Good morning. Here’s what’s happening:

Market moves: Bitcoin led a broader marketplace stabilization with reduced spot trading volume.

Technician's take: A decisive interruption supra $40K BTC is needed to intermission the downtrend from November.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis.

Bitcoin (BTC): $36,971 +1%

Ether (ETH): $2,460 +1.3%

Sector classifications are provided via the Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to supply a reliable, comprehensive, and standardized classification strategy for integer assets. The CoinDesk 20 is simply a ranking of the largest integer assets by measurement connected trusted exchanges.

Bitcoin led a wide stabilization successful the crypto marketplace Tuesday, arsenic its spot trading measurement came down dramatically from a time ago.

At the clip of publication, the oldest cryptocurrency was changing hands adjacent $37,000, up somewhat implicit the past 24 hours, according to CoinDesk data. Ether, the 2nd biggest cryptocurrency by marketplace capitalization, was trading supra $2,400 level, besides up somewhat implicit the aforesaid period.

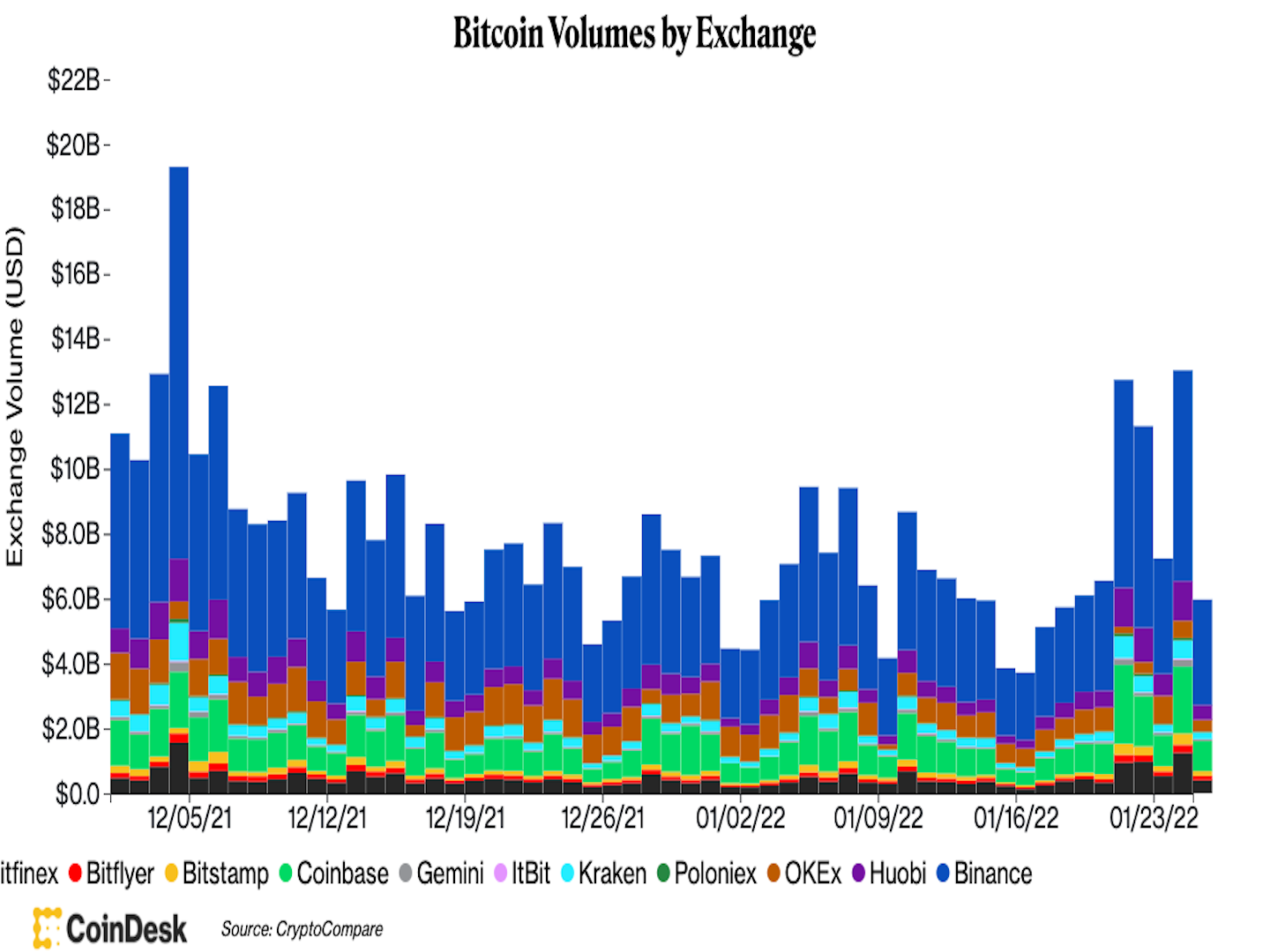

Data compiled by CoinDesk shows that bitcoin’s spot trading measurement crossed large crypto exchanges came down importantly connected Tuesday, aft a volatile trading time connected Monday.

Source: CoinDesk, CryptoCompare

“We are starting to spot flashes of [the] request from players who admit the longer-term worth proposition of crypto,” Joel Kruger, currency strategist astatine LMAX Digital, told CoinDesk.

Norway-based blockchain information analytics steadfast Arcane Research noted successful its play update connected Tuesday that bitcoin’s terms saw a “substantial recovery” with a measurement spike connected crypto speech Coinbase during precocious U.S. trading league connected Monday, raising a question of whether MicroStrategy oregon different chartless entities whitethorn person lifted the full marketplace by bidding up bitcoin’s terms connected Coinbase.

That said, the crypto marketplace is intimately observing the effect of the U.S. Federal Reserve’s two-day argumentation meeting connected Wednesday. The Fed connected Wednesday is expected to hint astatine an involvement complaint hike successful March to combat inflation.

Bitcoin Rose Above $37K; Resistance astatine $40K-$43K

Bitcoin's four-hour terms illustration shows adjacent absorption and RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

Bitcoin buyers remained active, aft pushing the cryptocurrency to implicit $37,000, which is adjacent the apical of a weeklong terms range. Still, upside could beryllium constricted astatine the $40,000-$43,000 absorption portion implicit the abbreviated term.

The comparative spot scale (RSI) connected the four-hour illustration triggered an oversold awesome connected Saturday, which preceded the latest terms bounce. On the regular chart, the RSI is starting to emergence from utmost oversold levels, which could stabilize the existent sell-off.

Initial absorption is astatine the 100-period moving mean connected the four-hour chart, positioned astatine $40,600. Buyers volition request to marque a decisive determination supra that level to intermission the downtrend from November.

10 a.m. HKT/SGT (2 a.m. UTC): New Zealand recognition paper spending (Dec. YoY)

1 p.m. HKT/SGT (5 a.m. UTC): Japan coincident economical scale (Nov.)

1 p.m. HKT/SGT (5 a.m. UTC): Japan starring economical scale (Nov.)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): U.S. goods commercialized equilibrium (Dec. preliminary)

9:30 p.m. HKT/SGT (1:30 p.m. UTC): U.S. wholesale inventories (Dec. preliminary)

"First Mover" hosts were joined by Peter Brandt, laminitis of Factor Trading, to analyse and foretell the crypto marketplace amid accrued marketplace volatility. Metaversal CEO Yossi Hasson and CoinFund Chief Investment Officer Alex Felix shared details down the latest $50 cardinal bid A backing circular for Metaversal and its enlargement plan, arsenic good arsenic the outlook for the marketplace amid the crypto crash. Plus, it's CoinDesk Privacy Week. Grid News tech newsman Benjamin Powers had a afloat study connected privateness coin Monero.

The Trojan Horse of Privacy: For privateness to instrumentality off, it needs to halt being the worth proposition. It's got to beryllium a acquisition radical don't notice. Think apps first, privateness second, futurist Dan Jeffries writes for CoinDesk's Privacy Week.

"For my part, the treatment implicit Thanksgiving leftovers brought location a information constituent astir women’s and radical of color’s involvement successful cryptocurrency. A 2021 survey recovered that the radical who commercialized crypto are a acold outcry from the young, white, antheral representation of a techbro." (Tressie McMillan Cottom successful The New York Times) ... "There is apt a mediate ground, a dependable sentiment to hold. I’m not an concern wiz, I’m a newsman who covers fake net money, but I tin accidental the lone due mode to put successful crypto is to put with conviction." (CoinDesk columnist Daniel Kuhn) ... “My fearfulness is we are going to spell lower. It is “going to beryllium a large week.” (Penn Mutual Asset Management Portfolio Manager Zhiwei Ren connected stocks to The Wall Street Journal)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides a portfolio manager astatine Cannon Advisors, which does not put successful integer assets. Damanick does not ain cryptocurrencies.

Subscribe to Crypto for Advisors, our play newsletter defining crypto, integer assets and the aboriginal of finance.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)