Good morning. Here’s what’s happening:

Prices: Bitcoin and ether were astir level implicit the past 24 hours.

Insights: Bitcoin has been underperforming large Asian banal indices amid investors' concerns astir involvement complaint hikes and uncertain macroeconomic conditions.

Technician's take: Range-bound terms enactment could persist for a fewer days.

Catch the latest episodes of CoinDesk TV for insightful interviews with crypto manufacture leaders and analysis. And sign up for First Mover, our regular newsletter putting the latest moves successful crypto markets successful context.

Bitcoin (BTC): $43,544 -0.3%

Ether (ETH): $3,227 +0.7%

Bitcoin did a small amended connected Thursday aft tumbling the erstwhile time but inactive fell slightly, pursuing a downward inclination for overmuch of the week. Ether fared somewhat better, but different large altcoins were mixed.

Bitcoin, the largest crypto by marketplace cap, was precocious trading astatine astir $43,500, astir wherever it stood 24 hours earlier and good disconnected the $47,000 threshold it crossed a week agone arsenic investors continued to digest the U.S. cardinal bank's caller hawkish strength and the ongoing swirl of economical events stemming progressively from Russia's penetration of Ukraine.

"Bitcoin is struggling for absorption arsenic Wall Street grows cautious implicit however assertive the [Federal Reserve] volition beryllium with tightening of monetary policy," Oanda Senior Market Analyst Americas Edward Moya wrote successful an email.

SOL and AVAX were precocious up astir 2% and 3%, respectively aft spending parts of Thursday successful the red. Terra's luna (LUNA) was precocious down implicit 4%. The meme coins DOGE and SHIB were some astir flat. Outside the CoinDesk apical 20, CAKE roseate implicit 6% astatine 1 point.

Crypto prices veered somewhat from the show of large equity markets, which were successful the green, albeit barely. The tech-focused Nasdaq was up little than a tenth of a percent point.

The U.S. cardinal slope has signaled powerfully arsenic a body, and by idiosyncratic governors, implicit the past week that it would ratchet up its efforts to tame inflation, which has reached astir 8%, a four-decade high.

On Thursday, Federal Reserve Bank of St. Louis President James Bullard told reporters aft a code that the Fed would person "to determination forthrightly successful bid to get the argumentation complaint up to the close level to woody with ostentation that we’ve got successful beforehand of us." His remarks followed 2 days aft Fed Governor Lael Brainard, who had been reluctant to wantonness the Fed's dovish posture of caller years, suggested the Fed mightiness summation involvement rates astatine a faster pace.

Other winds during the time blew much favorably for integer assets. Addressing crypto In a code for the archetypal time, U.S. Treasury Secretary Janet Yellen said that a integer dollar could go a "trusted wealth comparable to carnal cash."

Speaking to attendees astatine an American University event, Yellen highlighted the differing perceptions astir crypto, saying that’s often the lawsuit with “transformative” technology. “Some proponents talk arsenic if the exertion is truthful radically and beneficially transformative that the authorities should measurement backmost wholly and fto innovation instrumentality its course,” she said. “On the different hand, skeptics spot limited, if any, worth successful this exertion and associated products and advocator that the authorities instrumentality a overmuch much restrictive approach.”

Meanwhile, European and U.S. lawmakers who person criticized Russia's unprovoked onslaught connected Ukraine were considering and pushing guardant connected caller economical sanctions. They included a European Union prohibition connected Russian ember and a U.S. House ballot to region Russia's favored commercialized presumption and a halt to imports of vigor products.

Still, Oanda's Moya was cautiously optimistic astir bitcoin's near-term performance.

"Bitcoin has held up nicely fixed the caller enslaved marketplace sell-off, but it could conflict if that determination continues," helium said. "Bitcoin's semipermanent outlook remains bullish but if hazard aversion runs chaotic it could beryllium susceptible to a driblet towards the $38,000 level."

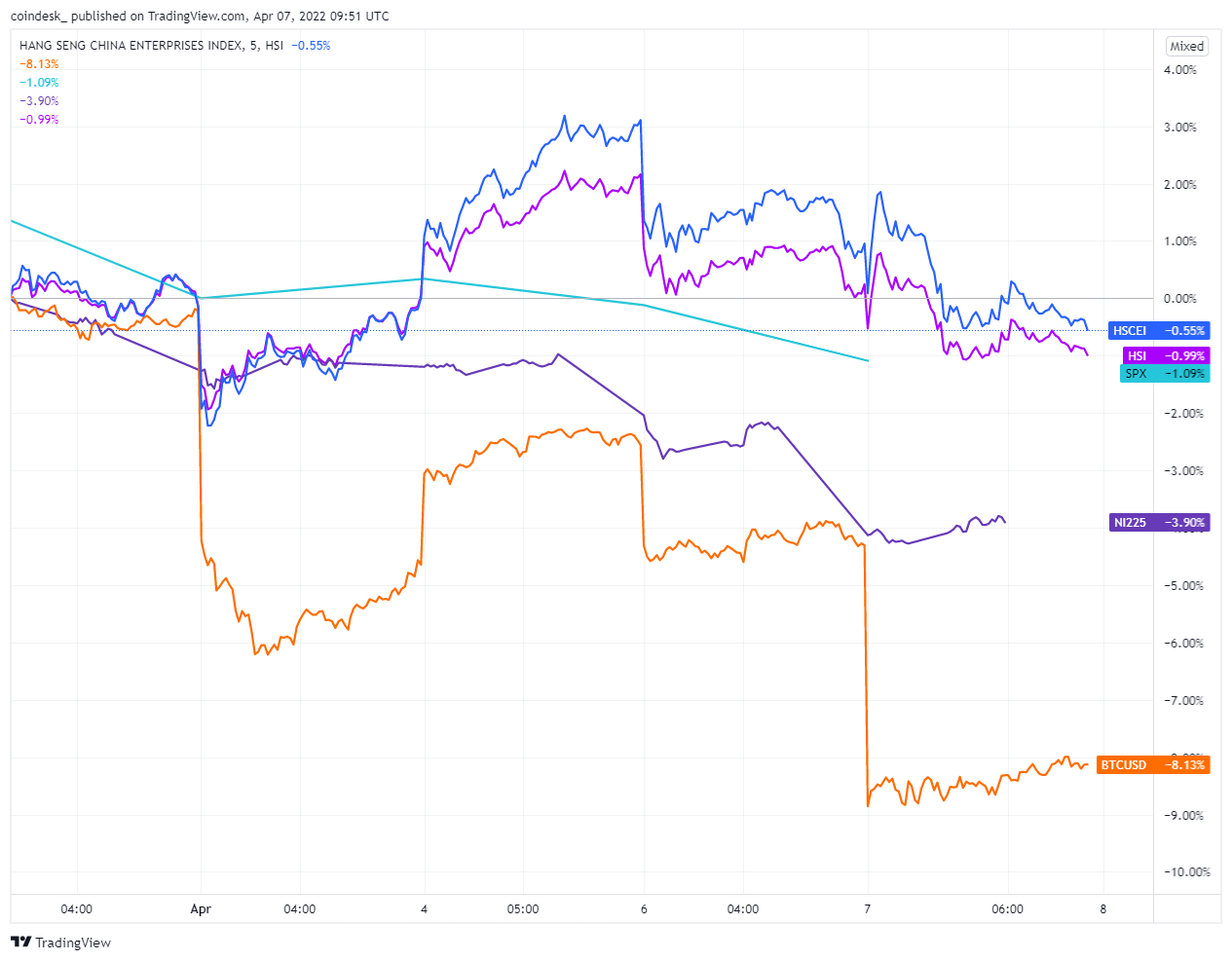

Bitcoin acceptable to adjacent week underperforming large asiatic banal indices

Concerns implicit however a hawkish Fed volition respond to inflation, the continuing warfare successful Ukraine and China’s COVID-19 situation sent Asian markets tumbling this week, and bitcoin with them.

Hang Seng and different indices (TradingView)

The world’s largest integer plus is acceptable to extremity the week down 8%, underperforming large indices successful Asia including the Nikkei 225, Hong Kong’s Hang Seng Index, the Hang Seng scale of Hong Kong-listed China Stocks, arsenic good arsenic the S&P 500.

Analysts person pegged uncertainty, anchored by anticipation of the latest Fed minutes, arsenic a crushed for the week-long sink. The Fed present has a mandate to tame inflation, but the question is however tolerant volition it beryllium of the system dipping into a recession.

In February, a fig of analysts who previously spoke with CoinDesk said the Fed would backmost disconnected tighter monetary argumentation if the system cools excessively much, excessively rapidly and stocks tank. These observers believed the Fed could tolerate astir a 20%-30% driblet successful equity prices.

At the time, the cardinal slope seemed inclined to rise involvement rates successful tiny 0.25 increments and by conscionable a percent constituent implicit the remainder of 2022, a “trivial” magnitude 1 expert said, with ostentation moving astatine 7% astatine the time.

Now, with ostentation surging person to 8% and the macroeconomic situation progressively uncertain due to the fact that of the Russian penetration of Ukraine, the Fed has indicated it whitethorn beryllium much assertive successful its anti-inflation measures.

How its attack affects crypto is uncertain for the agelong term. For now, investors look much risk-averse, which is atrocious quality for bitcoin.

Bitcoin’s slump connected Fed hawkishness aft a little rally was felt passim the broader crypto ecosystem arsenic traders who bought into tokens including DOGE and SOL, which thin to emergence and autumn successful sync with bitcoin, got rekt successful a monolithic liquidation wave with implicit $400 cardinal lost.

With bitcoin’s continued correlation to the S&P 500, the large question connected traders’ caput successful Asia is what volition interruption this trend? When volition bitcoin emergence again?

Galaxy’s Mike Novogratz thinks it’s each connected the shoulders of the Fed. Novogratz inactive believes bitcoin volition yet deed $500,000 and past $1 million, but it's going to beryllium successful retreat until the Fed takes its hands disconnected the system erstwhile it yet slows down.

Then, “Bitcoin goes to the moon,” Novogratz said.

Bitcoin regular illustration shows support/resistance, with RSI connected bottom. (Damanick Dantes/CoinDesk, TradingView)

The comparative spot scale (RSI) connected intraday charts are rising from oversold levels, which could support short-term buyers progressive into the Asia trading day. On the regular chart, however, the RSI is neutral with antagonistic momentum, suggesting range-bound terms enactment could persist for a fewer much days.

BTC volition request to marque a decisive determination supra above $45,000 successful bid to output upside terms targets, initially toward $50,966. For now, the terms betterment from the January debased astatine $32,933 remains intact, particularly fixed the affirmative momentum speechmaking connected the play chart.

Still, indicators connected the monthly illustration suggest upside is constricted for BTC implicit the intermediate term. That means BTC volition request to support stronger enactment supra $37,560 to support the three-month uptrend of higher terms lows stable. A decisive interruption beneath that level could invalidate the betterment phase.

Bitcoin regular illustration shows DeMARK set-ups with MACD connected bottommost (Damanick Dantes/CoinDesk, DeMARK Symbolik)

9:30 a.m. HKT/SGT(1:30 a.m. UTC): Australia fiscal stableness review

1 p.m. HKT/SGT(5 a.m. UTC): Japan user assurance scale (March)

Miami is charging up with its bitcoin superior ambitions arsenic it unveils a laser-eyed charging bull during the Bitcoin 2022 league this week. Mayor Francis Suarez joined "First Mover" to explicate his crypto projects for the city, and what's going connected with MiamiCoin. Plus, insights connected the imaginable interaction of Janet Yellen's code connected integer assets from Martin Leinweber of MV Index Solutions and much Miami bitcoin league quality from John Bartleman of TradeStation.

Other voices: Miami’s crypto craze connected afloat show astatine bitcoin league (ABC News)

"It isn’t often you’d perceive tech companies described arsenic dinosaurs, but they are so present conscionable that and request to germinate oregon hazard being relegated to an epoch past. The largest tech giants, including Amazon, Google and Meta Platforms, person go excessively accustomed to the outdated concern models of advertisement monetization, an manufacture that is increasing 15.7% annually. Ad tech is inactive an appealing opportunity, but blockchain has a overmuch higher maturation potential." (Rockaway Blockchain Fund Chief Investment Officer Dusan Kovacic) ... “With this caller concern structure, Tennessee volition beryllium a beacon for blockchain investment, caller jobs and investment,” [Powell] says. “Just arsenic Delaware became a hub for accepted LLCs oregon South Dakota for recognition paper companies.” (Tennessee authorities typical Jason Powell, quoted successful the Nashville Scene) ... "Credit standing agencies person indicated that payments successful a currency antithetic from the 1 the indebtedness was sold successful would number arsenic a default erstwhile the grace play expired. Russia’s indebtedness payments that were owed connected Monday person a 30-day grace play and had nary proviso for repayment successful immoderate currency different than dollars. It would beryllium Russia’s archetypal default connected overseas currency indebtedness successful much than a century." (The New York Times)

DISCLOSURE

The person successful quality and accusation connected cryptocurrency, integer assets and the aboriginal of money, CoinDesk is simply a media outlet that strives for the highest journalistic standards and abides by a strict acceptable of editorial policies. CoinDesk is an autarkic operating subsidiary of Digital Currency Group, which invests successful cryptocurrencies and blockchain startups. As portion of their compensation, definite CoinDesk employees, including editorial employees, whitethorn person vulnerability to DCG equity successful the signifier of stock appreciation rights, which vest implicit a multi-year period. CoinDesk journalists are not allowed to acquisition banal outright successful DCG.

Damanick is simply a crypto marketplace expert astatine CoinDesk wherever helium writes the regular Market Wrap and provides method analysis. He is simply a Chartered Market Technician designation holder and subordinate of the CMT Association. Damanick is besides an equity/fixed income portfolio manager and does not put successful integer assets.

Sign up for Market Wrap, our regular newsletter explaining what happened contiguous successful crypto markets – and why.

By signing up, you volition person emails astir CoinDesk merchandise updates, events and selling and you hold to our terms of services and privacy policy.

3 years ago

3 years ago

English (US)

English (US)