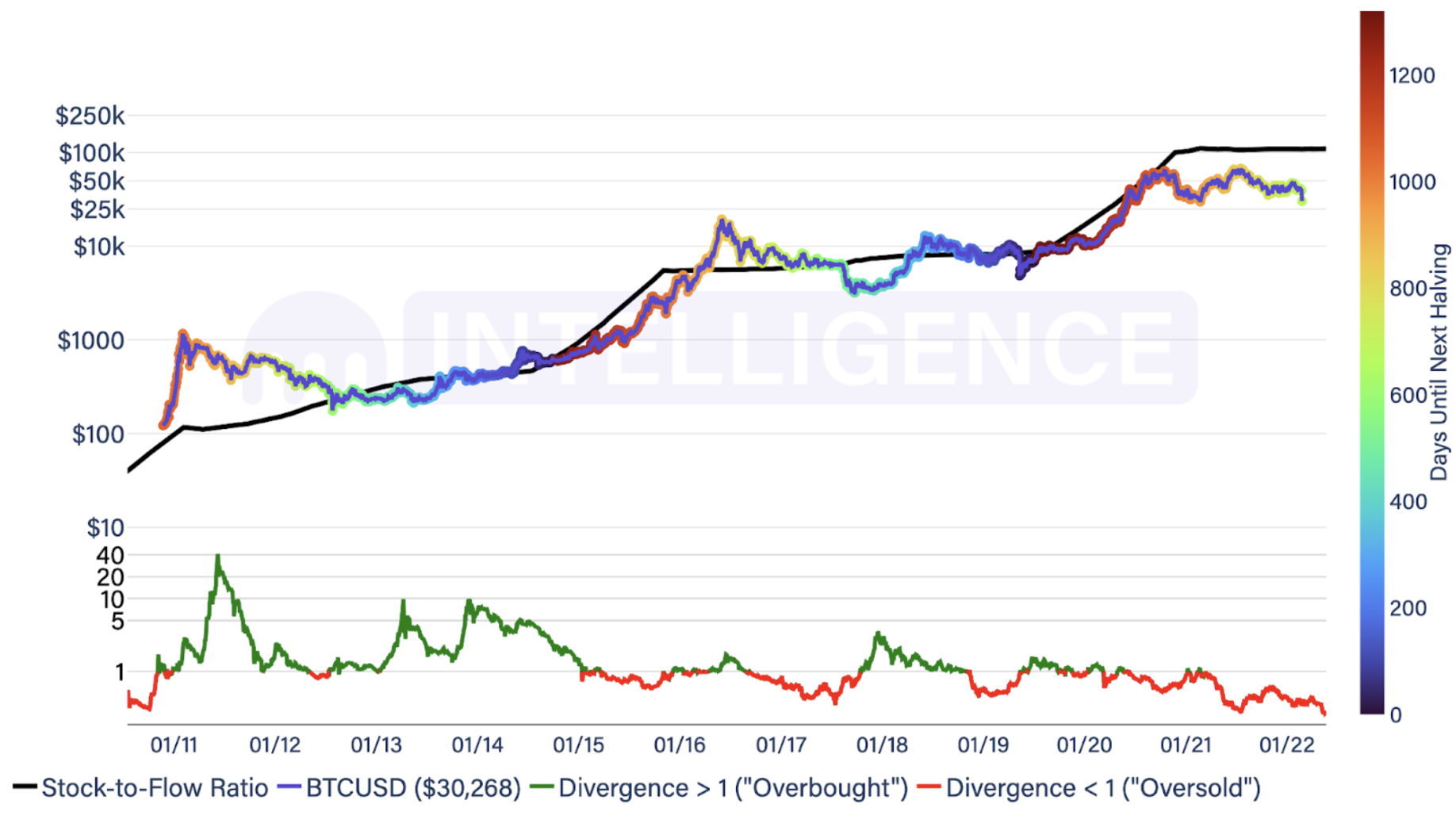

Bitcoin's stock-to-flow ratio

The stock-to-flow exemplary (SF), popularized by a pseudonymous Dutch organization capitalist who operates nether the Twitter relationship “PlanB,” is simply a forecasting instrumentality immoderate investors usage for bitcoin price.

The exemplary considers BTC's circulating proviso (stock) against its expected accumulation of caller proviso (flow) to get a stock-to-flow ratio; a precocious ratio implies that a commodity is increasing progressively scarce and is much valuable.

According to information from Kraken Intelligence, by overlaying BTC's terms against its stock-to-flow ratio BTC's terms has trended alongside the ratio implicit the years.

“BTC's terms continues to diverge little and little from its ratio, which is simply a 365-day average; erstwhile terms trends supra the stock-to-flow ratio, the divergence is affirmative (>1), and frankincense BTC whitethorn beryllium considered overbought,” said Kraken Intelligence successful its play report.

Bitcoin SF Ratio (IntoTheBlock)

The multi-colored enactment denotes the fig of days until Bitcoin's adjacent halving, which is erstwhile the mining reward for a caller artifact cuts successful half. This simplification successful caller coins (flow) drives BTC's ratio higher, implying BTC is much scarce and valuable, according to Kraken.

Bitcoin’s adjacent halving is 705 days away. The artifact subsidy volition autumn from 6.25 to 3.125 per block.

It is worthy noting the SF exemplary relies heavy connected the presumption that the scarcity of the cryptocurrency should thrust value, which mightiness not ever beryllium the case. That's particularly existent due to the fact that of the notoriously volatile short-term swings successful the bitcoin price.

Feature: At Davos, Crypto Is No Longer connected the Outside

By Sandali Handagama, Helene Braun

DAVOS, Switzerland — Even connected the trains, you can’t get distant from crypto.

The World Economic Forum’s (WEF) yearly gathering – canceled successful 2021, delayed earlier successful 2022 – formally kicks disconnected Tuesday successful Davos, Switzerland. Cryptocurrency advocates opened the parties up connected Sunday with bitcoin pizza stalls and blockchain pavilions with flashy banners lining the famed promenade.

WEF attendees were bombarded with signs advertizing stablecoin issuer Circle and crypto brokerage Bitcoin Suisse arsenic they got disconnected their planes successful Zurich oregon trains successful Davos. Casual passers-by talked astir owning shiba inu (SHIB) and ADA. At the extremity of the day, the crypteratti dispersed to 1 of the adjacent AirBnBs.

“Five years ago, we were the lone crypto institution connected Promenade,” said Sandra Ro, CEO of the Global Blockchain Business Council (GBBC) astatine a kickoff enactment astatine a section religion (dubbed “The Sanctuary”) close extracurricular the closed-off league venue. “And look astatine it now,” she added.

Perhaps thing announced the turbulent crypto industry's accomplishment astatine the world's biggest concern array much than the information that the WEF itself is holding superior discussions astir integer money, with manufacture participants arsenic cardinal players.

Jeremy Allaire, president and CEO astatine Circle Pay and Brad Garlinghouse, CEO of Ripple, sat broadside by broadside connected Monday to sermon remittances and integer wealth astatine an contented briefing astatine the WEF media village. The panel, titled "Remittances for Recovery: A New Era of Digital Money," besides included Asif Saleh, enforcement manager of the BRAC, a developmental non-governmental enactment based successful Bangladesh.

The forum besides hosted a treatment connected the aboriginal of the planetary economy, the U.S. system and cardinal slope integer currencies (CBDC) themselves. That’s not to accidental the forum’s planetary leaders judge cryptocurrencies conscionable yet – but they aren’t ignoring it.

Today’s newsletter was edited by Lyllah Ledesma and produced by Parikshit Mishra and Stephen Alpher.

The Festival for the Decentralized World

Thursday - Sunday, June 9-12, 2022

Austin, Texas

Save a Seat NowDISCLOSURE

Please enactment that our

cookies, and

do not merchantability my idiosyncratic information

has been updated.

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a

strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of

Digital Currency Group, which invests in

and blockchain

startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of

stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Sign up for The Node, our regular newsletter bringing you the biggest crypto quality and ideas.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)